HindeSight Letters Investment Insights Archive - READ HERE

Our new archive posts allow our subscribers to access valuable insights and analysis and a deeper understanding of market trends and investment strategies that were relevant at the time the HindeSight newsletter was published.

Additionally, reading archived newsletter content can give you a sense of the long term performance of the investments or strategies discussed which can be helpful in making informed investment decisions.

Furthermore reading this content can provide historical context and help you see how market conditions have changed over time, allowing you to better anticipate future developments.

Overall reading our archived content can be a useful tool for gaining a broader perspective on the market.

INVESTMENT INSIGHTS ARCHIVE

Originally posted in March 2017

As regular readers know, the Hinde Dividend Value Strategy is a methodology for stock picking, as the name suggests from a value perspective. Its multiple inputs screen all the components of the relevant stock markets and list them from the ‘cheapest’ to ‘richest’ in descending order. The theory being that the more ‘value’ a stock has, the better the return profile is with respect to risk. The focus is on well-capitalised companies with a long history that are currently at the low point of their cycles.

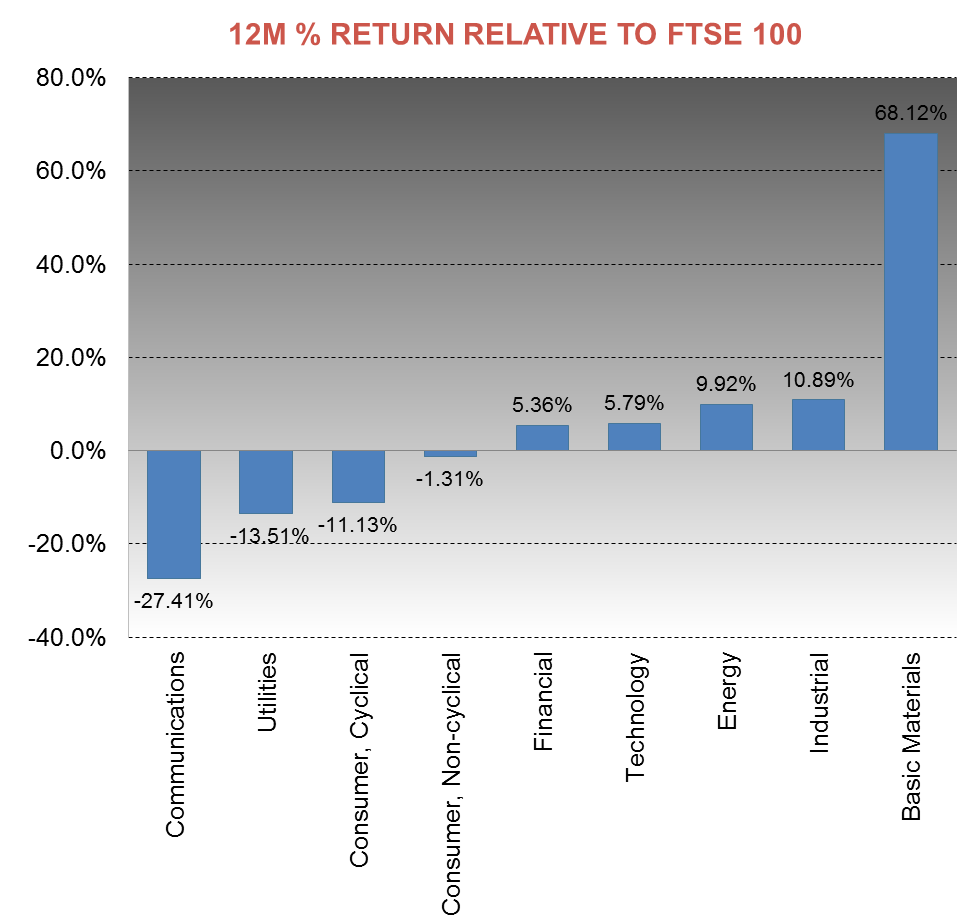

An important part of this is the sector analysis, where it is possible to understand the general state of affairs by sector before moving down to individual stock levels. Every month, in the mid-section of this letter, there is a bar chart (as below) that shows in simple terms the previous 12 months return. This is a good place to start any type of sector analysis.

Most analysts will agree that the broad headings include 9-11 sectors that include consumer discretionary, consumer staples, energy, financials, health care, industrials, information technology, materials, real estate, telecommunications services and utilities.

