HindeSight Letters Investment Insights Archive - READ HERE

Our FREE archive posts allow our subscribers to access valuable insights and analysis and a deeper understanding of market trends and investment strategies that were relevant at the time the HindeSight newsletter was published.

Additionally, reading archived newsletter content can give you a sense of the long term performance of the investments or strategies discussed which can be helpful in making informed investment decisions.

Furthermore reading this content can provide historical context and help you see how market conditions have changed over time, allowing you to better anticipate future developments.

Overall reading our archived content can be a useful tool for gaining a broader perspective on the market.

LIMITED OFFER. GET A 90 DAY FREE TRIAL OF OUR PREMIUM SUBSCRIPTION & MAXIMISE YOUR INVESTMENT POTENTIAL

INVESTMENT INSIGHTS ARCHIVE INDIA SPECIAL

Originally posted In Q3 2017

INVESTMENT INSIGHTS

The investment insights section in the HindeSight Indian newsletter is written to provide an education and understanding of financial investments by drawing on historical examples to help best navigate the future.

Investments are typically made out of hard-earned savings for the purpose of providing a long-term security plan for individuals and their families. The decisions taken in making well-thought out investments and not so well-thought out ones can often lead to vastly differing outcomes in wealth accumulation, so its crucially important to understand the basis of the investment. At the core of any investment, the two most important aspects are:

• The price you pay for it

• The current point in the economic/business cycle

Clearly, the cheaper price you pay for any asset and the better ‘economic’ winds for that asset class, the better the chance of a successful and profitable financial outcome. Despite how simplistic that sentence sounds, it is surprising how difficult it is for most people to appreciate and adhere to. There is a multitude of reasons why this is so. The average person might not be able to judge a ‘cheap’ price where there is real value, or understand even the simplest of economic cycles. Many people invest when they have money to invest without the patience to wait for a better price and time. Others believe times may have changed and the old rules don’t apply. History is full of ‘This time is different’ quotes, only for people to find it isn’t.

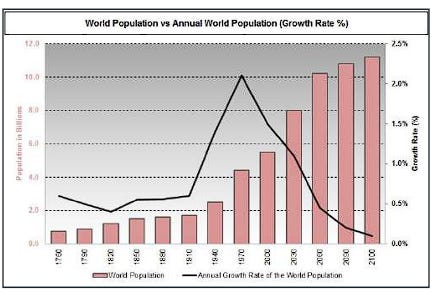

Since humans first walked on the planet some 50,000 years ago, the population has increased, but it took until AD1800 to reach the 1bn mark. Just over 200 years later, we are rapidly approaching 8bn people. With the growth rate falling sharply and competition for vital resources, such as water, the predictions of over 11bn by 2100 might not be met, but for now the expansion continues.

Despite an ever-increasing population, we have experienced many economic cycles throughout history, not necessarily all booms and busts, but regular up and down swings in economic output. We can observe high levels of employment and less than a decade later, high levels of unemployment. Similar observations can be seen in inflation and companies’ earning capacities. As the world is more connected that ever, especially in trade, similar cycles are often seen globally, as well as individual country cycles.

Investing in India

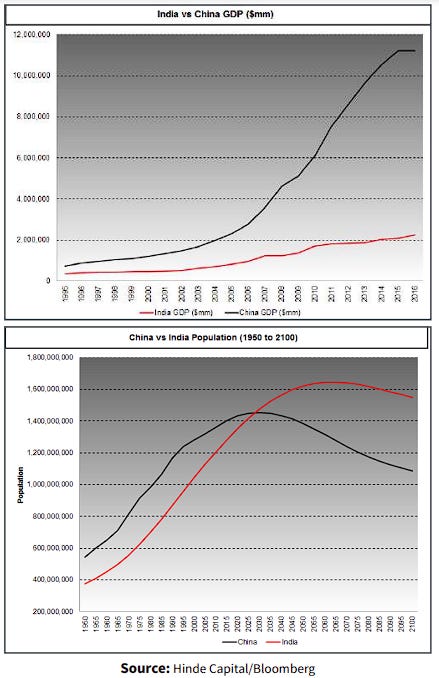

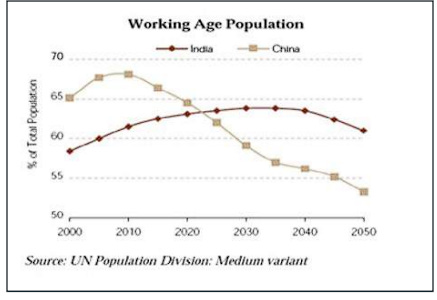

We believe that investing in India today offers many of the same characteristics that made the 1980-2000 period in the developed markets, especially in the United States, the most profitable in history. With a growing population, especially the working population looking to outpace China in a few years, the potential for the Gross Domestic Product to close the gap with China is there for all to see.

