HindeSight Letters Investment Insights Archive - READ HERE

Our new archive posts allow our subscribers to access valuable insights and analysis and a deeper understanding of market trends and investment strategies that were relevant at the time the HindeSight newsletter was published.

Additionally, reading archived newsletter content can give you a sense of the long term performance of the investments or strategies discussed which can be helpful in making informed investment decisions.

Furthermore reading this content can provide historical context and help you see how market conditions have changed over time, allowing you to better anticipate future developments.

Overall reading our archived content can be a useful tool for gaining a broader perspective on the market.

INVESTMENT INSIGHTS ARCHIVE

Originally posted in January 2017

January is usually a time for many journalists to write about the best investments from the previous year and their picks for the coming year. Always wanting to be a little different, we will leave our thoughts for updating your portfolio until next month. We would like to introduce one of the concepts that should be instrumental in investors’ thoughts that are often overlooked.

Currency management

The importance of understanding currencies, the level of valuations and the driving forces behind potential moves will matter more or less on where you are on the scale. At one end is maybe a farm worker in Scotland who never leaves the country, has little in the way of disposable income for goods or investments and can match his income with his liabilities in his home currency. On the other is the international businessman who spends a reasonable amount of time overseas with assets in property and investments around the world and runs an international business.

Most of us are likely to be somewhere in the middle and, as such, should have some understanding of currency levels. One of the reasons I am bringing this up today is for people to understand exactly where we are in the UK with respect to our currency and its competitors.

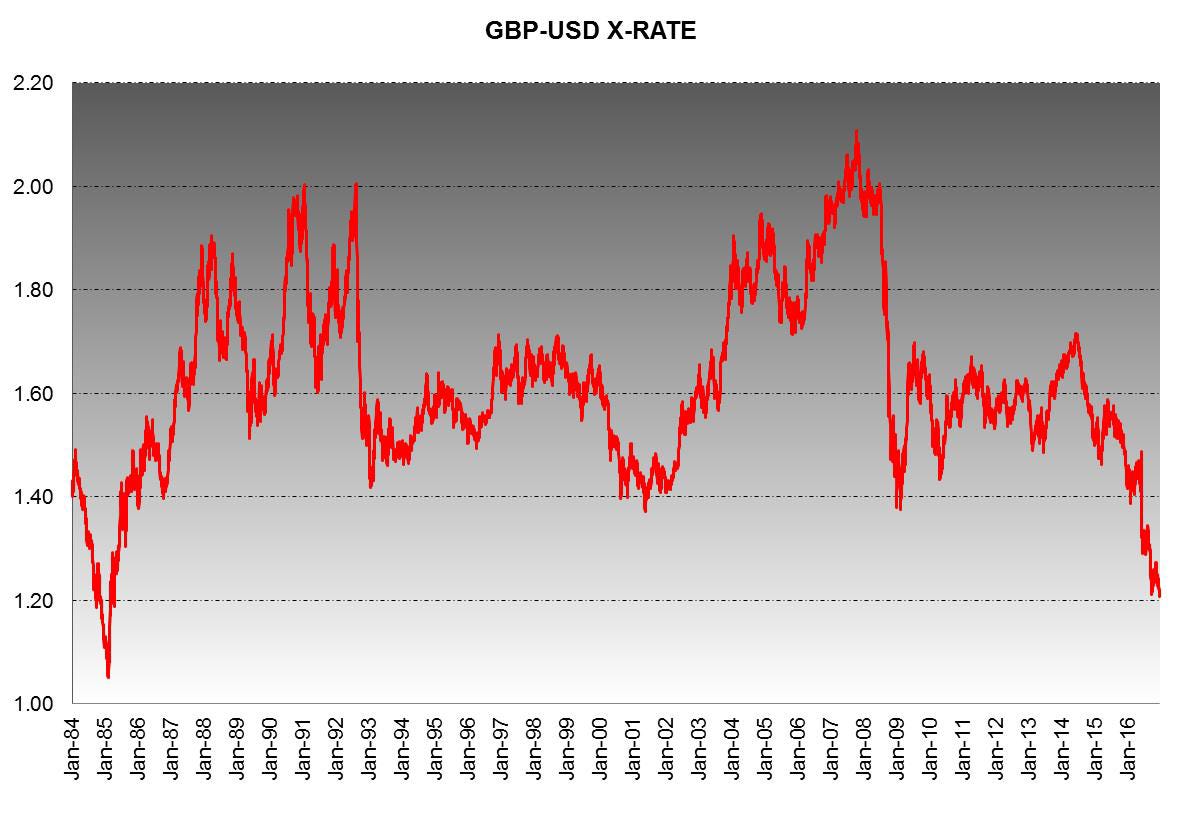

In any measurable way, the GBP has performed poorly over the short or long-term. On a trade-weighted basis (as above), it is 25% lower than at the turn of the century, while the USD is 15% stronger.

