OVERVIEW

Bringing an end to the conflict commonly known as ‘The First Peloponnesian War’, the ‘Thirty Years’ Peace’ treaty was signed in 446/445 BCE between the two most powerful city-states of Athens and Sparta as they fought for superiority in the times of ancient Greece. Only 20 years before the war started in 460 BCE, Athenians and Spartans had fought alongside each other in the Greco-Persian Wars but land disputes and grievances since had led to war. With Athens more powerful with their naval capability, Sparta’s land army was their strength but constant fighting and battles without full victory led to the peace proposal. The treaty detailed the terms of splitting the territories and possessions between the two powers and agreements on formation of allies to prevent future conflict. While seen as successful in its time, it lasted only 15 years until war came again to the historical empires.

For historians, the Athens-Sparta peace treaties are some of the oldest, but in fact the ‘Kadesh Peace Treaty’ is the oldest known. The treaty dated 1269 BCE marked the end of a long war between the Hittite Empire and the Egyptians that had been fought for two centuries over the lands of the eastern Mediterranean. The clay tablet found in 1906 in central Anatolia, Turkey, on the site of the old Hittite capital, Hattusa, records the text in cuneiform script pledging eternal friendship, lasting peace, territorial integrity, non- aggression, extradition and mutual help. These were the basis of the ideals of the League of Nations, the predecessor of the United Nations and today a replica of the treaty hangs in the UN headquarters in New York.

Such that we have a long, depressing human history of wars and peace plans but at least vast experience to draw from as the world looks to 2025 to bring an end to the Ukraine-Russia conflict that is close to three years now. Very few would have predicted such a duration between these two Slavic nations who had been allied throughout most of the 20th century but it is the US election result of a returning President Trump that has given hope for an agreement. With almost a million casualties between the belligerents amid a WW1-style futile warfare of land exchange and the constant concern about European escalation, the need for peace is much needed but the desired terms of both sides seem to make a difficult starting point for negotiation.

We will do well to remember the failed 1916 peace proposals from Germany that could have saved countless thousand lives on both sides from 1916-1918 but was deemed unacceptable to the Allies at that time with respect to territorial gains. The desire to continue and ‘win’ and then force the harsh ‘Treaty of Versailles’ in 1919 on the German state arguably was the root of WW2 and all the human losses and tragedy thereafter. The Biden administration and the neo-cons in the US have seen fit to believe the global plan has best suited bleeding Russia out, at the expense of Ukrainian lives and many Ukrainians and Europeans clearly blame the US for the messy war. The latest request to Ukraine from the US, its main arms donor that was rebuked was to lower the conscription age to 18 from 25 to solve the manpower crisis but still no discussion at all with a view to negotiations and the decision to allow long-term US weapons to be used on Russian territory will go down in history as most asinine in its provocation and potential escalation.

Of course, there will need to be compromises made on both sides, especially with respect to sovereignty over territory if there is to be a ceasefire and working settlement, although with the recent Russian advances on the battlefield and Trump’s desire to not send endlessly more financial aid, I imagine that Ukraine will have to compromise more than if negotiations had taken place at any other time. The Peace of Westphalia that was signed in 1648 was to bring to an end the Thirty Years’ War amid a back ground of 80 years of European conflict. It brought peace to The Holy Roman Empire after hugely costly human tragedy with up to eight million dead over the long conflicts. Many scholars have written on the principles of the Peace of Westphalia as the origins of modern international relations, collectively known as Westphalian sovereignty. While it is far too widespread in the current European press and political fields to ‘stand on the principle of sovereignty’ as complete justification for blindly supporting Ukraine, it is historically naïve to assume that will lead to a worthwhile and lasting peace. I have used this You Tube link before with respect to changing borders in Europe to demonstrate the norm of fluid change. However much we think we are ‘modern’ and ‘righteous’, it is obvious that we are not much different from the last 3000 years of war and peace plan history, as depressing as that is.

Let’s hope 2025 does bring us to an peace agreement with Trump’s influence, certainly parts of the market such as defence stocks dropping and the German equity market rising since November suggesting the increased probability. I would certainly imagine that the negotiations will involve Zelensky being sidelined in that process.

