HindeSight Letters Investment Insights Archive - READ HERE

UK exceeded 100% of the nation's GDP for the first time since 1961.

Our new archive posts allow our subscribers to access valuable insights and analysis and a deeper understanding of market trends and investment strategies that were relevant at the time the HindeSight newsletter was published.

Additionally, reading archived newsletter content can give you a sense of the long term performance of the investments or strategies discussed which can be helpful in making informed investment decisions.

Furthermore reading this content can provide historical context and help you see how market conditions have changed over time, allowing you to better anticipate future developments.

Overall reading our archived content can be a useful tool for gaining a broader perspective on the market.

INVESTMENT INSIGHTS ARCHIVE

Originally posted in April 2012

As you’ve no doubt seen in the news - the UK exceeded 100% of the nation's GDP for the first time since 1961. What is the wealth of a nation?

Wealth of A Nation

"Money won't create success, the freedom to make it will."

Nelson Mandela

"All nations with a capitalist mode of production are seized periodically by a feverish attempt to make money without the mediation of the process of production."

Karl Marx

"The farther backward you can look, the farther forward you are likely to see."

Winston Churchill

"Errors using inadequate data are very much less than using no data at all."

Charles Babbage

"I can calculate the motions of heavenly bodies, but not the madness of people."

Isaac Newton

"The only cause of depression is prosperity"

Clement Juglar

"Experience without theory is blind, but theory without experience is mere intellectual play."

Immanuel Kant

Ever wondered as to why there are huge disparities in incomes and living standards across the world today? Why did the United States, United Kingdom, and Germany become rich and why are Central America, South Asia and sub-Saharan Africa poor? The top thirty richest countries and the bottom thirty countries today are broadly unchanged over the past one hundred and fifty years. But step back 500 years and the scene was somewhat different.

The Aztec and Mayan civilisations of Central and South America were rich in money and culture whilst North America was positively in the Stone Age. Why the reversal? Explanations of this and indeed of why there is such inequality in the world today are diverse in scope and there is no unifying theory. Well that was until recently. Two economists, Daron Acemoglu and James Robinson, have proposed one. They show the type of humility that John Maynard Keynes inferred was missing when he said 'if economists could manage to get themselves thought of as a humble, competent people on a level with dentists that would be splendid.'

In their most thoughtful and stimulating book, Why Nations Fail: The Origins of Power, Prosperity and Poverty they illustrate historically and contemporarily how nations sustain prosperity by encouraging an openness of society, willingness to permit creative destruction and democratic rule of law. It is the relationship between man-made economic and political institutions that fosters these aspects of the nation. Those institutions that promote real growth through productivity enhancement and encourage progressive innovation will thrive, as opposed to those that move towards repressive institutions of the State will stagnate and fail.

The premise of this letter echoes the sentiments of these economists. We define the hierarchy of wealth that underpins a nation and the pillars of economic freedom that we believe are required for a nation to sustain its wealth and thrive as prosperous nation. In addition, we also show why and how the credit cycle is the primary driver of long term business cycles which are inherently entwined with property cycle boom and busts.

Economic freedom is the key to the long lasting 'wealth of a nation'. All other aspects of society will thrive if a nation adheres to this ideal. Unfortunately, as we will demonstrate, excessive imbalances in property cycles have accelerated this loss of freedom. Property cycles propagated by credit availability, the use of property as collateral and a nation’s institutional framework to prevent deleveraging in the economic system have amplified swings in long term economic (business) cycles.

We explore how nations mired in debt, have a stark choice should they wish to prosper in the future. We believe that a nation will tend to bankrupt its citizens before it bankrupts itself; especially under fiat currency systems when they have the temptation to fund a welfare state through continued deficit financing.

Wealth of a Nation

Ranking a nation by GDP does not tell us very much about the 'wealth of a nation'. GDP is defined as the value of all goods and services in an economy measured in the currency of the country. In truth GDP is an accounting identity that does not reflect the true production of an economy, it has come to reflect the growth in the money in the economy; all be it at a diminishing rate. Alasdair Macleod, of the Austrian School of economic thought explains this concept very succinctly in his blog piece The extraordinary tale of a false statistic.

Defining the place of a nation in global standings based on GDP is too narrow and frankly not very informative about the future sustainability/trend of the nation. It is also says nothing about the desirability of living in such a country. For instance there are many national and international studies on examining the overall 'Wellbeing' of a Nation:

• The State of Happiness: report from the Young Foundation and Local Government and Improvement highlighting that promoting and influencing happiness is no longer an airy aspiration

• The Happy Planet Index: The New Economics Foundation’s assessment of ecological efficiency with which human well-being is delivered

• Developments in the economics of well-being: 2008 report from HM Treasury

• Human Development Index: devised by Pakistani economist Mahbub ul Haq and Indian economist Amartya Sen in 1990

• The Sprit Level: Richard Wilkinson and Kate Pickett’s 2009 book argued that the level of equality in developed countries is crucial to determining the overall level of wellbeing in a society

The notion of a nation’s wellbeing provides a crucial insight into the psyche of a country, but to foster such a notion a nation must, in our opinion, develop economic freedom. It is the core asset by which a country can develop a nation.

