HindeSight Letter: Revisiting Energy & the Economy – June 2018 Insights in 2025 Perspective

Link to download our June 2018 Investment Insights: Energy & the Economy

In June 2018, our Issue 43 of the HindeSight Dividend UK Letter (above linked) delved into the pivotal role of energy—specifically oil—in driving economic growth and shaping societal development. Titled "Energy & the Economy," the piece underscored oil's historical contribution to demographic shifts, urbanisation, and economic specialisation, noting that fossil fuels still accounted for over 75% of global energy consumption. It cautioned that despite the buzz around renewables like solar and wind, their cost-efficiency (even with subsidies) couldn’t yet rival the entrenched dominance of oil and gas. The newsletter introduced the concept of Energy Return on Energy Invested (EROEI), highlighting how declining EROEI—especially with costly shale extraction and depleting conventional wells—threatened economic surplus and growth.

The piece also painted a tense picture of the oil market in mid-2018: supply tightening due to geopolitical instability (Venezuela, Libya, Nigeria, Iran sanctions), OPEC production cuts, and a decade-low in new oil discoveries. With oil prices climbing past $70/barrel from a sub-$30 low in 2015, we warned of potential economic headwinds—rising inflation, higher interest rates, and recession risks—echoing historical patterns where rapid oil price spikes preceded downturns. The newsletter concluded that while electric vehicles (EVs) garnered headlines, their impact was overhyped, and oil’s grip on the global economy would persist, influencing investment landscapes profoundly.

How Things Have Played Out Since June 2018

Fast forward to February 21, 2025, and the energy landscape has both validated and diverged from our 2018 outlook. Oil prices did indeed climb into 2019, peaking near $80/barrel before the COVID-19 pandemic in 2020 triggered a dramatic collapse—briefly dipping into negative territory as demand evaporated. Yet, the recovery was swift: by 2022, prices soared past $100/barrel amid Russia’s invasion of Ukraine and subsequent sanctions, reinforcing the geopolitical fragility we flagged in 2018. Today, Brent crude hovers around $80-90/barrel (based on trends up to late 2024), buoyed by supply constraints and steady demand, though not quite the runaway spiral we feared.

The EROEI thesis remains pertinent. Shale oil, while a game-changer in U.S. production (making it the world’s top producer), continues to grapple with high extraction costs and rapid well depletion—validating our skepticism about its efficiency. Conventional oil production has stagnated in many regions, and new discoveries remain scarce, aligning with our 2018 note of a post-2014 decline. Meanwhile, renewables have surged—solar and wind now contribute over 15% of global electricity (up from ~10% in 2018)—but their intermittency and infrastructure costs mean fossil fuels still dominate primary energy at around 70-75%, slightly below our cited figure but far from dethroned.

Economically, the rapid oil price swings we predicted did ripple through. The 2022 spike fueled inflation, prompting central banks to hike rates aggressively, squeezing growth in oil-importing nations like India and Japan—exactly as we foresaw. Yet, recession fears, while realised briefly in some regions, haven’t universally materialised, thanks partly to fiscal stimulus and energy efficiency gains. EVs have grown faster than anticipated—over 10 million sold globally in 2024 alone—but with 80-90 million total vehicle sales annually, internal combustion engines still rule, supporting our view that the transition would be slower than hyped.

