OVERVIEW

Last month, I found myself driving through Essex near where my wife used to have a house many moons ago and passing by the famous signpost for the “Secret Nuclear Bunker”. I had visited the Kelvedon Hatch bunker, as a museum a few times, some 20 years ago to pass the time on a rainy Sunday morning. Do go, I heartily recommend it. Built in the early 1950’s, it was fully operational for over 40 years throughout the Cold War as a potential regional headquarters for the UK government if the nuclear apocalypse had occurred. With capacity for 600 people to live 30m underground for three months, it was certainly one of the very largest bunkers in the country.

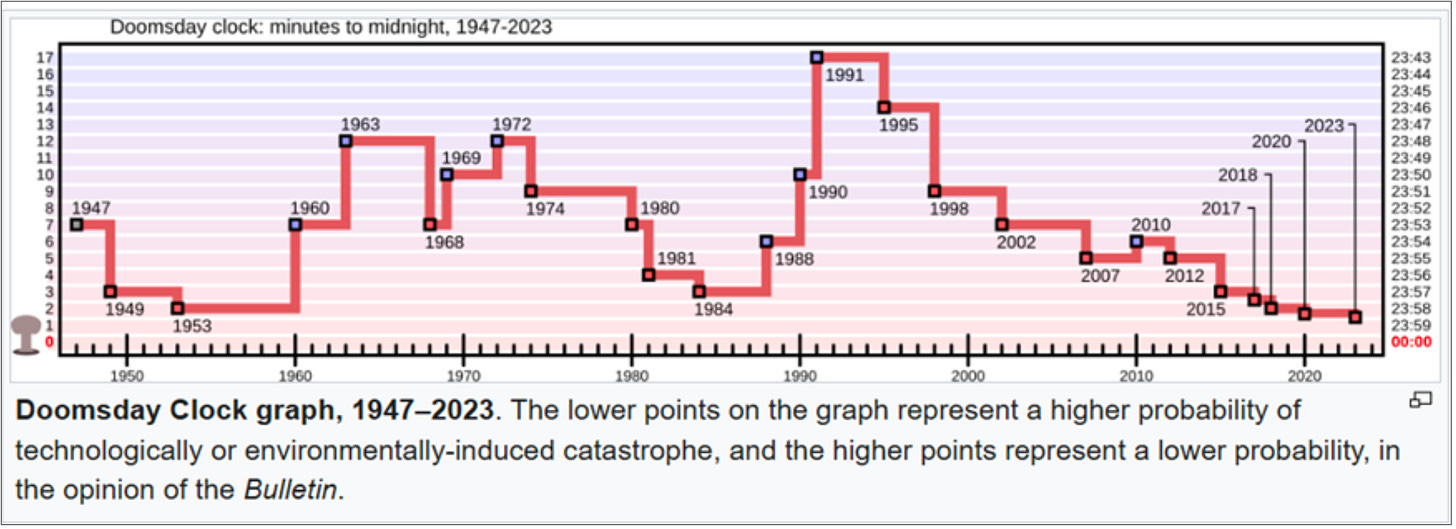

According to Subterranea Britannica, at one time there were almost 300 bunkers in the UK that were expected to be places of refuge for the chosen few. Nearly all were de-commissioned in the 1990’s, with only the key sites in London and military establishments in operational status nowadays. Clearly, the ‘end’ of the Cold War in the 1990’s came with the peace dividend of a safer world with our much watched Doomsday Clock reaching 17 minutes to midnight.

It’s unlikely I am the only one wishing that they had snapped up a ‘cheap’ nuclear bunker when the government was selling them off 20 years ago, knowing that it was only a matter of time before they would be unwelcomingly relevant again. Since the re-set at just 89 seconds to midnight on the Doomsday Clock in January 2025, we now have yet another crisis with Iran’s nuclear programme taking a battering from Israeli and US bombings. Iran has one of largest populations in the Middle East at 92 million, second only to Egypt at 113 million and 10X Israel’s population and despite being predominantly Shia Muslim, with no natural alliances with other Middle East countries, it’s alliance with Russia shouldn’t be forgotten.

