HindeSight Letters Investment Insights Archive - READ HERE

Our FREE archive posts allow our subscribers to access valuable insights and analysis and a deeper understanding of market trends and investment strategies that were relevant at the time the HindeSight newsletter was published.

Additionally, reading archived newsletter content can give you a sense of the long term performance of the investments or strategies discussed which can be helpful in making informed investment decisions.

Furthermore reading this content can provide historical context and help you see how market conditions have changed over time, allowing you to better anticipate future developments.

Overall reading our archived content can be a useful tool for gaining a broader perspective on the market.

LIMITED OFFER. GET A 90 DAY FREE TRIAL OF OUR PREMIUM SUBSCRIPTION & MAXIMISE YOUR INVESTMENT POTENTIAL

INVESTMENT INSIGHTS ARCHIVE

Originally posted in August 2015

VIEWS - ReMemBer Gold?

By Ben Davies (with excerpts from Sean Corrigan)

On 20th July, gold was very much not the flavour of the month. The Shanghai bear raid, which saw gold flash from $1130 to 1086 a tr.oz in the overnight Asian trade, received an inordinate amount of media attention. Interestingly, even the mainstream media spoke of sinister intentions and manipulation. In truth, the market was bullied by traders out of China and with there being little interest elsewhere to buy the falling market, gold had a cascade that had commentators revising their downside forecasts, from 1050 to 800 and beyond – usually a sign of a bottom.

This year, I spoke to RealVision TV and stated that the market was trend-ready in gold and that, as managers of a long-only gold fund, we were trying to be agnostic and position ourselves for a break either way. I did, however, mention that when our models are trend-ready, we often get a false sharp break one way first, only to see a snap back within a few days or weeks.

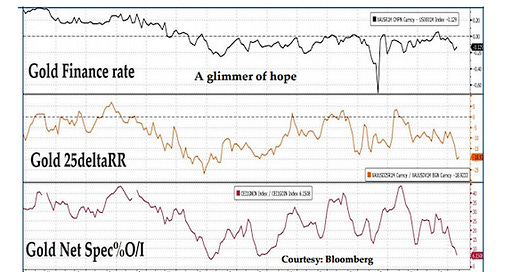

Gold became so out of favour at the lows that the net spec longs had all but completely evaporated for the first time since the Great Bull Market began at the turn of 2001. Without doubt, all sorts of technical measures, from basic RSIs to risk reversals, also pointed to the fact that selling pressure was getting far ahead of itself.

Taken from the 29th July MidWeek Macro Musings:

So, even before the PboC shocked the markets last week, we were writing that gold was due a bounce. Elevated speculative and commercial shorts – the first of its kind for money managers – a net position that was no longer strongly long, negative forward rates and a wide put-call skew, all testified to an imminent short-squeeze potential.

This was all in the face of an asset that looked decidedly expensive to its industrial counterparts and black gold – the WTI. However, one must consider the fact that gold – in its customary anti-commodity role – frequently rallies against the industrials at times of financial stress or economic weakness. And, as we have written, downside volatility is about to rise.

Taken from 19th August MidWeek Macro Musings:

Since the PboC made an adjustment to the RMB/yuan on 11th August that sent it to its lowest rate in three years versus the dollar, followed by another adjustment the next day, people have begun to fear that this opening up to the market could lead to an uncontrolled flight of capital out of China. The adjustment opens up the possibilities of a market-induced devaluation that the PboC couldn’t easily control. Worse still, investors have finally begun to consider that China’s economy really is ailing, since the PRC’s botch job of managing the stock mania and crash, and started to think that this might have serious consequences for the RoW, beyond emerging economies. It’s as if no one has been watching the tea leaves of excess debt in China.

Even gold seemed to disbelieve the intendant implications of RMB’s devaluation, as it seemed to rally and stall on the announcement, spending the morning back below the $1100 mark.

It was like participants had forgotten gold, but the PboC move helped them to ReMemBer. Out of the depths of the gloom, gold was back to a glimmer, then a glisten, and then a full shine. Since the chart above was posted, gold has climbed, firmly and aggressively through $1150 to $1169. If it can hold above $1150 next week, it will migrate back to the High Volume Point (HVP) at $1,200. I believe it will.

Since the events of the 11th, the world has been awash with ruminations, even rumours that China is trying to capture the gold market. Sean Corrigan and myself disagree over the extent of China’s interest in the metal. I have, since 2008, been on record as saying that China would become an increasing source of demand for gold – part per capita wealth accumulation, part monetary reserve accumulation. But one thing we would both agree on at this stage is this – there is no chance of China backing the RMB to gold. For Sean, this is never. For me, it could occur, but only at much, much lower currency levels, if at all. Right now, they need a weaker currency to aid their export market, which China still can’t transition away from as the major driver of her economy.

So, we would be hesitant to say this announcement is a cause for the resumption of the Gold Bull Market just yet. We think it is more likely that gold will hold its purchasing power relative to other assets and will only begin to rise again, forcibly, in the last stages of the likely debt collapse to come.

PBoC and Gold

After six long years of paranoid radio silence, the country’s gold reserves were some 57% more voluminous than had been made public. Following hard on the heels of this revelation, we learned that a further 610,000 ounces had been acquired in July. This was a timely declaration, which is now obligatory as part of the PboC’s drive for SDR inclusion.

Sean has spent long hours trying to reconcile the conflicting and partial Chinese data on gold. It has yielded little result, other than the fact that the reserves appear to be held at some sort of yuan historic cost measure on the PBoC’s books, while being declared in mark-to-market dollars in the reserve total. What we might note, however, is that the authorities have intimated that they might be absorbing domestic mine output (together with scrap resales). This would help to both bail-out the diggers and stabilise the money supply in the face of ongoing FX purchases. As such, this is likely to be more high-powered than anything attained by giving overburdened banks new assets. It might also forestall the distress selling of collateralised gold in the manner that has already been afflicted, such as copper. Supportive, maybe. Decisive, no – not yet.

As readers of HindeSight Investor Letters know only too well, we have been writing persistently since the GFC that China, as the creditor in the Bretton Woods II monetary equation, would soon impart a highly disinflationary headwind for the rest of the world, as it too took its turn to bow to its own credit fuelled economic excess.

In our HindeSight Investor Letter November 2013, ‘ToP of the BoPs’, we discussed that the instability in emerging market economies, and especially China, was a direct consequence of these global imbalances, which became stymied briefly by global bail-outs, only to have been left in a more vulnerable economic position.

We wrote: "The deleveraging process which began in 2008 has been a slow burner but is likely now in full swing. The deflationary risks are very high. China is the driver. All eyes on China.”

Two years on and that slow burn is turning into an inferno. The Great Wall of Money, that has flamed global assets higher, is now about to engulf them and bring them down in a pile of embers. The Chinese stock market is already burning down, our HindeSight Investor July Letter, ‘Another BRIC in the Wall’, covers all this. And to catch up with our thinking on what China means for the world’s other economies and global asset classes, our August letter, ‘The Great Wall of Money’, will be released this coming week.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

LIMITED OFFER. GET A 90 DAY FREE TRIAL OF OUR PREMIUM SUBSCRIPTION & MAXIMISE YOUR INVESTMENT POTENTIAL

Visit hindesightletters.com for more information