Against the USD, it is now back to 30-year lows.

Arguably, an import-skewed nation with the combined largest twin deficits of budget and trade was living way beyond its means for years and it was only a matter of time. Brexit brought that home to roost and we now sit as the poor man of the world, in currency terms at least.

Hopefully, as we are not an emerging market, we will not face a complete currency collapse, as you might see in Turkey or Russia. Many ‘academics’ with government-defined pensions welcome this drop in GBP to ‘rebalance’ the economy, but it is not as helpful to the less well-off who are facing inflation of food essentials.

Just like any business, understanding your income versus expenses and your assets versus liabilities are key in currency management.

• What currency does your income come in? What are your expenses?

• What currency are your assets in? What are your liabilities?

Earning money in the strongest currency, while paying your expenses in the cheapest is understood clearly by businesses who sell into the US and have their factories in China.

The same goes for holding assets in the cheapest currency and having your liabilities in the strongest. Many people who invest abroad, either in financial investments, property or business, often fail to think currency first or even at all, but it can be exceptionally profitable to make astute investments with timely respect to:

• Currency

• Investment merits

• Earning yield

Let’s look at a straightforward example.

Brazil, a long-term emerging country is still experiencing booms and busts, both with its financial markets and its currency.

If you had made the timely decision to exchange £10,000 into Brazilian Real in late 2015 at 6 Real to £1 you could hold those Rs 60,000 in a one-year bond at 14%. Fast-forward to December 2016, and if converted the now Rs 68,400 (after interest) back into GBP at 4 Real to £1, you would receive £17,100 – a whopping 71% return in just one year.

Maybe Brazil is too far from home, so how about buying a ski chalet in Switzerland in 2007 with the GBPCHF at CHF2.45 to £1? Spending £300,000 would have got you CHF 735,000 back then. Today, even assuming zero price appreciation in property in Swiss franc terms, which is not the case, those CHF 735,000 at today's FX rate of 1.22 makes it worth £600,000 – a 100% return on the currency alone.

In other investment cases, we have seen over the years, when there was a widespread belief that Japanese equities would recover from the lows of the 2010-2012 period, many invested in the standard broker route of first converting their GBP into yen. By 2015, the Nikkei, the Japanese main index was up over 100% in yen terms but, unfortunately, the GBPJPY had weakened dramatically cutting that return to less than 25% in GBP terms. The difference between a currency-hedged Japanese equity and a non-hedged fund became all too apparent.

A similar situation occurred in gold when UK investors bought gold in USD terms in 2000. This is referred to as ‘The Gordon Brown low’ in gold circles when the UK Chancellor at that time auctioned off most of the UK's gold reserves at the cheapest price in years, which were never seen again. Gold was at $257/oz and GBPUSD 1.40. By 2007, gold had reached $650/oz, a rise of 150% in USD terms. Unfortunately, the rise of the GBPUSD rate to 2.00 had limited the unhedged UK investors to a GBP return of 75%.

So it does matter, sometimes even dramatically so. To make the best of your business and investments, currency is just as important, if not more than the asset/business itself. Of course, like most potential profitable events in the future, it is not obvious why a currency should move and over what time frame. We can make some relative assessments on ‘cheapness’ or ‘richness’ based on history, but the fundamentals that provide the impetus for movement are harder to define. Most people understand that both real interest rates (rates after inflation) and some purchasing power parity argument (think Big Mac index) are good starting points. In the long-term, the theory goes that money will flow to those higher interest rate currencies whose PPP is low, but there are many other short-term factors. If it were easy, everyone would be doing it!

Unfortunately, UK investors or UK earners currently find themselves in a cheap currency; in fact, the cheapest it’s been in a long time. As a result, any money earned buys the least in international terms, whether it is ski chalets or US equities. In business, the vast array of importers are getting crushed and the few non-service exporters are doing better, while the poor consumer is facing higher prices for food, apple products and foreign holidays. If you have benefitted by holding assets in other currencies, maybe this is the time to cash in and move your money back into sterling. If you are looking for a new business venture, think first about an export business where your sales are in rich currencies, but your production is in ‘cheap’ sterling. And if you are looking to buy overseas assets, property or equities, certainly consider taking out a currency hedge with a spread better like IGG.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

Visit hindesightletters.com for more information

.