It was Adam Smith, the Scottish philosopher, to our mind the pioneer of political economy, who wrote in his first book Theory of Moral Sentiments (1759), a passage which holds true as much then as it does today for the true wealth of a nation;

"Little else is required to carry a state to the highest degree of opulence from the lowest degree of barbarism, but peace, low taxes and tolerable administration of justice ; all the rest being brought about by the natural course of things. All governments which thwart this natural course, which force things into another channel, or which endeavour to arrest the progress of society at a particular point, are unnatural, and to support themselves are obliged to be oppressive and tyrannical."

His ultimate masterpiece though, and one of the most cited economic books, was the tome spanning 5 volumes, An Enquiry into the Nature and Causes of the Wealth of Nations. The Wealth of Nations as it is commonly known, pointed out that division of labour was the major reason why the economic output of some countries grew faster than others. But the most illuminating point Smith deduced in his work was this underlying principle for the success of a nation: freedom was the most efficient economic model. The capitalist economy would work best, if each individual pursued his own interest because then the 'invisible hand' - the metaphor coined by Smith - would allow the self-regulating nature of the market place to take place, as it would be devoid of protectionism and overt government regulation.

So what is wealth really? As the author of The Crash Course, Chris Martenson actually has a specific chapter on this - What is Wealth? (Hint: It's not Money). He elucidates on the idea of wealth as being a hierarchical structure from primary to tertiary. He uses a lovely segue to describe how towns surrounded by pine trees tended to have historic churches that were small, modest affairs often without steeples. The churches looked poor, whereas the towns with large Maple trees had much grander churches, ornate and with magnificent steeples. The reason for such disparity given was Pine trees often indicate unproductive land - weak, sandy and acidic; whilst the land which bore the Maples were fertile and rich in nutrients. The saying to be 'dirt poor' took on a new meaning.

Poor land quality signified a poor community. No matter how hard our ancestors laboured on such lands the people of the fertile lands were highly likely to prosper. Our wealth emanates from what our ancestors felt first hand, resources from the earth are our primary wealth. We can think of the wealth of a nation as a pyramid:

Primary Wealth (the base) - natural resource base of rich soils, concentrated ores, rich in hydrocarbons, fresh water and abundant fisheries.

Secondary Wealth (what we make from primary wealth) - ore becomes steel, fisheries becomes dinner, soil becomes food in the store, and trees become lumber for construction.

Tertiary Wealth (paper abstractions, actualisations of primary and secondary wealth) - stocks, bonds, derivatives. These are a claim on our secondary and primary wealth. In of themselves they are worthless without access to that primary source. A vital distinction in the hierarchy of wealth.

If your primary wealth was poor, so it would be hard to be create the same level of productivity. The landed gentry were higher in the societal hierarchy accordingly. Technological advancement and financial innovation has transformed our primary wealth to tertiary wealth faster than ever.

The cornerstone of any nation developing its primary resources to maintain wealth has largely been held to be due to labour productivity, which in turn is driven by the interaction of these factors:

1. Quality of human capital, well-educated and flexible

2. Innovation and ability to move up value chain, (technical training, and growing R&D)

3. Strong core physical infrastructure maintained by high gross capital formation

4. Flexible and transparent business climate, with regulatory and legal transparency

5. Favourable demographics

In order for a Nation to extract its primary wealth and help its people grow per capita income they need the above factors. It is not a given that a resource rich country will migrate to creating better standards of living and sustaining it. Argentina didn't succeed, Russia hasn't and Brazil might but hasn't yet.

Adam Smith focused almost entirely on the role of labour in creating wealth and very little on the primary wealth as arguably there was an abundance of resources at the time of his works. He was engaged in the secondary notion of wealth. He was less concerned than we should be today about just sustaining the use of primary wealth; but he did recognise freedom was the most efficient economic model.

Even on reaching high levels of per capita income it is not necessarily sustainable. We should add this notion of 'freedom' as a 6th factor to development and sustainability of a nation for without this next factor the rest are obsolete:

Economic freedom

Friedrich Hayek in The Road to Serfdom wrote:

"To build a better world, we must have the courage to make a new start. We must clear away the obstacles with which human folly has recently encumbered our path and release the creative energy of individuals. We must create conditions favourable to progress rather than “planning progress.”… The guiding principle in any attempt to create a world of free men must be this: a policy of freedom for the individual is the only truly progressive policy."

Economic Freedom

Any discussion on Economic Freedom must incorporate Classical Liberalism. This philosophy or ideology advocates private property, an unhampered market economy, limited government, rule of law, due process, as well as constitutional guarantees of liberty of individuals that, ie freedom of religion, speech, press, assembly and free markets. Adam Smith himself, John Locke, Jean Baptiste Say, Alexis de Tocqueville and David Ricardo - the list is long and but some of the noteworthy individuals who helped shaped these ideals.

The modern day followers have been inspired mainly by the Austrian School, the 'Acting Men' - Hayek and Rothbard most notably.

