Originally from Newsletter #35 in October 2017 we were taking a look back on Mark Carney’s reign as chancellor and had this to say: “All good actors know when to leave the stage. Politicians, like football managers, rarely go out at the high points, even when the cycle is clearly turning. For central bankers like Mark Carney, time is running out if they want to keep their reputations intact. Maybe he should reconsider his decision to extend his term.“

With Rachel Reeves in the same position he held in government, we thought it’d be interesting to see what history has taught us in that time.

Hugh Hendry made the decision to close his long-running macro hedge fund, Eclectica Asset Management, last month amid losses but he is not alone. Most of the legendary traders are suffering losses and redemptions ¬– Brevan Howard, Tudor, Rubicon and Moore to name a few. These former ‘Masters of the Universe’ are being slowly wiped out. Why?

They can’t all be losing their touch at the same time. There are many theories but some are indisputable. The costs of running an investment business these days have climbed to extremes with the new levels of oversight insanity. In the wonderful acronyms of FATCA, GATCA, CRS or MIFID II, you can find more rules and regulations than a sane man would ever have thought possible. After the next financial crisis, we will doubtless discuss how it could have happened with all the new compliance and policing. Blackadder’s infamous words, ‘It was a bollox plan,’ will probably be ringing loudly in our ears by then.

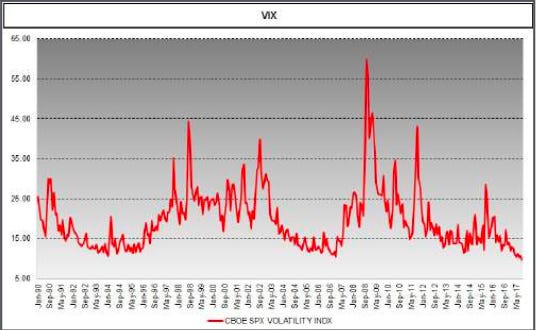

Costs apart, the main arguments for the demise of the macro hedge fund are the lack of volatility and the irrationality of prices for an extended period. Actual volatility (Historic/Delivered) is even lower than the implied volatility of the option markets, and there must be some investors who have benefitted from ‘shorting vol’, believing that nothing much would keep happening. But for most investors, this has the ‘picking up nickels in front of the steam train’ analogy to it.

Many older macro traders made their money in the interest rate markets over the decades, but now struggle to make sense of low, zero, or in many cases, negative yields. Last month, we saw Austria join the club for sovereign issuance of 100-year bonds at a paltry 2% yield. With the duration (the time to get your money back) somewhere around the 45-year mark, most investors may be dead before that event. Call me old-fashioned but I’ll pass on that ‘fabulous’ investment opportunity!

In a low rate environment, with little in the way of daily interest rate ranges, watching paint dry has come back into fashion. My brother, a long-term interest rate broker, tells me that he often has to stop the urge to turn his pricing screens off and on to make sure they are still working; the price action is so repressed. With the same need to make money, but with nothing happening, this invariably means increasing the trading size. Instead of trading $50mil, you now trade $250mil, and so on. When you are a young gun, this might make total sense. The trouble is, the older and wiser you get, the more acutely aware you are that the market is going to move violently again one day. It may be sooner than you think, and having five times the trading size will be a fast way to the bankruptcy court, especially as one of the ‘great’ achievements of all the new regulatory policies is to reduce the number of liquidity providers/ risk absorbers by well over 70% in the last five years. I can guarantee you that when the need comes, as it surely will, the trampling stampede for the exit will be something that’s truly fascinating to watch.

In his ‘exit interview’ on Bloomberg TV, Hugh Hendry talked about the potential perils of the last few years’ monetary experiments.

“When you have Quantitative Easing plus wage inflation that is helicopter money.”

We haven’t had wage inflation yet. So far it’s been only goods’ inflation, as we can see in indices like the UK Retail Price Index and asset price inflation, as well as in the extremes of bonds, equities and property valuations, but not wage inflation. When it comes, and that ‘helicopter money’ comes, interest rates will have to go up dramatically and no asset and no economy will be safe. No doubt, by that time, all investments will be in some huge global Exchange Traded Funds, passively dropping by 50% in the biggest and quickest mark down in history. C’est la vie.

On a more optimistic note, many of you will have been sent the inaugural edition of the HindeSight India letter. For those who haven’t, you can go to the www. hindesightletters.com website to download it and sign up for future quarterly updates.

With ‘Reg Varney’ dithering at the wheel of the UK economy, in a will I / will I not raise interest rates a quarter point bluff mode, maybe you don’t want to sit in overpriced UK bonds and equities. Go somewhere there’s a hope of a proper yield, real earnings growth and excellent demographics. The three charts and tables that should grab you are reprinted below.

So what have we learned since 2017? Fast forward to today, the landscape has evolved, yet many of the underlying issues persist. With Chancellor Rachel Reeves now at the helm, the UK economy faces challenges eerily reminiscent of those days.

The prolonged period of low interest rates eventually gave way to the volatility we all anticipated, culminating in the economic upheaval brought by the pandemic and subsequent geopolitical tensions. Macro hedge funds have seen a resurgence of interest, but the lessons from the past remain critical.

The regulatory environment has not eased; if anything, it has grown more complex with additional layers of oversight and compliance. The once-unimaginable acronyms have been joined by others, adding to the burden of running investment businesses. Volatility has returned, but in an unpredictable and often irrational manner, driven by unprecedented global events.

While the fears of wage inflation and dramatic interest rate hikes came true in fits and starts, the resilience of economies and markets has been tested repeatedly. The advent of digital currencies, shifting trade dynamics, and evolving monetary policies continue to shape the investment landscape. The parallels between the past and present highlight the cyclical nature of markets and the enduring need for adaptability and foresight in investment strategies.

How does this all hit your portfolio? Subscribe and we’ll keep you posted. Subscribe with add and close alerts (just £4.99 a month) and we will show you how we’re building our portfolio to counter these scenarios, in real time. Dive in!