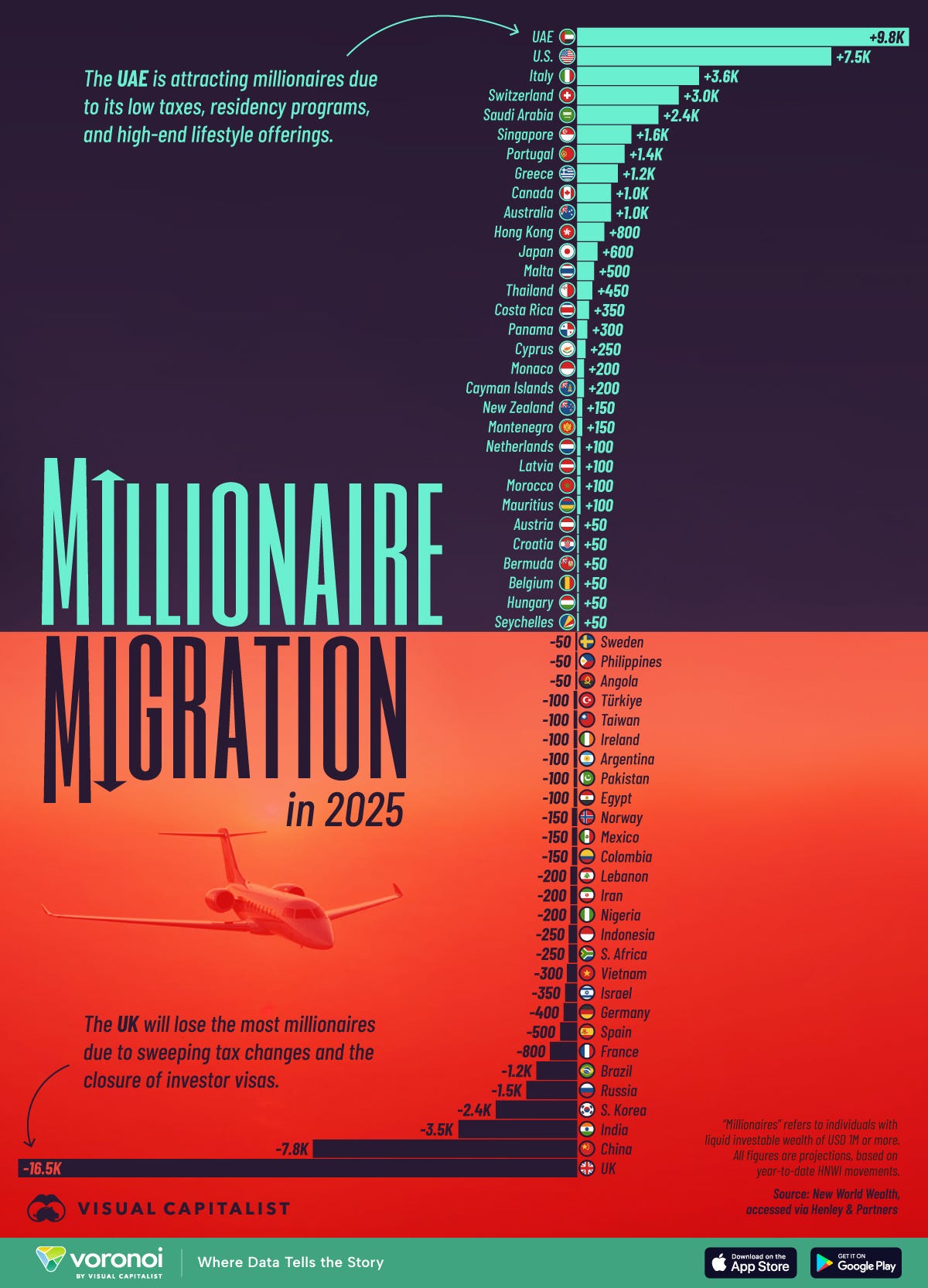

A friend who was scheduled to fly from Madrid to Tokyo last week reminded me of the worrying state of affairs with respect to world air travel. Dubai Airport in UAE and Doha Airport in Qatar combined see almost 150 million passengers per year transit through or to their airports. Well, unless it’s in the middle of a war zone and the air space is closed like last week! My friend was very lucky to not spend three days dossing on Doha airport floor, watching the ‘fireworks’ above! I’m sure there were a few UK tax exiles in Dubai wondering if their new found residence had connotations of Warsaw in 1938.