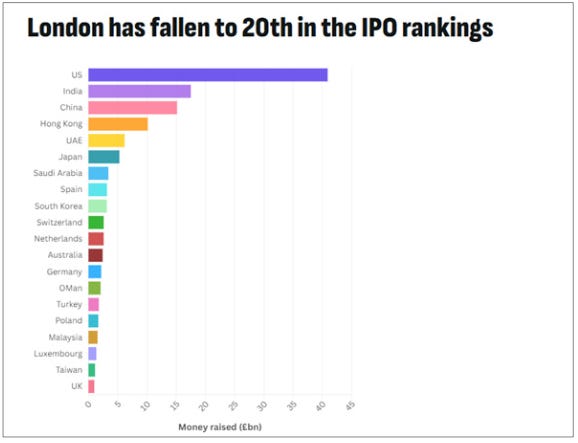

I can remember early in my trading career during the 1980’s when any ‘detente’ news during The Cold War was typically positively received by the equity markets and the German DAX potentially has reflected that too among other influences since early November. Unfortunately, the UK equity and currency markets haven’t been able to benefit from the same beliefs or even a standard Santa rally. The autumn budget given by ‘Rachel from Accounts’ has damaged any optimism in the UK, with the increased taxation costs that private businesses are having to face. Not only are people not expecting much comparable growth but now the potential of outright recession. Of course, the maths is quite straightforward although not something that Rachel or the Labour government may be aware of. According to the Office of National Statistics, the average profit margin for private non-financial firms was 9.3%, with services firms at 14.9%, hardly the most attractive place to do business in the first place compared to the US and even Europe. The yearly total pre-tax profits of UK companies are less than £200bn in the context of Rachel Reeves trying to raise £40bn. So guess what, you tax these companies a lot more to fund the inefficient public sector and you get less growth, less investment (domestically and from overseas) and more business closures. As one writer bluntly remarked, “Wrong people in charge at the wrong time and wrong place with the wrong plan”!

There are some winners who are benefitting from the government public sector spend. I regularly hear about people “Having it off” with an NHS related contract, no questions asked etc. The latest wheeze I have heard personally about is people making shedloads of cash ‘managing services’ within the immigration and asylum sector that is growing exponentially. Think gardening and food services at massive margins at RAF Manston, now being used as an asylum processing centre. Of course, there are unintended consequences of these policy changes such as very limited train services into London over Xmas, apparently train drivers with their recent huge pay rises courtesy of Rachel didn’t need to do any overtime which the services typically rely on. C’est la vie.

INVESTMENT INSIGHTS

The last UK Permanent Portfolio of 2024 has the scores on the doors with a return of 8.45% which is certainly not to be sneezed at with respect to diversified risk across the basic asset classes. Assuming the starting portfolio was £100,000, the ending value would be £108,450. The final splits were;