This should not be confused with social liberalism which deviates from this doctrine, as it denies the self-regulatory capacity of society and advocates that the state is called on to redress social imbalances; unfortunately the creep to socialism is what classical liberalists fear. There are many overlaps in ideology by political groups of each extreme, socialists, liberals and conservatives. A useful way to rank countries based on their economic freedom credentials is one compiled by the World Heritage group. Notwithstanding the neoconservative support (we remain apolitical) we believe they rank countries based on several key areas which provide more qualitative understanding of the worth of a nation. It groups 10 economic freedoms into four broad categories or pillars of economic freedom:

• Rule of Law (property rights, freedom from corruption);

• Limited government (fiscal freedom, government spending);

• Regulatory efficiency (business, labour and monetary freedom); and

• Open markets (trade, investment and financial freedom).

Economic Freedom: Global Regions & Population

Credit Suisse provided some useful data on literacy rates. We consider education the essential ingredient by which a nation can begin to have economic freedom. Until such time as the populace are sophisticated both in literacy, and educated across the country at the secondary and tertiary levels (school and University), as well as developing vocational skills, then the people will always be at the mercy of government propaganda and coercion. This is why the ‘Internet reformation’ is a great leveller for society globally. It’s an educator.

Emerging Market Literacy 1990 to 2009

Graduates in Engineering, Science and Technology

Debt and Economic Freedom

Over indebtedness leads to loss of economic freedom.

As a nation progresses through the phases of primary to tertiary wealth it tends to ultimately place an inordinate amount of faith in this tertiary concept, which is why and how money is valued has a bearing on the ability to utilise the tertiary wealth for increasing productivity. We tend to forget our 'roots' if you will excuse the pun.

Money is considered by many as 'wealth'. It is not. It is a store of wealth, which is also a way for society to measure and transfer the true ownership of wealth from one entity to another. It is an amorphous claim on wealth.

Money exists only because government decrees we pay taxes with the national currency, but money has only value if we continue to accept it collectively as something we can use to exchange for something else. If the supply of money becomes out of balance with our primary resources, we will experience deflation (fall in credit and the money supply) or inflation (an increase in credit and the money supply.)

The value of wealth will become less either as we service more debt and or increase the supply of money to service this debt, (even if indirect or direct this is really deficit financing). At such point society hits an inflection point where capital is absorbed in the private sector not to aid innovation but too help offset the growing primary fiscal balances. The likelihood is that a nation will regress not progress in such circumstances. We don't want to enter the debate on resource sustainability here, suffice to say the cost of primary wealth transfer is rising.

In theory, debt (not deficit) financing of public spending could make a positive contribution to productive investment and ultimately to economic growth. Public debt could also be a mechanism for positive macroeconomic countercyclical interventions or even long-term growth policies such as marginal tax rate reductions. On the other hand, high levels of public debt may have numerous negative impacts such as raising interest rates, crowding out private investment, and limiting the flexibility of government to respond to future economic or national security crises. Mounting public debt, particularly debt that merely boosts government consumption or transfer payments, is likely to undermine overall productivity growth and lead ultimately to a loss of economic freedom and economic stagnation.

Today the size of debt relative to GDP has become the most talked about element of macroeconomics. Boring the repetition may be it is crucial for a nation to understand this concept, as it will deeply impact its course of economic development. It is imperative that nations pursue economic freedom policies as they will likely foster growth. Now we want to be careful not to define growth as the ever exponential rise and GDP, which as we will see has merely been facilitated by the growth of credit. It's a national obsession by economists and politicians alike that we must have year on year growth. Nonsense, what we need is stability of prices and the production of capital that allows savings. GDP can be stable, whilst increasing savings.

Von Mises himself wrote in Human Action, Treatise on Economics that “the attempt to determine in money the wealth of a nation or the whole of mankind is as childish as the mystic efforts to solve the riddles of the Universe by worrying about the dimensions of the pyramids of Cheops”. But we can advance criticism one step further to demolish any pretence the GDP statistic has to represent the values of production, and therefore be a valid measure of economic output.

Let's examine Alasdair Macleod's conciseness on this point - we need to consider an economy with sound money, with no change in the quantity of money and bank credit, and a balance in trade and cross-border capital flows. If, on the last day of the previous year, GDP is one billion monetary units, what will it be on the last day of the current year? It has to be the same one billion units. Production activity can change, the ratio between consumption and savings can change, the ratio of private sector to public sector in the economy can change, but if there is no change in the quantity of money, GDP must be the same. The adjustment is on prices, so a rise in overall production leads to lower prices, and lower production to higher prices.