Of course, for the current Labour government which is hurtling full speed into internecine destruction, (Standard outcome with too many clowns in one circus) geo-politics is not as relevant as defending benefit freebies and focusing on economic mismanagement at home. It’s difficult not to become nauseous with the number of U-turns in policy since last July, but that tends to happen if the plans were ‘bollox’ in the first place. Baldrick would have been proud. There are so many new lows in this administration that it is difficult to judge but my winner this month has to go to Darren Jones, Chief Secretary of the Treasury spouting on Question Time that the majority of people (arriving) in these small boats from France are children, babies and women. This is the guy, more than any minister who should be living and dying by facts, statistics and numbers. The actual split of the 6,420 small boat arrivals across the English Channel in 2025 is of course, 5,183, (81%) being adult males. Unfortunately, it sums up the current state of affairs with the Labour party’s policies, “ Got the wrong numbers, wrong facts and the wrong policies as a result”.

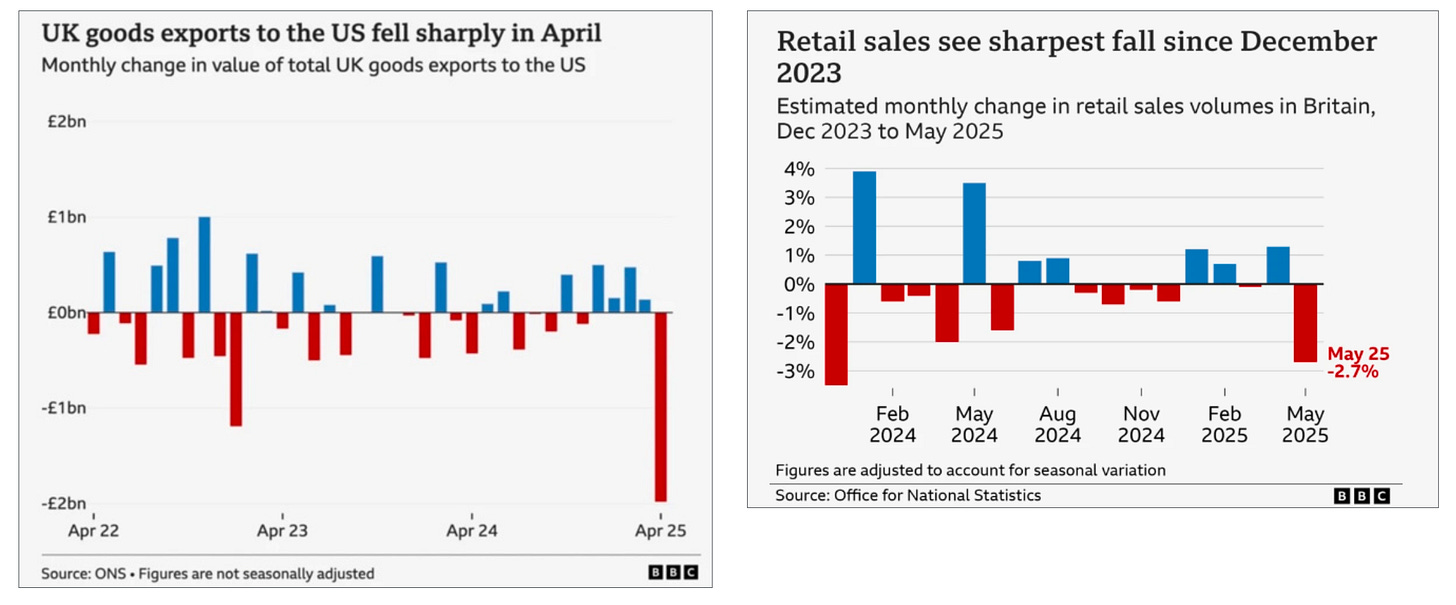

Considering the worsening war footing that the world is facing and the UK’s Labour government only one year into its term, of easily arguably the worst government since Christ was a cowboy, the UK stock markets among others seem extraordinarily resilient CURRENTLY, at almost +10% including dividends on the year. Many will shout that UK valuations are ‘cheap’ compared to overseas competitors which by many metrics is true, the reason why so many UK companies are disappearing from our shores, either being acquired or making the decision themselves. The rumour this morning is that the FTSE 100’s biggest company, Astrazeneca is considering a move for its primary listing and possibly its head office to the US. A departure of the £161bn market cap giant would surely be, not just the loudest wake-up call but also maybe the death knell of UK Ltd as far as global equity indices are concerned. Our shores are no longer considered friendly from regulatory or tax perspectives and Rachel Reeves et Al are doing their best to worsen the situation.