Gold-GBP, +27.8% £31,950

1-year cash equivalents, +4.76% £26,190

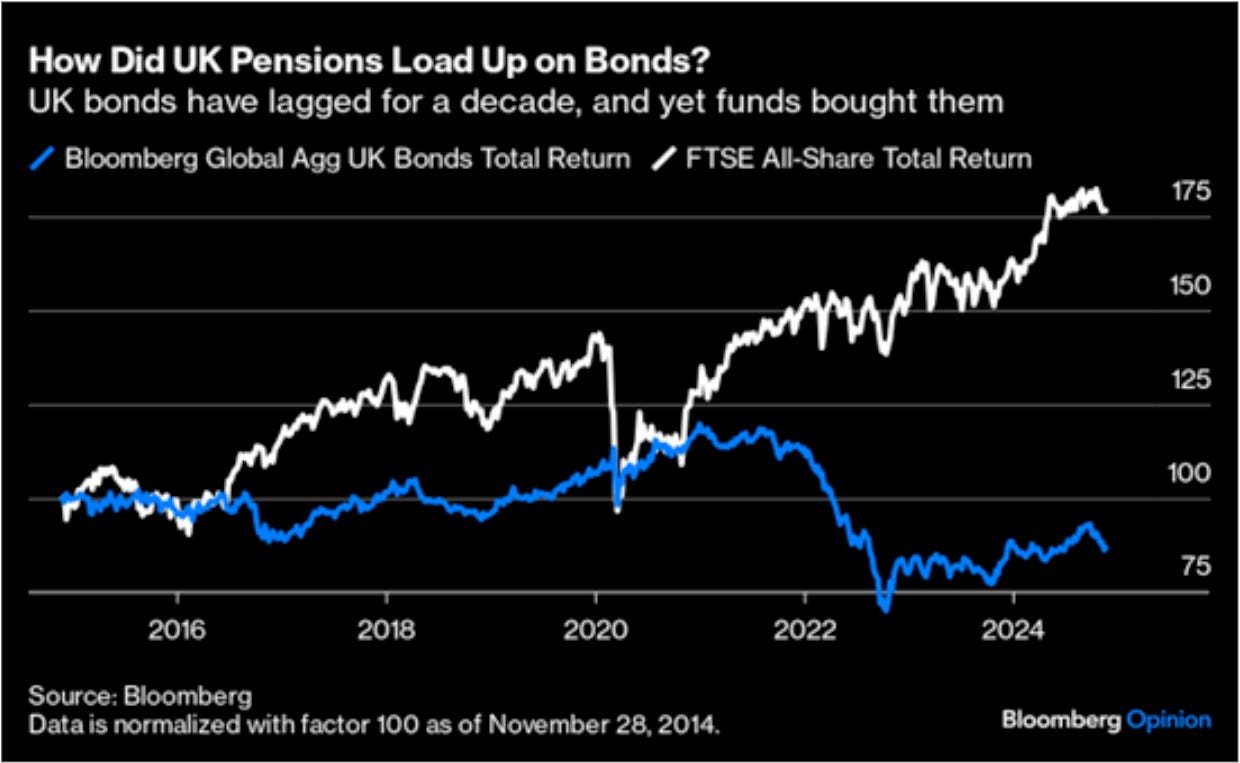

20-year UK Gilts, -7.5%

FTSE100, +9.2%

FTSE250, +8.2%

Clearly, gold has been the stellar performer which has made the returns this year and longer dated gilts the big loser. The UK equity markets including dividends seem reasonable but compared to the markets such as US S&P, +26% or Germany’s DAX, +20%, they look very uninspiring and a typical 60/40 bond-equity portfolio was barely in positve territory.

For any re-balancing here, you can either assume the return is taken out and then the re-set is the four-way split on £100,000 again or ‘compound’ and split the £108,450 which would demonstrate the ‘profit-taking’ in gold for example and re-investing into the poorly performing long gilts.

The Permanent Portfolio

Historically, long-dated fixed income bonds has responded well to the start of an interest-rate cutting cycle, typically steepening the curve in the process and while the basis point movements might be largest at the front end of the curve, the % moves can be better further out. In the UK, I think the slowing of the economy exacerbated by the budget taxation effects will see the BoE forced to cut rates despite the ongoing concerns of inflation. As such, I can see some parts of the UK bond curve might well be the best performers in the Permanent Portfolio in 2025, although the 20-year point might be too far out.

Like most reasonably well-read and informed analysts, I put more chance in seeing the proverbial Elvis Presley returning to be in concert in 2025 than much of the Labour party’s promised growth with story after story getting worse. To see the Office of National Statistics revise down all their UK productivity numbers due to new estimates of net migration, (No surprise there) was almost a new low closely followed by the story of the government writing to regulators such as FCA to beg for ideas for growth and investment. Just embarrassing beyond belief.

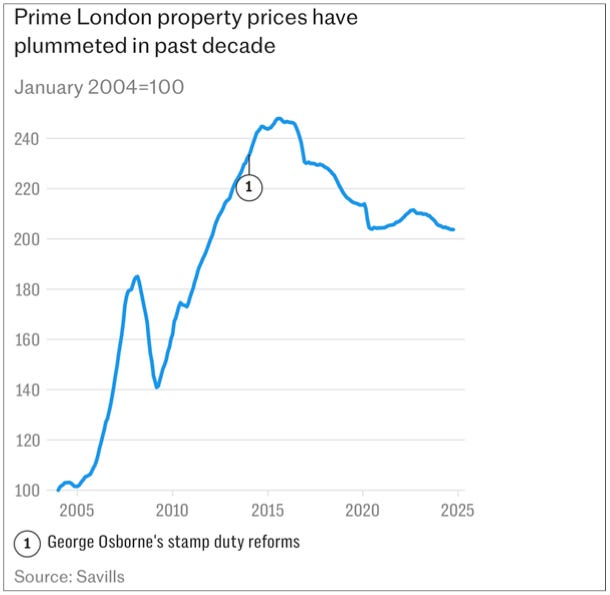

I had the great experience and pleasure of living in London for over 30 years but it seems to be very much on the wane. Arguably, Covid changed the dynamics for office work dramatically but the attractions that have made London great are lessening by the week with many other locations far preferable especially with a Socialist government in power. While UK house prices are always ‘going higher’ in the press, I was interested to see the chart below regarding central London prices. My wife rarely gives me credit for much, ‘taking the bins out’-maybe! but she does remember that in 2015 our decision to exit from London real estate and move to the country was a good one. A culmination of stamp duty increases amid dodgy wealth orders put the kiboosh on that and liquidity is far worse now.