What we want to encourage in an economy is savings where the private sector is encouraged to produce savings that stimulates production and thus capital which can either be consumed or saved. We do not want the following that reduce economic freedom:

• inflation

• increased government spending

•tax increases to finance debt service payments

• public debt burdens which crowd out private sector access to credit and free market rates

• public debt burdens which siphon external financing flows from productive private initiatives

The size of debt relative to GDP becomes the issue, taxing more to help pay down debt, and then funding the ensuing collapse in growth and hence tax receipts leads to coercive behaviour by governments to attract or 'conscript capital' to fund the nation. This impedes the level of economic development, both now and in future. There is a point too far, an 'End Game - Tipping Point':

Tipping-Point Debt Levels Identified from Empirical Studies

The leading empirical studies on debt sourced above show that debt to GDP of 60 to 90% for different groups of countries seriously hampered economic freedom and as a result growth. One other point that became clear is those countries with high economic freedom had more chance of sustaining the debt levels for a longer period of time than those with low economic freedom.

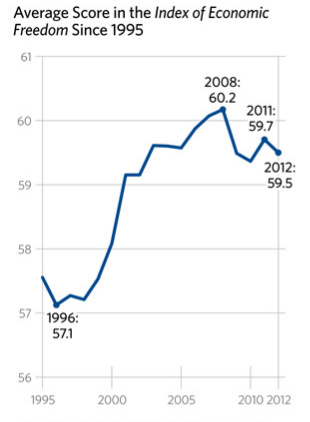

Observing levels of indebtedness has led ultimately to a loss of in the share of global GDP. Countries with more debt are more likely to be un-free or repressed. The chart below illustrates this consistent theme of Hinde Capital - financial repression will rise as the tension between government control and the free market escalates - particularly in the developed countries. The mounting burden of fiscally imprudent governments has begun to erode the gains made in other areas of economic freedom such as encouragement of private sector growth or simply by siphoning financing away from the private to the public sector.

Global Economic Freedom

Global competitiveness, which has been evident throughout history and interdependence of economies have been magnified by the financial turmoil of recent years. Broadly this is because, we share a common monetary system, that of a credit system funded by the interrelationship between banks and governments.

So policy decisions that hamper economic freedom in one country can negatively impact other countries and retard overall economic performance. For example increased regulatory oversight of Pension Funds which require (mandate) higher holdings of government debt in one country may see other countries mandate domestic government bond investment only; starving other countries of external funding. Economists have termed this capital conscription or as we have 'captive' capital. This is an example of how economic repression leads to political repression.

1 Terry Miller and Anthony B. Kim, “Defining Economic Freedom,” chap. 1, in Terry Miller, Kim R. Holmes, and Edwin J. Feulner, 2012 Index of Economic Freedom (Washington, D.C.: The Heritage Foundation and Dow Jones & Company, Inc., 2012), at www.heritage.org/index.

Business Cycle and Property Cycle Theories

We believe a mega credit cycle has propagated the final stages of a long wave boom to bust which is typically earmarked with a bust to the property or real estate sector on a global scale. Except in some countries the authorities have tried to mitigate this eventuality.

It is this excessive imbalance in property debt that has accelerated loss of economic freedom, as governments have employed the institutional framework to prevent a deleveraging of the system.

Business and property cycles both appear to have 4 to 5 years (short cycle) and 18 to 20 years (long cycle). Coincidence? Or does one drive the other? We believe that the property cycle is the leader and is integral to the business cycle. But it is the credit cycle that is inherent in them both.

Before diving into why this is case, first let us take a look at Business Cycle Theories. These have encompassed a long and colourful list of concepts from Haas and Ezekiel's Cobweb Theorem on hog cycles to William Stanley Jevons theory that economic fluctuations were due to fluctuations in the intensity of sunshine, created by regularly occurring 'sunspots' (large fireballs on the surface of the sun).

It has become generally accepted that economies experience long term growth trends interspersed with shifts in economic activity. These shifts or fluctuations take the form waves or cycles, which manifest from periods of rapid economic growth (expansion, boom) up to a peak in the cycle and then periods of decline (contraction, stagnation, or recession) to a trough; the business cycle.

There is a vast array of literature on the subject, and one only has to dip into the content to realise one is entering a vortex of debate. It is truly fascinating and has captured the imagination and turned the most modest of men into obsessive and deranged beings. It becomes a life-long passion trying to decipher the DNA of business cycles. Do they exist? How long are they? Why do they occur? And can we predict the timing and duration of cycles? Entrepreneurs, portfolio managers as well as economists seek the knowledge of the business cycle in the hope they can interpret and invest in the right business or asset class that benefit from or even propagates the cycle.

The evolution of research into cycles began as early as the 1700s with the likes of Richard Cantillon, John Law, Francois Quesnay and Henry Thornton; whose work on money, credit and velocity were the foundations for actual business cycle theory. As Lars Tvede notes with humour in his work on business cycles, we owe much of our knowledge on money to a team consisting of a Scottish murderer, philanderer and gambler, an Irish hard core speculator, an English banker and a French doctor.

Business and Real Estate Cycle Phase Nomenclature

Wesley Mitchell, the American economist was arguably the first to assimilate the array of business cycle theory and provide a unifying and coherent definition to bind them. He cofounded the NBER (1920) - National Bureau of Economic Research - an institution who primarily based their work on international business cycles. They discovered that many economic and financial indicators could be grouped as 'leading' the cycles, 'coincident' with them, and others as 'lagging'. In fact our macro research company Variant Perception, particularly focuses on the true leading and coincident indicators to help them forecast economic activity. It is this type of cycle analysis which has enabled Hinde and VP to assess investment opportunities for its investors.