During those early April days of “Tariff Madness”, all stock markets cratered, the US dropped 17%, Germany by 19% and the FTSE 100 by ‘only’ 12% reiterating the downside correlations that are ever present. Of course, the UK market by metrics such as P/E ratios is ‘cheap’ to the US, for easily justifiable observations as many CEO’s know only too well. But, we know the US is not ‘cheap’ by any historic measure, once again we show Hussman’s GVA long-term chart showing the extent of America’s exceptionalism or ‘speculative lunacy’, whichever you prefer. My readers are often generous with their praise on the change selections in the HindeSight Portfolio, (better lucky than smart) with reference to a glimpse of the last 40 closed trades but I have to keep telling myself and you that the world isn’t great, certainly not for equities, especially not inflation- adjusted. The historians will always point to the very long-term return in equities, (mostly made up of dividend compounding and re-investment) as being stellar, but history tells us that long periods of going nowhere amid horrid drawdowns are the norm from overvaluation levels such as we see now. The same must be said for UK house prices, that for most people’s lifetimes have been an indisputable one-way ticket to wealth creation, but overvaluation and excessive price/income ratios amid crazy stamp duty tax levels have finally put paid to that. I’m told that liquidity in London property is nowhere to be seen. John Maynard Keynes’ great saying that “ The market can remain irrational (too low but usually too high) longer than you can remain solvent” should always be followed that one day, rationality will return with a vengeance.

INVESTMENT INSIGHTS

The HindeSight Portfolio methodology and strategy works very much on the regular rotation of single large cap stocks within a portfolio and far less ‘buy-and- hold’. Many of our selections have featured in the portfolio several times over the last decade of so as they move from ‘cheap’ with a perceived margin of safety to either fair or higher value. The target has always been 30% return within a nine-month holding period, which of course is quite arbitrary but over the long-term rotation, we hope a reasonable average.

In fact, if we look at the last 40 closes for the HSL portfolio with a 39/40 win-loss ratio, the average return is 32.93% and the holding period average is 352 days, which is not far off target - Must try harder!

