HindeSight Letters Investment Insights Archive - READ HERE

Our new archive posts allow our subscribers to access valuable insights and analysis and a deeper understanding of market trends and investment strategies that were relevant at the time the HindeSight newsletter was published.

Additionally, reading archived newsletter content can give you a sense of the long term performance of the investments or strategies discussed which can be helpful in making informed investment decisions.

Furthermore reading this content can provide historical context and help you see how market conditions have changed over time, allowing you to better anticipate future developments.

Overall reading our archived content can be a useful tool for gaining a broader perspective on the market.

INVESTMENT INSIGHTS ARCHIVE

Originally posted in August 2018

Baron Rothschild, an 18th-century British nobleman who is rumoured to have made fortunes at the time of the Battle of Waterloo, is usually credited with the expression, “Buy when the blood is in the streets”. The other derivative, “Buy on the sound of cannons, sell on the sound of trumpets”, is also often attributed to the same famed banking dynasty.

The general interpretation is that one of the tenets of successful and profitable investing relies on buying when there is obviously bad news and sell when there is seemingly only good news. In last August’s HSL, we showed the chart below, which shows how UK stock prices were at an extreme low around the time of the evacuation of the British Expeditionary Force from France and the Battle of Britain in 1940. The blood was certainly on the streets then.

Every asset class, including currencies and interest rates over time, has oscillations that historically can be shown to be low-cheap to high-expensive, around a typical mean average. The cycles of these asset classes may be measured in months, years, decades or longer, but their relevance places market timing at the very heart of investment gains.

In times of crisis, many assets are priced down dramatically and wealth transfers and losses are the main story. In normal times, some assets are very cheap while other assets are considered to be very expensive. Whether this is irrational or not, many assets are very highly valued at the pinnacle of exuberance and huge paper gains are the bragging points. Until the start of 2018, we were arguably at the latter point, with most investments worldwide smugly soaring to the moon. This was largely aided by the longest decline in interest rates in recorded history. For the most part, interest rates have dropped on average from the early 1980s to the lows last year, and are still negative in many countries.

These low interest rates, largely a result of the extreme monetary policy that followed the financial crisis of 2008, fuelled valuations to nose-bleed territories and very few assets could be considered cheap on standard metrics. Now, in the late summer of 2018, times have started to change enough that it’s worth discussing the age-old adage, ‘The best and worst time to invest.’

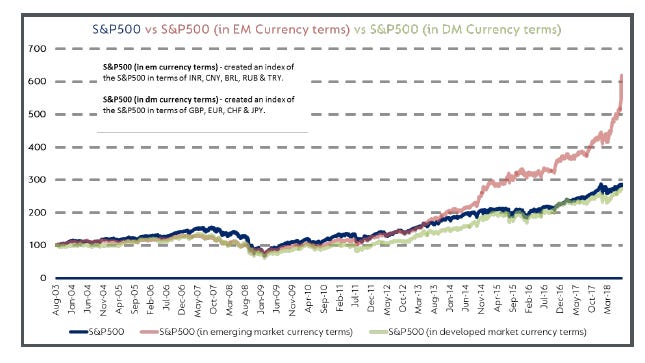

Well, the trumpets are certainly blaring very loud in the US stock market. In global currency terms, US stocks are priced for perfection and are so historically lacking in both value and margin of safety, it should be obvious that your money could be better deployed almost anywhere else, while you still have time. Worryingly, US retail investors at stockbrokers like Charles Schwab have very little cash in their portfolios and remain heavily invested.

Almost the polar opposite of this would be investing in some of the emerging markets, like Turkey, whose currency and stock market has been truly battered to a potential point of extreme value. While the situation may well get worse in Turkey, it’s hard to see a reason why some dollar cost averaging isn’t worth starting immediately as the market has clearly priced in complete catastrophes. Turkey has a large young population, which is uniquely positioned in Asia and Europe. Politically, things look terrible, but in business, companies tend to recover from short-term disasters.

Closer to home, the UK currency, GBP, is back in the doldrums again. It is not only close to its all-time lows versus the US dollar, but it is also facing similar lows across many other currencies. Much must be blamed on the continued uncertainty of Brexit and the ‘no-deal’. From a global investor point of view, our weak currency makes many of our assets, such as property, bonds and equities, attractive and if there is more weakness into March 2019, they may be seen as even more so.

As managers of the Hinde Gold Fund, we are long-term believers in the power of gold in any portfolio for insurance and diversification. Gold is also one of the assets that is currently very cheap over most metrics, especially in US dollar terms.

Certainly, many Turkish people would have been well-served to have held gold in their time of crisis. In ratio terms against the US SP500 index, gold is back to levels last seen in the 2005-2007 pre-financial crisis era. Coupled with the very positive seasonal time of year, it is very oversold on a technical Relative Strength Index weekly basis and very under-owned by traditional speculators (Commitment of Traders report).

Whether it’s a currency, equity, bond or commodity, there are usually identifiable cycles. Closer to home, our proprietary Hinde Sight Dividend Model works in much the same way. It systematically weeds out and ranks all the UK stocks in the FTSE 350, from cheap to rich, under the written rules. The highest-ranking stocks invariably suffer from some well-known problems, industry or specific. These are accompanied by poor headlines and the market has driven the price lower to reflect these issues. However, the cycle of mean-reversion and margin cycles often make this the best time to invest. The current model’s ranking was shown earlier in the Playtech write-up.

Investing or disinvesting at different times has been often been shown to be the way to make considerably better returns than passively holding a ‘mixed’ portfolio. One of my biggest worries is that the long-term decline in interest rates, led by the central bank, has made investing seem much easier, especially in the vein of buy and hold, because assets over time ‘have to go up’. Unfortunately, I believe many people are going to find out the hard way investing is going to be much, much harder in the future, as interest rates will not decline to the same extent again and will probably have to start rising. The need for timing will be significantly more relevant.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

Visit hindesightletters.com for more information