It is Mitchell's definition of Business cycles we will observe first.

Business cycles are a type of fluctuation found in the aggregate economic activity of nations that organise their work mainly in business enterprises: a cycle consists of expansions occurring about the same time in many economic activities, followed by similar general recessions, contraction, and revivals which merge into the expansion phase of the next cycle; this sequence of changes is recurrent but not periodic; in duration, business cycles vary from more than one year to ten or twelve years; they are not divisible into shorter cycles of similar character with amplitudes approximating their own. (A. F. Burns and W. C. Mitchell, Measuring business cycles, New York, National Bureau of Economic Research, 1946

This defines it but doesn't really explain why. To help us understand why we prefer to take a more pluralistic approach and explore any concepts rather than dogmatic adherence to any one theory or strain of economics. Besides many of the Business cycle theories overlap in their expression of what causes the fluctuations: underconsumption and overinvestment, Keynesian under- and over - employment and Wicksellian over and under supply of money, Minsky's Financial Instability hypothesis and a host of other heterodox economic theories on the subject.

We would highlight some of the most well considered business cycle works which have encompassed inventory, capital investment and property cycles. This has led to a typology of business cycles according to their periodicity.

• Kitchin Inventory Cycle - 4 - 5 years (Joseph Kitchin 1920s)

• Juglar Fixed Investment Cycle - 7 - 11 years (Clement Juglar 1860s)

• Kuznet Infrastructure Investment Cycle - 15 - 25 years (Simon Kuznets 1930s)

• Kondratiev Wave Technological Cycle - 45 - 60 years (Nikolai Kondratiev 1920s)

Since the end of World War II recessions, in industrialised countries, have occurred every 8 to 10 years, with Kitchin, Juglar and Kuznet cycles providing intuitive explanations for these occurrences. The distinguishing features of these cycles are that the Kitchin cycles are characterised as being for four to five years and dominated by swings in inventory investment, while the Juglar cycles are characterised as lasting for seven to eleven years and dominated by long-term shifts to investment in equipment, and the Kuznet cycles are characterised by migration and investment in construction. However, the present cycle of change is more associated with the Kondratiev cycle, which is mainly concerned with structural economic development issues.

Nikolai Kondratiev, in his book The Major Economic Cycles (1925), described the notion that the capitalist world economy exhibited sinusoidal-like cycles or waves. Unlike short wave cycles such as Kitchin's and Juglar's these long waves lasted a duration of 53.3 years. These long economic super-cycles are otherwise known as K-waves or long waves. The Soviets were less than impressed with his work as it undermined the idea of the Soviet 5 year plans, as it inferred capitalism would stay alive. This was in diametric opposition to Karl Marx's Das Kapital (1867-94), which predicted each new economic crisis would become more severe until eventually the system would collapse in its entirety, paving the way for collectivism. This is partially why his work for many years remained consigned to a fabled status that super-cycles were mostly mythological. They didn't or don't exist.

The Soviet encyclopaedia defined his theory so: "Theory of long cycles, one of the vulgar bourgeois theories of crises and economic cycles..."

There has been some statistical support from work done by Korotayev and Tsirel (2010) through the use of spectral analysis. What the hell is spectral analysis? Let's not go there.

The Kondratiev phases:

• Spring phase: a new factor of production, good economic times, rising inflation (Improvement)

• Summer: hubristic 'peak' war followed by societal doubts and double digit inflation (Prosperity)

• Autumn: the financial fix of inflation leads to a credit boom which creates a false plateau of prosperity that ends in a speculative bubble (Recession)

•Winter: excess capacity worked off by massive debt repudiation, commodity deflation & economic depression. A 'trough' war breaks psychology of doom (Depression)

For our firm, the stand out elements of cycle analysis revolve around the concepts of exogenous versus endogenous and credit /debt. Most of the original work considered booms and crises to be caused by specific phenomena - exogenous (external) shocks or even mistakes; but none had treated these phenomena as interlinked phases of a fundamental wavelike movement inherent in a capitalist economy. Incidents in an economy were not independent. We believe crises were internal (endogenous) manifestations of the dynamic (complex) economic system that occur periodically and with regularity.

It was Clement Juglar who in his book on economic fluctuations who wrote, "the only cause of depression is prosperity". To our mind he nailed the reality that instability was inherent in the build up to a crisis and was propagated by the boom itself.

So it is the credit cycle and psychological aspects inherent in all these cycles we would like to focus on as part of the explanation of the evolution of cycles; and more specifically how the property cycle (a cycle within a cycle if you will) has become a major driver of instability in particularly the developed world’s economic long term trends.

Credit and the Austrian Business Cycle

A defining relationship between all these business cycle theories is the concept of credit and the crucial relationship between credit and housing price booms and busts, (Borio and Lowe (2002). This partly reflects the normal behaviour of credit, which tends to be procyclical. However, credit booms in conjunction with asset price booms also reflect the amplification of the real economy effects through the financial accelerator and other supply side mechanisms. We call this the credit cycle.

