OVERVIEW

Anyone who has seen David Haig’s excellent play ‘Pressure’ will be well aware of the sliding doors moment for Europe in 1944. I was lucky enough to see this in Hastings as amateur dramatics but the story was so powerful, it didn’t need to be a West End production for me.

The written history of successful D-Day landings on June 6th 1944 and a ‘fighting march’ to Berlin over the next nine months with Nazi Germany’s defeat rarely mentions the close run luck there was, which could so easily have played out very differently. As the play reveals the Allied meteorologist teams led by Group Captain James Stagg are at the epicentre of arguably the most important weather forecast in history with little of the modern technology to help them. Much is made of the rivalry between US meteorologist Colonel Donald Yates and Stagg, both vying for Supreme Allied Commander Dwight Eisenhower’s approval but the desperate crux of the matter is the notoriously changeable English weather.

For the D-Day invasion force of 7,000 ships and almost 200,000 men from eight allied countries to have any real chance of success, it needed a low tide, full moon, little cloud cover with light winds and low seas. If the invasion had launched on the 5th June, it would have been a disaster as the storms came in. If Stagg hadn’t correctly predicted a small window of fine weather on the 6th and Eisenhower deciding to go with it, they would have had to wait till around the 20th of the month. But, between 19-22 June, the weather in the English Channel was the worst for 20 years so it wouldn’t have happened then. So, with a real possibility of the invasion delayed until 1945 and no Second Front to relieve the Soviet Armies fighting in the East, the war may have taken a different turn, especially with the arriving German new ‘super’ weapons.

The ME262 jet fighter was the only jet fighter to see service in WWII and the V-2 rockets had just started launching devastating attacks on London. The ME262’s top speed was almost 200 mph faster than the legendary Spitfire and the V-2 rockets could reach speeds of 3,400 mph which in 1944 was truly mind- blowing. Once the US and Russia armies got their hands on the German scientists such as Werner Braun who developed the V-2, they would be the blueprints for all the ICBMs, (Intercontinental ballistic missile) that were built in the decades after.

Without the D-Day invasion in the summer of 1944, with Germany’s new weapon superiority, maybe the US would be contemplating both nuking Berlin and Hiroshima or the negotiated settlement would have seen a Soviet-Germany split of Europe and the post war period would have been quite different.

But as it turns out, D-Day in 1944 was a success and the US armies who landed in Normandy ended up staying for 80 years.

US President Trump’s arrival on the scene has thrown much of the US and NATO post WWII military policy up in the air, but currently there are still over 40 US bases in western Europe and more than 100,000 personnel. In comparison, the UK which at one time had 80,000 troops, (British Army on the Rhine) back in the 1950’s and almost 20,000 still in 2010, now has less than 500.

Arguably, German’s lack of military spending has been easier to understand after their huge army builds and warmongering saw Europe in ruins twice in the 20th century but less so for the rest of Europe and notably the UK.

The fact is, that it has just been too easy to cut defence in countries’ budgets in order to spend elsewhere and rely on the US to maintain the military spending and protection umbrella for Europe and NATO. But no longer, Trump has called Europe out on that now. It reminds me of the old progressive tax explanation where everyone in the pub has been poncing drinks for years off their rich mate and then he decides they have been taking the piss for too long.

The last time I was in Russia was 1991, as communism was collapsing and the Cold War was ending with the Doomsday Clock set at 17 minutes to midnight. The peace dividend that was reflected in the clock setting may well have been good reason to cut back on defence spending but in January 2025, the clock was set at just 89 seconds to midnight, much of the recent decline towards Armageddon attributed to the re-emergence of European wars amid global fragmentation and growing distrust. I don’t really think the US will be closing its 40 airbases and pulling out of NATO but the threat has had to be real to get us Europeans to get our budget priorities right even with 89 seconds to midnight staring us in the face!

It seems terribly depressing to think that my latter years will see massive re-armament in Europe and my young son will grow up with all those concerns of nuclear Armageddon again of the Cold War, obviously praying not actually going to happen this time!

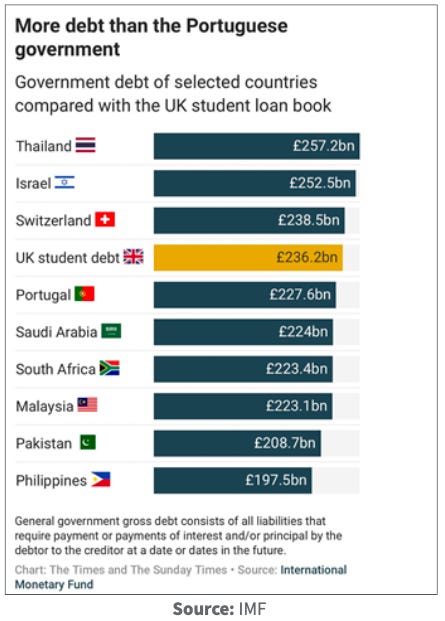

Much of the variability of historical and future events comes naturally from the politicians and policy makers of the day. I fear the worse with our current leaders. Unfortunately, I agree with US envoy Steve Witkoff who despite being a property developer with no diplomatic experience spoke about the Churchill-like posturing of Keir Starmer and other European leaders and their current ‘peace plan’ which leaves me very cold indeed in their naivety. The unpredictability of US President Trump and the anti-Europe sentiment currently in his administration leaves much to be desired but we really should not have let European military forces be depleted so much over last 30 years. Maybe, the only upside from the proverbial ‘kick up the arse’ for NATO defence spending from Trump is that Germany has announced a monstrous fiscal spend on both defence and infrastructure. In terms of GDP, it is greater than the post WWII Marshall Plan and the 1990’s Reunification spend. Of course, Germany that has been under a debt-brake of austerity since 2008 and enjoys a debt/GDP ratio of just 65% so it’s an amazing opportunity to kick start the economy and regain the centre stage in Europe. Unfortunately, most of the rest of the countries including the UK haven’t that luxury with 100% debt/ GDP ratios with zero fiscal capacity after spunking it overspends on welfare and public sector largesse etc.