Whether the business is large or small, the same factors generally have to be taken into account to see the net profit or earnings. These are:

• Actual sales or revenue is the top line, against which costs are subtracted

• Cost of materials

• Cost of labour

• Cost of capital/finance

• Taxation

Leaving net profit

The ratio of net profit/ revenue gives the profit margin. Any combination of greater profit margin and larger revenue is the most desirable naturally, but it is important to realise the variations within.

• Revenues may remain constant while profit margins oscillate in some amplitude – a low amplitude margin may be tobacco, a high one real estate

• Revenues may rise with declining profit margins as the market grows towards maturity

• While the well-known route to bankruptcy is declining revenues with declining profit margins into negative territory

The earnings of the index as a whole will offer some reflection of the business cycle where there will be periods of economic growth and slowing growth, as well as recessions, where growth will contract before the cycle repeats itself. The corporate profit cycle, the credit cycle and the inventory cycle all play their part with central bank monetary policy and the all-important unemployment and inflation levels in the mix.

The US and UK economies broadly saw 11 business cycles from the Second World War until 2009. The average cycle lasted roughly six years with five growth years and one year of contraction on average. This expansionary phase is currently very long in the tooth, thanks mainly to the lunacy of zero monetary policy.

While the business cycle is the most important overall, most sectors enjoy a cycle of revenues and profit margins, according to their specific industry.

If we look at some of the larger sectors in the indices, we can list the cycle stages.

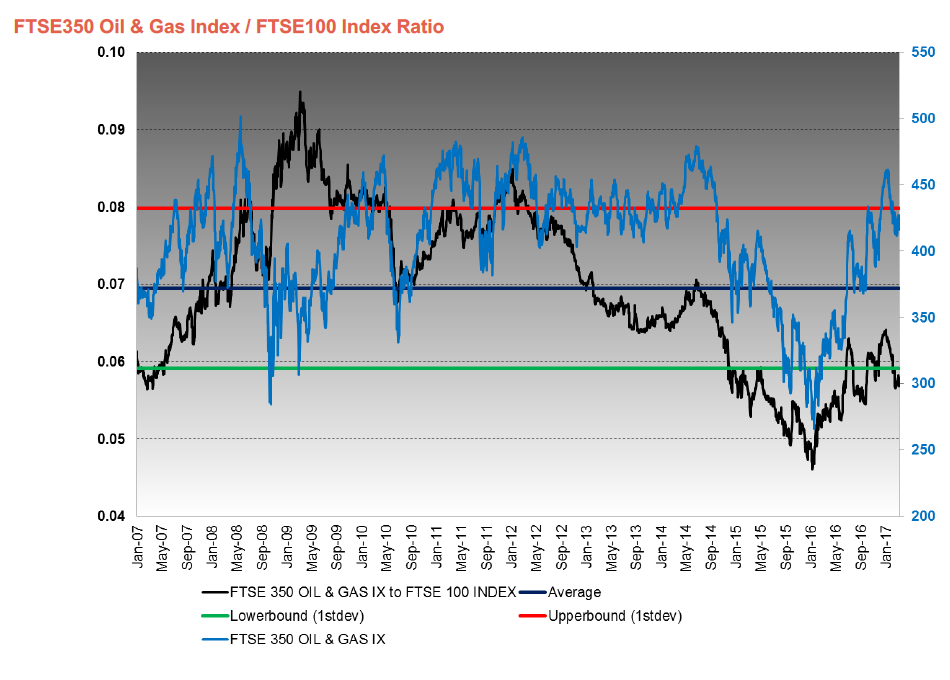

Oil & Gas extraction and mining resources make up almost 20% of the UK index. The cycle invariably goes like this:

• Commodity prices rise as demand increases and the world economy grows, or an important part like China

• Revenue rises dramatically leading to concerns about an inability to fulfil future demand

• Expansion, acquisitions and capex increases are seen

• Competition may enter the ‘easy’ marketplace and the government potentially increases taxation, often named the windfall tax

• Oversupply and economic slowdowns hit ‘unexpectedly’

• Commodity prices turn down

• And the profits quickly turn to losses

• Write-offs and selling ‘non-core’ assets occur

• And repeat

In the huge financial sector of banking and insurance:

• Demand for credit rises and loans are made

• Amid rising rates, the steepening yield curve allows increasing profits

• Banks clamour to keep up with competitors as more and more loans are made with ever-decreasing credit levels in the bull market

• Asset prices, against which many loans are made, start to fall and default rates rise with a flattening yield curve

• Profits turn to losses, huge write-offs occur and the government may have to step in to bail out weaker players

• The insurance industry sees an ‘event’ which creates huge losses

• Regulatory changes and bad practices with penalties rise to the surface and continue to affect profits