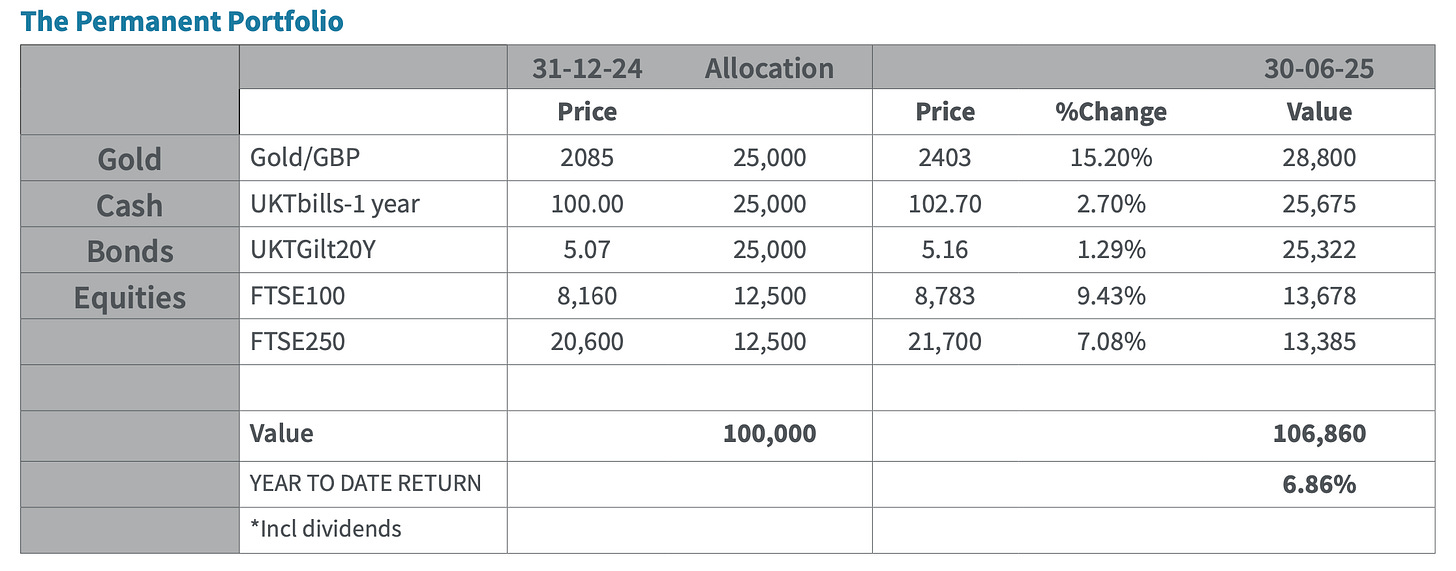

In the same vein with the allocation splits across portfolios, we believe that we should be very aware to the concept of rotation and re-balancing. In our demonstration of The Permanent Portfolio that we show regularly, we re-balance every January 1st back to 25% allocation across the four asset classes. There is much historical data available regarding ‘dynamic’ re-balancing to improve return profiles, typically when any major asset class has risen or fallen substantially within a certain time period such that is ‘over-bought’ or ‘over-sold’ and it is never far from my mind, especially when you add seasonal factors into the mix. As we mentioned last month, with UK equities up almost 10% year-to-date coming into the seasonally poor part of the year, it could well make sense to be lightening up at current levels. I think +/- 10% is as good a yardstick as any other for most major asset classes within a YTD or rolling 1-year basis.

But, then we come to gold. In many ways, but especially for The Permanent Portfolio, it is viewed as the core asset but typically the actual % return profile is no different from the other asset classes, but often inversely correlated to equities in direction. Historically, gold being up more than 10% within a rolling 1-year period would be seen as ripe for a correction as it would usually have come from a period of speculation and most portfolios would be well- advised to have some trailing stops to re-balance. But, in recent years, gold has become a different animal. In GBP terms, gold is 50% higher than just 18 months ago and pullbacks of any scale have been few and far between.

Anywhere you look, it’s hard to come to any conclusion other than it’s probably going higher and that it needs to be in any investment portfolio, which for most unfortunately, it has been sadly absent.

The few articles below that came across my desk this month are a constant reminder. The central banks of the world continue to add gold holdings to their reserves and many of the already large holders are demanding repatriation from vaults at the Federal Reserve and the Bank of England.

In the headlines we have Germany and Italy, the 2nd and 3rd largest world holders (at 3,352 and 2,452 tonnes respectively) being urged by their citizens and advocacy groups to repatriate £245bn of gold bullion from US vaults. Of course, UK only has 310 tonnes, a meagre £25bn worth, having sold almost 400 tonnes by UK Chancellor Gordon Brown in 2000 at less than £200/oz. Our coffers have missed out on the 15X up-trade since then, roughly £30bn more, which Rachel Reeves could sorely do with to stop her tears. Is she crying for all of us at the state of the country?

The fracturing geo-politics is clearly making central banks not just add gold to their reserves but also demand it is in their own vaults. Far harder for the Fed or Bank of England to exercise control over the paper gold markets of unallocated and futures if they don’t control the physical. But, if you want some fundamentals to back up the demand for gold, you don’t have far to look than;

• A concern that 3-4% inflation rate might be as good as it gets

• The US debt-to-gdp ascent looks like it is unstoppable higher

• The interest payments of the ever growing debts is reaching almost 20% of tax revenue.

Clearly, these are not fundamentals that any country wants. Reserve currency or not, this is unsustainable and any bet that the new currency reset may be gold based at much higher levels is becoming less of a longshot with each passing day.

SOME CHARTS BELOW AS ALWAYS THAT MAY BE OF INTEREST

HINDESIGHT PORTFOLIO UPDATE (JUNE 2025)

There were two CLOSE alerts and no ADD alerts for the HindeSight Portfolio in June:

CLOSE ALERT- FRESNILLO, (FRES), Absolute Return +97.5% (Incl Divs), Relative Return, +75.5% (FTSE100), Holding Period, 1351 days

CLOSE ALERT-IDS/ROYAL MAIL, (IDS) Absolute Return +11.5% (Incl Divs) Relative Return, +8.5%, (FTSE 100), Holding Period, 1153 days

We finally cashed in our chips on FRESNILLO, after 3.5 years of waiting, much of it underwater I have to say. While I am happy to take the 97.5%, including dividends such that it’s almost 30% a year, I do look at Hochschild and berate myself for not selecting that much more straightforward return relative silver price.

HINDESIGHT DIVIDEND UK PORTFOLIO # 1 (JUNE 2025)

PORTFOLIO UPDATE AND CONSTRUCTION

Simply tap below to see the PDF of the current Portfolio #1 Construction.

Happy Investing from all of us here at HindeSight!