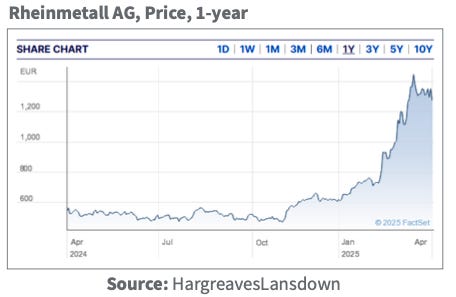

The Marshall Plan after WWII saw Germany continue to be a manufacturing giant and still with all the expertise of building machinery, whether it be tanks, cars, engines or arms, so we can expect much the same again, if there is enough time. Many of the defence companies are also in France so the European core may well be the place to be as some of the most recent stock price moves have shown us. Investments will have to take all this on board for the new narratives, (see Investment Insights section) as they are unlikely to be changing any time soon. Trust takes a long time to come back....

Finally, RIP for Oleg Gordievsky, who died last month, aged 86. The most famous British double agent of all, who was sentenced to death in absentia by Moscow after his escape to the UK in 1985 but seems to have eluded Moscow’s reach to the end and died of natural causes. I had the great privilege of having dinner with Oleg many years ago with my Russian teacher at the time. From the conversation and his many books, he convinced me and many others that the Russians are naturally paranoid and they have always believed that NATO was and is, capable of a nuclear first strike despite how crazy that seems to us in the West and in 1983, during the NATO exercise ‘Abel Archer ’, Oleg had to forcibly persuade Moscow that it was just an exercise, potentially averting an Armageddon scenario.

INVESTMENT INSIGHTS

Unfortunately, I am crucially aware that very few UK fund managers have much, if any exposure to gold through years of experience trying to convince them

while running The Hinde Gold Fund with my partner Ben Davies. While gold was one of the star performers in 2024, it is still in sprint mode this year, up a whopping 16.2% in GBP terms in the first quarter and because of the 25% allocation in your standard Permanent Portfolio, the return is at least 4%+ overall as clearly UK stocks and bonds aren’t helping much at all, even with coupon and dividend income. Much has been written in the financial press over the last year of Labour and prior to that of the need for more UK pension fund monies to flow into UK Ltd and their exchanges. The argument has always been that UK pension fund managers were focusing on the US markets ‘Exceptionalism’ in performance terms. No doubt, some UK funds will have found themselves over exposed to those thoughts as the US exceptionalism mentality has faded fast this year and the portfolio switch of the year has been out of US stocks and into German stocks. As HSL was going to press, we had the end of ‘Liberation Week’ with Trump’s much greater tariffs that saw major equity declines from quarter end but will leave that discussion in full till next month.

The current investment narratives playing out here are;

US Tariffs and global responses tit-for-tat

Huge German fiscal expansion

Continued geo-political fragmentation

UK Labour government very poorly thought out economic policies

Such that the movements in most of the primary asset classes are responding;

German stock markets trending higher while German bond yields rising

US stock markets losing ground from high valuations amid tariff related recession concerns and US bond yields falling

Gold continuing to move higher with relentless global central bank demand and lack of production capability to mitigate the demand/supply dynamic at current prices

For UK investment markets, they are facing the worst problems with slower growth and recession likelihood increasing by the day.

The FTSE100/FTSE250 ratio is widening as the smaller companies get clobbered with more and more taxes and costs which is very obvious but the UK bond market is more worried about inflation and the fiscal headroom issues or taking its cue from German interest rates rather than focus on weak growth. We don’t have the luxury of fiscal expansion in the UK and the policy decisions that Rachel Reeves is making look very death spiral in nature to any sane person, which is hardly ideal for investors.

Of course, the numbers are struggling to add up with 27 million private sectors workers (most thinking of leaving the country) to support;

• 9 million can’t be arsed economically inactive people 16-64,

• 6 million public sector workers with very low productivity

• 13 million pensioners

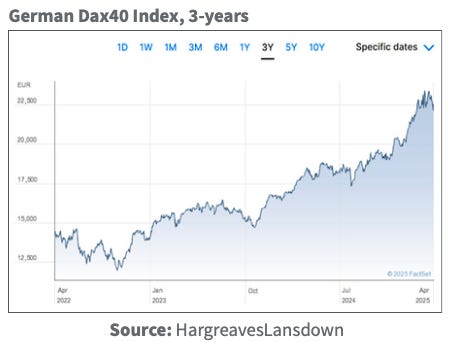

It’s not pleasant to look at the FTSE250 basically flat since the start of 2024 and see the German Dax40 Index up a huge 33%!

Clearly, it’s not the worse quarter for your typical UK investor with UK stocks and bonds combined as roughly flat but obviously some gold, some German stocks or some of HindeSight Portfolio choices, your returns would been far better. A quick look at the one year interest rate charts of US, UK and Germany below.

HINDESIGHT PORTFOLIO UPDATE (MARCH 2025)

Download the HindeSight Letter Portfolio PDF to see the state of all our shares from over 100 issues and years of investing - simply click below and have a read.

Happy Investing!