• The central banks have cut rates by now and the yield curve steepens again to help the banks, ‘the lifeline of the economy’, while insurance premiums have risen

• And repeat

Human nature figures highly in many economic cyclical tragedies. Over exuberance, blind optimism, ‘this time it’s different’ or just plain believing in your own bullshit – call it what you want. The arrogance of 15th Century Venetian bankers were no doubt an equal match for more recent stage characters, like ‘Fred the Shred Goodwin’, in their ineptitude at the wrong point of the cycle. Glencore’s CEO Ivan Glasenberg went from hero to zero in less than a few years as the commodity cycle turned down, with no plan B it appears. Having met more than 1000 mining CEOs in the last 10 years, we certainly can’t remember a single one saying at the peak of 2011, “Sell everything, these assets will be worth 1/10 of today’s prices in two years.”

Just like today, when the sight of ride-sharing taxi firms, disappearing photo apps and social media sites worth billions means that most people can’t grasp the high cycle point of insanity of the current day.

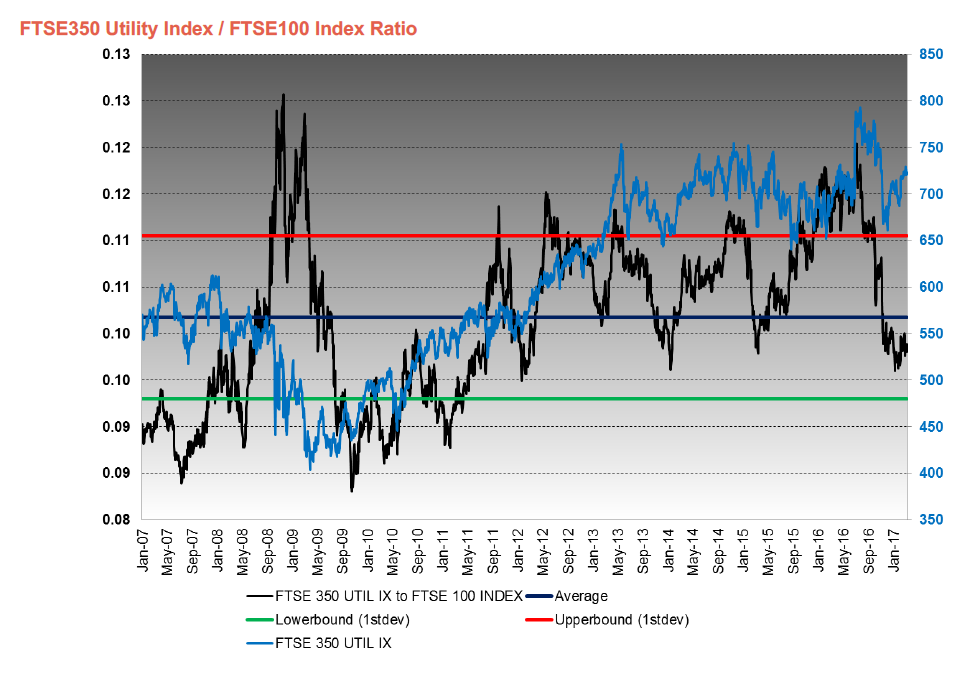

In our sector analysis, Telecoms and Utilities are the cheapest sectors currently, as seen below. Telecoms with its heavy weighting of BT, whose share price recently dropped after the Italian job fraud, and Vodafone are notable. Utilities are mainly cheap as they haven’t participated in the momentum surge of the FTSE since last year’s Brexit lows. By their nature, they are exposed to rising interest rates on the large debt that is needed to maintain their operations, despite the regularity of revenue. However, cheap points in the Utility cycle often occur pre-crashes as the boring utility companies can’t keep up with the booming value stretched other sectors. Buying utilities is a clear defensive strategy employed by many fund managers, often not soon enough.

In the Hinde Dividend model, sector analysis is key to looking for ‘cheap’ stocks within ‘cheap’ industries. Last month’s pick Inmarsat is in the depressed Telecom sector (up 25% since our recommendation) and Vodafone is still in the Hinde Dividend portfolio.

But it is also very important as a gauge for the market as a whole. Large companies with long histories rarely go out of business or grow exponentially. They oscillate from good times to bad times, as their profit margins and P/E ratios rise and fall accordingly.

Currently, the strong move higher in banks and insurance companies on the back of higher yields and the relative cheapness in utilities against the index are additional warning signs to us that we are very late in the business cycle. Coupled with the declining excess liquidity in the Overview section, the red flags are popping up everywhere. Stay tuned.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

Visit hindesightletters.com for more information