The credit cycle is the expansion and contraction of access to credit over the course of the business cycle. The Austrian school regard credit cycles as the fundamental process driving the business cycle. We would concur. The Austrian school can be epitomised for its development of its theory on capital in its theory of the business cycle, (Austrian Business Cycle Theory or ABCT). They argue that business cycles occur inevitably because of excessive growth in bank credit, encouraged by central banks interest rates remaining below the natural rate at which an individual would lend or borrow.

During the upward phase in the credit cycle, asset prices experience bouts of competitive, leveraged bidding, inducing asset price inflation. This can then cause an unsustainable, speculative price ‘bubble’ to develop. As this upswing in new debt creation also increases the money supply and stimulates economic activity, it tends to temporarily raise economic growth and employment.

When new borrowers cannot be found to purchase at inflated prices, a price collapse can occur in the market segment inflated by excess debt, along with a dramatic reduction in liquidity in that market. This can then cause insolvency, bankruptcy, and foreclosure for those borrowers who came in late to that market. If widespread, this can then damage the solvency and profitability of the private banking system itself, resulting in a dramatic reduction in new lending as lenders attempt to protect their balance sheets from further losses. This in turn results in a contraction in the growth of the money supply, often referred to as a "credit squeeze" or a "drying up of liquidity".

It was Kiyotaki and Moore whose research showed that there was a dynamic interaction between credit limits, asset prices and the real economy accordingly. They argued that collateral requirements amplify business cycle fluctuations, as in a downturn if there is insufficient income from this capital (collateral), the price of the capital falls and a viscous circle occurs as now the collateral is worse less and the borrower is forced to sell. Lending and borrowing falls and the recession deepens. Irving Fisher depicted this best in his Debt Deflation Theory in the early 1900s.

Real estate has become the collateral of a vast amount of private debt. There is no other means for the ordinary man to obtain sums of money far in excess of his annual income or often life savings than by access to hypothecation of his house. Borrowed money collateralised by real estate. So stable have property prices appeared over the very long run that housing has been one the largest sources of private sector collateral this past century.

Indeed learned men, such as Henry George as early as the 1800s saw this issue as a problem. George advocated government ownership of part of the economic rent value of land, and viewed land price cycles as part of the credit cycle. He saw land as God-given, and none should belong to any individual; all land properly belongs to society as a whole. He saw too much unearned wealth going to landowners and not the workers; and that they could extract economic rent at cost of the workers, who could not afford the land. He believed in a Single Tax (Land Value Tax) that of a 100 per cent tax be raised annually on land rent and paid to society’s representative the government.

Henry George wrote a popular works, Progress and Property (1879) about land speculative bubbles being the cause of depressions. His work sold 3 million copies, an International bestseller even by today’s standards. Whilst we agree land speculation has been responsible for business cycle fluctuations and ultimately busts, we would defer to Rothbard’s Georgist criticisms. God-given is a premise we can accept, just not that it is given to society. Talents, health, beauty may all be said to be God-given, but obviously they are properties of individuals, not of society. Land belongs to individuals and any such tax would blight production.

Another economist Melchior Palyi (1892–1970) popularized a concept known as the marginal productivity of debt. He proposed that the declining marginal productivity of debt is a result of debt based money expansion flowing into land, including housing and commercial real estate, and financial markets in the second half of the 20th century instead of non-real estate production capital, which is saturated. Real estate also became heavily saturated with debt. The significance of property collateral becomes even more evident when we look specifically at Property cycle literature:

Property Cycle

The typical total value of real estate tends to equal 2 - 3 times annual GDP; in a typical country that constitutes around 50% of total variable-price gross wealth, (Tvede 2006). What society has learned through extensive research is that this price is variable, so property cycles have can have an astonishing and at times catastrophic impact on an economy.

How do we classify property itself? There is both private and public property. About 20- 25% of property construction is public which is stable. It is the other 75% which displays cyclical behaviour. Research on cycles examines residential and commercial real estate (mainly retail, office and industrial). 75% of the market is residential.

Now there are property cycles and there are property cycles. Credit induced property cycles we believe are the culmination of a major boom bust cycle most usually associated with Depression-like behaviour. To our belief excessive valuations in property values are part and parcel of the business cycle. They are part of the endogenous process that ultimately fuels the crescendo in the business cycle boom and its ultimate bust; but more significantly they signal the end of a super-cycle of credit growth.

If there is anything you want to know about property cycles, one place we found to start looking was actually a piece of research on the research of property cycles themselves. It's title "A Century of Research on Property Cycles - A Literature Review and Annotated Bibliography" by A. Jadevicius, B. Sloan and A.Brown.

