Back in the day (12 months or so ago) we used to be called the HindeSight Dividend Letter but we changed the name for a few reasons, mainly ease of use, dropping the ‘Dividend’.

We assure you, though the word is dropped from our name, there’s still mucho importance attributed to the dividend part of our portfolio. Dividends have been the target of a lot of research over the years and they all say the same thing, reinvest them and get the best dividends you can, they are important to your bottom line. That’s a universal truth and only a crank would dispute this. Go for a quick Google search if you don’t believe us.

Sure there’s a lot of other forms of investing, and we’re down with all that but for the purposes of our letter and what we do, we’re taking the dividends to the bank thanks.

Cool. Cool. So you just invest in the top 10 dividend players in the UK then you’re set right? Hold your horses there. It’s not so simple. Just because they have a good dividend doesn’t mean they’re fit enough for the HindeSight Portfolio #1. We look at a lot of other metrics, but we attach an importance to the dividend amongst many other things. The below list of shares is the top 10 dividend payers in the UK and we have had a bit of most, but not all of them over the years.

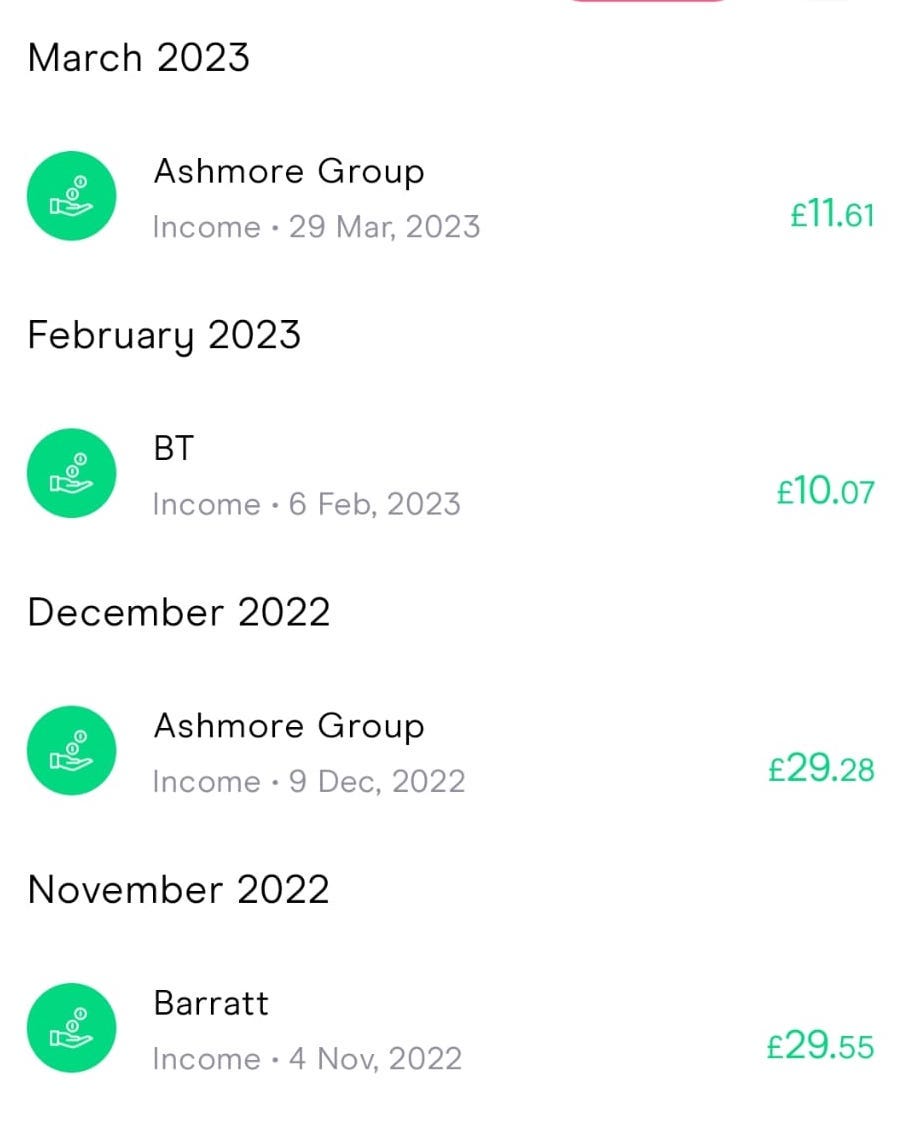

If you have an account for shares then you’ll see the dividends drop in every now and again, and they’ll add to the data we use in our graphs (below) to improve the overall return on investment. Some of them have a chunky dividend and we like this, but only at the right price.

You’ll notice above SSE is +10.55%. but if you look at your live share data for the share in your portfolio it’ll be at +4% to 5% depending on when you bought into it. That’s the magic of the dividends. Have a look at your shares and see the live price, then check the backend of your digital wallet for shares and see how much the dividends add up to. If you’ve been following the live portfolio, you’ll have accumulated some nice dividend action. Putting some more of your money to work and keeping the account in credit, ready to be deployed to the front lines.

Onwards!