Have you heard the news? The FCA wants you to invest your hard-earned cash. Why? Because apparently, they're running out of ideas on how to stimulate the economy, and they've realised that there's a lot of money just sitting in bank accounts not doing anything. “The watchdog’s recent Financial Lives survey found 4.2 million people in the UK held more than £10,000 in cash and are open to investing some of it.“ HERE

Now, you might be thinking, "But wait, isn't it expensive to get financial advice from an independent advisor?" And you'd be right, it certainly can be. But fear not, dear reader, because the government has a solution: they want to make investing easier and cheaper for the masses. Sound familiar?

We set up HindeSight Letters seven years ago because we felt the democratisation of not just data for the stock market but also the knowledge about the mechanics behind shares and the world of money needed to happen. Money is one of the last real taboos, when people will tell you all sorts of shit now from sex to their kinks but ask them how much they earn and what savings they have and hardly anyone will be honest and most will think it rude. As above, the fees can be large, but with HindeSight you’ll get a lot for little. We don’t take a % of your investment, we don’t even make you buy the shares we write about, you’re 100% in control of your money, as it should be.

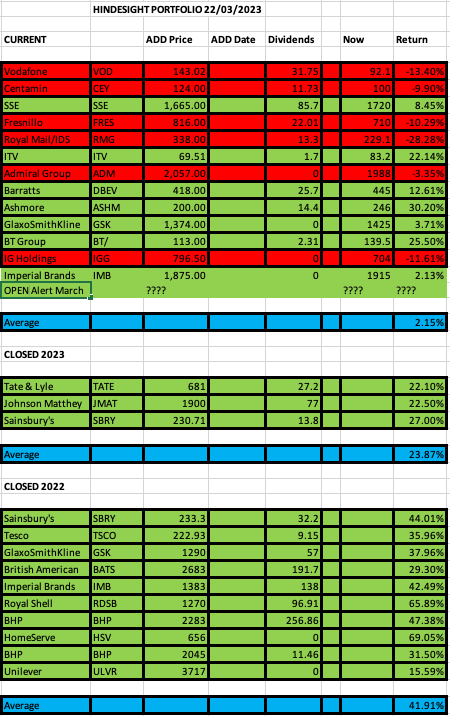

So what's the FCA’s plan, you ask? Well, they're looking to promote low-cost investment options like index funds and robo-advisors as part of their push. We say why pidgeon-hole yourself, we use AI AND humans, because AI is OK and humans are OK but put them both together and well you get the list below. Our current HSL Portfolio (minus the one add alert we sent out yesterday to paid subscribers). Bearing in mind we just had a significant market movement thanks to a few banks collapsing, we’re still in good shape.

But don't worry, the FCA is not just leaving it up to the robots. They're also planning to launch financial education programs to help people understand the ins and outs of investing. Again this sounds like something that might need a seven year track record that’s available for anyone to see. *cough that’s us*

It might not be easy for Vanguard, but we have this covered. Share this and see if you can get some people onboard, and try us for a month or two, you can cancel anytime as we’re living by our numbers, we do well, you do well, everyone’s happy.

Be ahead of the curve and get involved.