We provide a short list of cycle analysis:

• Homer Hoyt 18 year Real Estate Cycle - One Hundred Years of Land Values in Chicago (1933)

• Clarence Long 4 to 5 years and 15 to 20 years - Building Cycles and the Theory of Investments (1939)

• Richard Barras and D. Ferguson 4 to 5 years, 9 to 10 years, 20 years and 50 years (1985, 1987)

• Thomas Helbling 20 year cycles - BIS Papers #21 Real Estate Indicators and Financial Stability (2005)

• Roy Wenzlick 18.3 year cycles - The Real Estate Analyst (1936) and later work (1973)

We ourselves would look no further back to 1932 and Homer Hoyt. This man made the Property Auditor's Office in Chicago his home for several years, devouring each and every file they had. The result a veritable tomb, some 519 pages long, with over 200 accompanying tables and illustrations; Hoyt's One Hundred Years of Land Values in Chicago covers the relationship of the growth of Chicago to the rise of its land values from 1830 to 1933.

This was his PhD thesis and what a thesis. The empirical observations he made then are a generic blueprint for property cycle propagation today, even allowing for debates on duration of such a cycle. The key drivers have not changed.

The key point we learned from Hoyt was there were cyclical fluctuations in prices, and they were slow, but while they were slow they were huge and got very messy in a downturn. Often these cycles were independent of equity and commodity cycles, although in major busts all asset prices participate.

In 2003 the IMF and BIS had a joint conference on Real Estate Indicators and Financial Stability. This was the first tacit admission that in order for the IMF to adhere to its mission of safeguarding stability of the international financial system it recognised that relationships between real estate, business cycles and the stability of banking institutions cannot be thought of in isolation.

The US Savings and Loans crisis in the late 1980s, the Swedish and Japanese Financial crises in the early 1990's, and the Asia Tiger financial crisis in 1997-8 were all interwoven with the rise and collapse in real estate prices.

Thomas Helbling of the BIS analysed 14 developed countries (equity prices from 1959 to 2002 and house prices from 1970 to 2002) and concluded that 'busts' in the business and property cycle came very close on each other. They were identified as follows:

A bust is defined as a peak-to-trough decline where the housing price contraction had to exceed 14% compared with 37% for equities. In 14 countries with real residential housing prices (1970 to 2002), 20 housing price crashes were recorded (25 equity price crashes). This corresponds to roughly one bust every 20 years.

Cycle Drivers

The key concepts for why we have fluctuations, are lag time, and lack of information. These are the endogenous impacts of response to drivers. Property price oscillations are also driven by endogenous factors, most notably supply lags and the historical dependence of investment decisions. On the one hand, the supply response in the property market is much slower compared with that of other goods, mainly as a result of limited land supply and the length of the approval process and the construction phase. On the other hand, the flow of information in the property market is usually inefficient. Because the turnover rate of properties is usually very low, the price information is rather limited and often inaccurate. In particular, much of the information that is important to understand the dynamics of property prices is related to knowledge of local markets, which is accessible only at a substantial cost.

However there is one overriding factor that is consistent between all the analysis, and that is credit availability is the key driver of long cycles in property. Intuitive but not necessarily a given. Indeed modern analysis of the property cycle examines the end of Bretton Woods I and the growth of financial engineering and international capital flows (eg. peg determinates) as providing the essential ingredient for severe housing boom and bust. We put that down to the availability of excessive credit. (Dehesh and Pugh, 2000, "Property Cycles in the Global Economy").

The mere fact that housing starts provide one of the best economic leading indicators for the economy as a whole, and that when they crash, property markets have invariably turned before the economy does, are strong indicators that the property (real estate) markets drive the turning point of business cycles. And as we have highlighted earlier the research concludes there are both short (4 to 5 years) cycles and long (around 18 to 20 years) property cycles. So we would contend the business cycle has major cycles of 18 years as well.

We want to highlight the key concepts that presage both the business and property cycle as one amorphous and dynamic being:

The cycle dynamics of both respond to changes in interest rates and aggregate demand

Hog cycle, entrepreneurs increase supply by too much in response to demand increase

Financial Accelerator: real estate is used as collateral, which leads to a

Emotional Accelerator or ‘Swarm’ concept as entrepreneurs co-join to propagate an impulse cycle, which causes a self-reinforcing act and cause overinvestment or malinvestments (Austrian Business Cycle downturn);

The result is capital misallocation and marginal debt productivity which creates a negative feedback loop of falling collateral value and falling aggregate demand which collapses economic output

All this is encapsulated in the Financial Instability Hypothesis of Hyman Minsky and

Debt deflation theory of Irving Fisher that leads ultimately to:

Liquidity traps, Keynes

A liquidity trap invariably sets the scene for insolvency either by explicit default and or both implicit default of inflation. Both of which we argue we are seeing today.

The psychological component is central to all cycle work, as credit is a function of the individual’s use of it. It may be encouraged or forced upon individuals by the state’s misuse of monetary policy but it’s ultimately the individual who decides whether they want to consume now or later. This time preference concept is central to Austrian Capital theory and their ABCT. The emotional need to have whilst others are enjoying the benefits of cheap credit leads to an emotional accelerator which comes hand in hand with the financial accelerator; whereby collateral is rehypothecated ie pledged against more leverage until we are left with a Ponzification of the market. This still remains to this day as evidenced by the demise of MF Global.