The Energy-to-Gold Mining Ratio: A Historic Opportunity

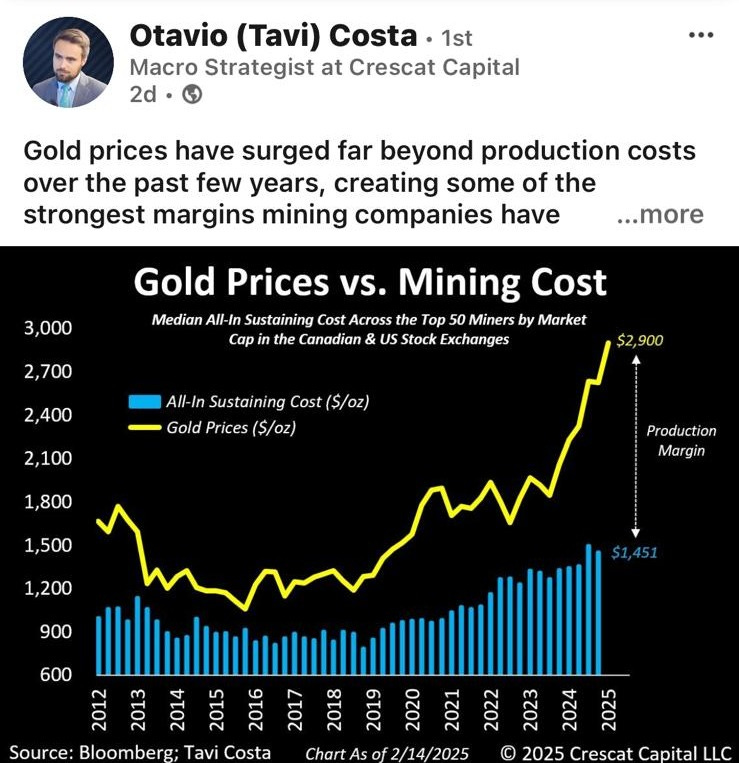

One striking development since 2018 ties energy dynamics directly to another asset class: gold. Historically, the energy-to-gold mining ratio—essentially the cost in energy terms (often proxied by oil prices) to extract an ounce of gold—has fluctuated with oil prices and mining technology. In 2018, we noted the gold/oil ratio hitting extreme levels during the sub-$30/barrel oil slump of 2015-16, implying gold was "expensive" relative to energy. Today, the tables have turned dramatically. With oil at $80-90/barrel and gold prices soaring past $2,500/ounce (up from ~$1,200 in 2018), it’s never been cheaper in energy terms to mine gold. This shift is driven by higher oil prices, stagnant mining costs (thanks to efficiency gains), and gold’s bull run amid inflation and geopolitical uncertainty.

The payoff for gold miners is at historic highs. Profit margins have swelled as the cost to extract—say, $1,000-1,200/ounce for top producers—lags far behind gold’s market price. In the 1970s oil shocks, a similar dynamic emerged: high energy costs squeezed margins, but gold’s price surge outpaced them. Today, energy costs, while elevated, are a smaller fraction of production expenses due to automation and renewable-powered mines, amplifying returns.

The gold/oil ratio that last got to a notable high in 2016 at 30-1( 30 barrels per ounce) now sits closer to 40-1 since this gold surge in the last 18 months, a level never seen. This is hugely favourable for miners signalling a unbelievable sweet spot where energy inputs remain manageable but gold output fetches premium high prices with most analysts looking for even higher metal prices.

For investors, this anomaly suggests gold mining stocks—especially mid-tier producers with low all-in sustaining costs (AISC)—are undervalued relative to their cash flow potential. The sector’s leverage to gold prices (a 10% price rise can boost profits 20-30%) makes it a compelling hedge against the energy-driven inflation we flagged in 2018.

Implications for Investing in the Coming Years

Looking ahead, energy remains a linchpin for investors, but the dynamics are shifting. Oil’s resilience suggests continued relevance for energy majors (e.g., ExxonMobil, Shell), especially those balancing upstream efficiency with downstream diversification. However, declining EROEI and geopolitical risks—think Middle East tensions or Russia’s unpredictable output—mean volatility is baked in. Dividend-focused portfolios should favour firms with strong balance sheets and adaptability, as capex needs (still ~$450 billion/year to offset depletion) could strain weaker players.

Renewables, while not yet the economic silver bullet, are maturing. Battery storage advances and falling solar/wind costs could erode fossil fuel dominance by the 2030s, making selective bets in clean energy infrastructure (e.g., grid upgrades, lithium producers) compelling for long-term growth. Yet, the transition’s pace suggests a hybrid energy world persists, where natural gas—bridging coal and renewables—offers stability and yield potential.

Gold mining emerges as a standout opportunity. With the energy-to-gold ratio favouring miners, firms like Newmont or Barrick Gold could deliver outsized returns, blending inflation protection with dividend growth. Pair this with energy exposure, and you hedge both commodity cycles and economic turbulence.

Macro risks loom large. Oil price spikes could again stoke inflation, especially if supply shocks (e.g., Iran sanctions redux) coincide with robust demand. Central banks, already wary after 2022-23, may tighten further, pressuring equities—particularly in energy-importing economies. Conversely, oil exporters like Russia or Saudi Arabia could see windfalls, shifting global capital flows. Our 2018 recession warning still holds. With interest rates normalised from their zero bound, any strong oil price advance could tip fragile economies over the edge.

For HindeSight readers, the takeaway is clear: energy isn’t just a sector—it’s the economy’s heartbeat. Diversify across oil stalwarts, gas intermediaries, emerging green plays, and gold miners, but stay nimble. The net energy cliff isn’t here yet, but its shadow looms.

Happy Investing.