The Power Of HindeSight In Gold Trading

Gold, which historically has enjoyed very high decade returns twice in the last half century, is off to a good start, maybe to 2030? I remember writing this a few years ago about the peak of the last bull run.

A significant memory was the 2010 ‘Denver’ Gold Show, held in Zurich, which our Hinde Capital group attended en masse. It was in mid-April of that year, when the eruptions and ash cloud from the Icelandic volcano, Eyjafallajokull, saw 20 countries close their airspace for over a week, leaving millions of travellers stranded. Some quick thinking saw most of us get the Zurich-Paris express train, stay overnight in Paris and with the last available Eurostar tickets, make our way back to London. While much alcohol was consumed on the way, it had many of the hallmarks of the last train out of a war zone. The large presentations at the show were standing room only as CEO after CEO proclaimed their fabulous projects and sky-high share prices, enrichening them all, ON PAPER. The Gold Miners Junior Index was over 11,000 at the time and the cigar smoke at the Park Hyatt Hotel bar was so thick it was almost at bar levels (the good old days before everything got banned!). Yet, within a few years, the index had dropped over 80% and hundreds of small-cap companies had gone to the wall, with not enough cash flow to survive- HSL November 2020

VanEck Junior Junior Gold Miners ETF

The last peak in the gold price in USD terms actually came in August 2011, around $1900/oz, a level that it is barely above today. A far cry from the rampaging stock market returns of the last decade, fuelled by years of the insanity of central bank money printing, with debt levels soaring. But, you don’t have to dig deep to understand the basic fundamentals of significant gold price appreciation from here are arguably the best in history.

85% of the gold in existence was mined in the last 200 years and is most still in existence, in jewellery, artefacts and central bank vaults. The proverbial statistic that one of the rarest metals in abundance in the Earth’s crust, is that the total mined stock would only be enough to fill eight Olympic size swimming pools, with current production barely adding an additional 1.5% a year to that.

I never understood Warren Buffett’s distain for gold investment as a ‘non-earning’ asset. Surely, it’s just the total return over time that’s important, unless you want to live on quarterly dividends? Much wealth creation has been in property, but you have to rent it if you want it to earn.

The current fundamentals for gold see;

• Huge central bank buying

• New discoveries in terms of number and grade and yearly production are on the decline

• Total reserve banks by the major mining companies declining

• USD weakening amid total indebtedness rising

• Comparative valuation levels as inflation levels continue to worry

• One of the most under-owned asset classes • Geo-political fragmentation and conflict escalation growing

Readers should certainly add the excellent commentaries of Otavio Costa at Crescat Capital LLC to their financial learnings. His report on gold mining is well worth reading as well.

https://www.crescat.net/mining-industry-renaissance/

I’m sure Jim Rogers will have already made his 2020- 2030 ‘assessment’ that gold is preferable to stocks with all the fundamentals above to hand. But, very relevant in recent developments is to also appreciate that the two biggest gold producing countries, China and Russia, (at over 300 tonnes/year each, roughly 10% of the global total) are for all intents and purposes the other side of the new ‘curtain’ now. While China has never exported their gold production and is a large importer, the sanctions/ ‘permanent’ confiscation of $300bn of Russian reserves by the US have sufficient global concerns that other countries realise that holding assets at home and diversifying from USD is wise in this changing times. In 2001, 73% of global reserves were held in USD, by 2021, 55% and down to 47% in 2022. The trend looks clear.

As in the last bull decade of gold, while the metal’s price appreciation was substantial, by far the biggest winners in return multiple are the junior mining companies, that are gobbled up by the majors, desperate to maintain their reserve bank, typically paying the highest prices for in-situ gold reserves. When we used to run the Hinde Gold Fund, one of our spreadsheets gave the assumed value across companies reserve base, weighted by category, (Proven+Probable, Measured+Indicated and Inferred) and by grams/tonne grade. Those ounces were then multiplied by the gold price to get a value and a % taken of company market cap/in-situ value. Any company with less than a 5-10% level would be worth investigating further, as it might well be an M&A target.

e.g. 1mil ounce in-situ x $2000 = $2bn. If the market cap of the company was $100mil, that would be 5%, an effective value of paying $20/oz for the acquirer.

With jurisdiction more relevant than ever in light of geopolitical change and reserve nationalism, (e.g. Chile just nationalised their lithium mining production), focussing on operations in ‘friendly’ countries is important.

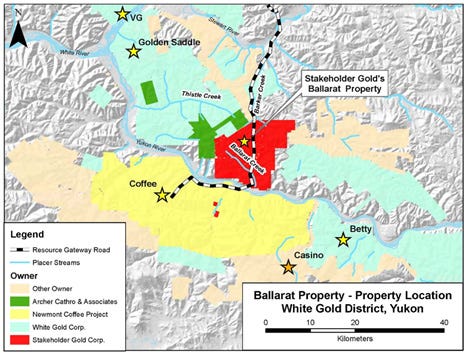

We have written before in this letter of some gold mining companies that may be worthy of further research by subscribers. One of those is Stakeholder Gold, (SRC-V) with a small market cap of just C$11mil. Of immediate note is that the CEO, Chris Berlet, who we have known for many years during our Hinde Gold Fund days, seems to be moving his stock ownership towards the 19.9% level and that the treasury issuance is still only 13mil shares, benefitting from the company’s cash flow from quartzite mines in Brazil, unrelated from the Yukon property targeted for gold exploration.

But, the recent news in April has certainly caught our eye with Stakeholder tripling their land position looking a real coup in this fertile ‘friendly’ gold mining district, prior to any exploration, especially as the land package straddles the main road, with major mining companies like Newmont and Agnico/Kinross committing more resources here.

We have started regularly updating our “Permanent Portfolio” in the Insights section of the letter to demonstrate that gold really shouldn’t be the barely owned asset class that it is, and 25% is very reasonable. Whether you believe in decade cycles and choose to risk more at this time is a personal decision, (or even understand that the real money in a gold bull market will be owning best of class, junior mining companies that get acquired at real multiples) but having a zero weighting in your portfolio, with valuations in stocks and real estate currently, is really not wise at all.

Stakeholder land position, prior to April 14 2023 announcement

Stakeholder land position, post April 14th 2023 announcement

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

Visit hindesightletters.com for more information