Many developed nations have become hamstrung by an obsession with property. This is very unhealthy for their overall economy. The sooner we realise, and unfortunately reality of time will force the loss of this obsession upon us, that we must not focus our production on this sector and the indebtedness it brings the sooner a nation can be begin to flourish productively. Such nations need a change of psychology. My home is my castle not my investment or speculation - it's a place we call our own and develop the memories of ourselves and our children; hopefully happy ones.

A nation of would-be property tycoons, and we all know hundreds of them, is not conducive to long-lasting and sustainable economic prosperity. If we all decided to buy and sell houses the economy would become horribly unbalanced, as they have. Think USA, UK, Ireland and Spain and Australia and Canada and, you get the idea. They have all become overly reliant on one sector to sustain incomes at the macro and micro level, even allowing for resource rich countries.

Individuals who bought up property and buy-to-let's announced themselves as real estate portfolio managers or developers. Some having left dull or even interesting professions in the pursuit of easy money was dime a dozen. Entrepreneurs they called themselves.

Virgin CEO Sir Richard Branson is the iconic British manifestation of a serial entrepreneur, creating positively disruptive waves in mature industries. This is the definition of enterprise as production of capital is organically produced all be it with some debt, debt is not the multiplier here - ingenuity is.

By comparison a would-be property tycoon is not an entrepreneur, but a speculator. No doubt such ventures of 'speculation' were encouraged, if not exacerbated by over enthusiastic, self-appointed property gurus who mainstream media have helped propagate because the masses were on a "@&8!" feeding frenzy.

These individuals have no more understood the dynamics of a property cycle, that of slump, recovery and boom; than they have of its inter-relationship with the business (credit) cycle. They have like most have only understood and propagated the myth that property only goes up over the lifetime of an individual. Like those who believe that in real terms equities are a buy and hold for life. The pain of losses on property, especially on high loan-to-value mortgages will naturally adapt human behaviour, but only until the myopia of the next generation arrives. How easily we forget or chose to forget as humans the trials of our past. Until such time as we limit the availability of credit and property collateral, as well as the institutional framework of using more credit to prevent a deleveraging of the system; a nation’s wealth will be severely impaired.

Last March we wrote how 'The Facebook Revolution' of the Arab Spring uprisings was precipitated by the rise in food prices, a fall-out from abuse of the US numeraire by the Federal Reserve Bank. The Fed by fixing rates below their natural rate has hampered free market economic activity as all economic decision making has become distorted. This is one form of financial repression, which goes hand in hand with political repression.

A lack of political rights was the common factor for the Arab countries to revolt, as encapsulated by twitter comments such as those of Mohamed El Baradei - former director of the International Atomic Energy Agency; "Tunisia: repression + absence of social justice + denial of channels for peaceful change = a ticking bomb."

Developed nations of the West should take heed, as their monetary and fiscal abuse have sown the seeds of revolution as economic and political freedom is marginalising their nations' populations.

Lest We Forget - the Land of Rising Sums and Falling Values

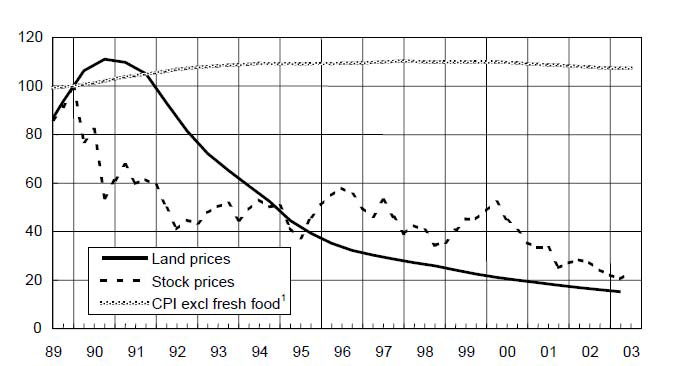

Japan in 1990 built the most fantastic asset bubbles of our generation. The combined value of both commercial and residential land in Tokyo doubled over two years from 1986 to 1988 to the point where Tokyo real estate values exceeded all the USA total real estate value put together.

By the peak of the bubble in 1989 Japanese real estate values (all Japan) exceeded the USA real estate by a factor of not 1 not 2 but 5. But wait it gets better this was 2 times the value of the entire World equity market capitalisations.

But no wait again – by 1990 Japanese real estate value was worth 50% higher than the global real estate values. Even the Emperor’s palace and surrounding gardens were worth more than all the land in California.

The ensuing collapse of Japan can be seen in graphic illustration. A stark reminder of a major boom and a very long bust. Now Japan ultimately exported its capital (inflation) in the years to come as it tried to reflate as every man and his dog borrowed at zero yen rates to invest in overseas high income and return assets. This was very much part and parcel of the global asset boom which died in 2008.

Japan Asset prices, general prices and economic environment Year-on-Year changes (%)

Asset Price Deflation - Japan 1989 Q4 =100

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

Visit hindesightletters.com for more information