Looking forward to 2025, what can we expect from a return perspective, too optimistic to target 10% again? In the HindeSight Letter and for many years prior at Hinde Capital running a gold fund, we have highlighted the Permanent Portfolio as an easy and accessible starting point for any investor for their savings. I hope 2024’s return showed once again that gold invariably has a big seat at the table, especially when there are real issues in the world.

While I can see all the reasons why UK Ltd and its listed companies are struggling to perform with the fiscal drag, much of the unattractiveness is priced in and long-dated fixed income clearly has some real value as the economy declines. As for gold, after a stunning near 30% return for 2024 it’s difficult to expect much this year but the global indebtedness and continuing geo-political fragmentation is still there in spades.

A few charts and links below.

UK productivity crisis worse than feared as net migration surges:

https://www.msn.com/en-gb/news/news/content/ ar-AA1vblIX?ocid=sapphireappshare

HINDESIGHT PORTFOLIO UPDATE

(DECEMBER 2024)

For our Premium Subscribers an alert went out on the 18th of November that we were adding Sainsbury’s to our Portfolio #1. It currently stands at +7.35 having risen to +13% in mid December.

Sainsbury’s Plc has appeared four times in The HindeSight Portfolio over the years;

CLOSE DATE 21/03/2016, Return +30.14%, Holding days 467

CLOSE DATE 11/01/2017, Return +23.13%, Holding days 157

CLOSE DATE 12/01/2022, Return +44.01%, Holding days 1031

CLOSE DATE 03/02/2023, Return +23.09%, Holdings days 268

Sainsbury’s is a household name, blue-chip equity in FTSE and solid performer for The HindeSight Portfolio historically with classic sine waves with a strong dividend payout, currently 4.87%. Arguably, many people would refer to Sainsbury’s as a ‘ Bond Proxy’ having a regular return without dramatic movements but with our historical return profiles, I would easily argue that it’s typically far superior than a bond return.

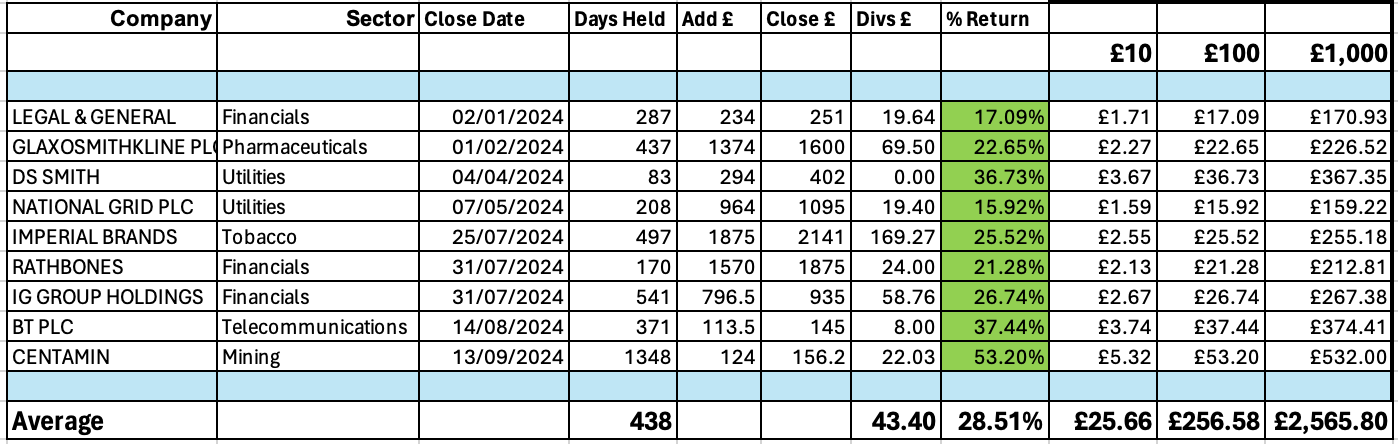

A reminder of last year’s history from our add and close alerts for the Premium Subscribers who spent just £4.99 a month to get the very best from our letter. A simple table to see where an investor would be if they did the same with a range of budgets invested in a portfolio mimicking ours.