Government bond yields are 6.5-7%, rising to 8.5% for many corporate bond yields with declining inflation. Whether this bout of low inflation under 3% currently, continues or not, compounding yields at 7% over time, as we can see in the US bond total return chart later, really pays off for the long-term investor’s portfolio.

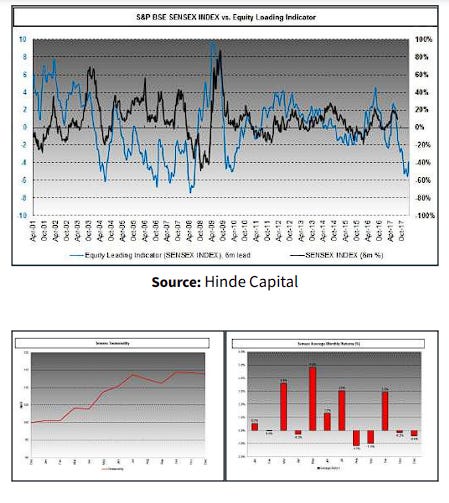

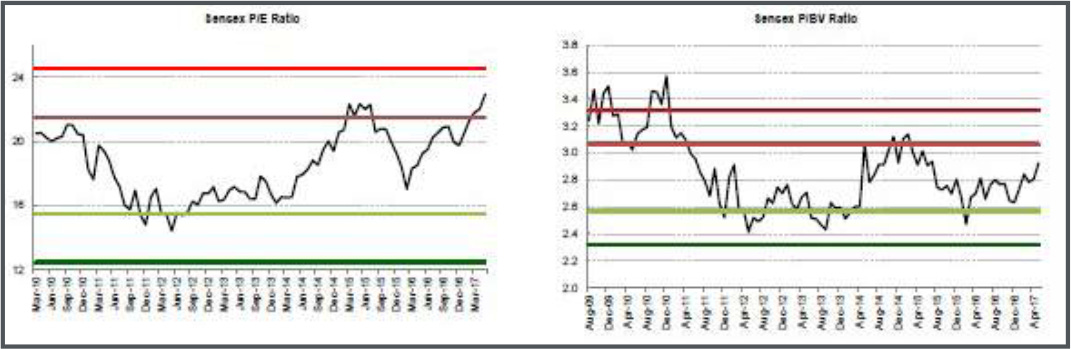

Indian equities have been on a tear for most of 2017 and there is every probability of a pullback, or period of consolidation (see Leading Sensex indicator above), especially as the US equity market is currently very expensive and long overdue for a reversion lower. A downturn in the US would naturally see global markets, including India, fall and normalise. However, the power of the earnings growth in India still makes many companies ‘cheap’ today and any general sell off will give an extremely attractive entry point to buy into India equities. We can see this opportunity may arise as seasonally the next three months (Sept-Nov) do not tend to be particularly positive for Indian equities. From 1990-2000, a standard portfolio of 50% equities/50% bonds in the US returned 15% a year. This represented a four-fold return on the initial investment, and more importantly, there was no draw down in any one-year period.

We believe that history in the developed markets has given us a clear road map as to why the best investment portfolio for the next ten years will include a portfolio of Indian stocks and bonds. This is based on tried and tested systematic methods, just as it was for the US in the last decade of the 21st century. We want to be at the forefront of this fabulous investment opportunity in India today and in the future, and we are delighted to bring out the HindeSight India letter to help guide investors build their own savings program.

‘If men could learn from history, what lessons it might teach us! But passion and party blind our eyes, and the light which experience gives is a lantern on the stern, which shines only on the waves behind us!’ - Samuel Taylor Coleridge, English poet, 1831.

The majority of wealth held around the world is in the following asset classes:

• Property

• Bonds

• Equities

• Gold

The briefest of summaries:

Property investment is seen by many as the bedrock of a savings plan, as we all need to live somewhere, but clearly there are good and bad times to invest in property. The factors that are most pertinent are:

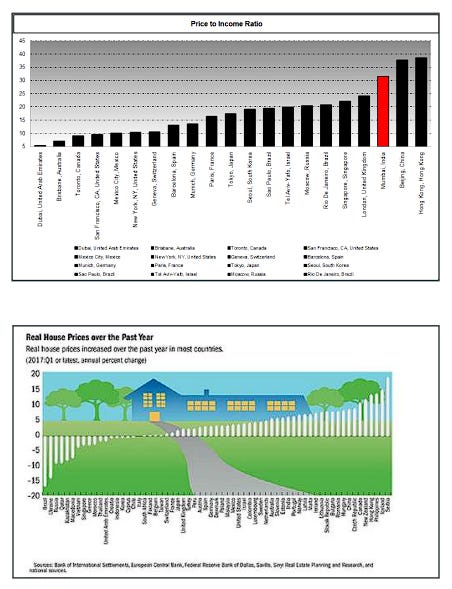

• The price-value point, based on a typical ratio of a multiple of income/average house price

• The cost and availability of credit for the purchase

• The economy where wages are rising/falling and unemployment is rising/falling, which changes the first factor

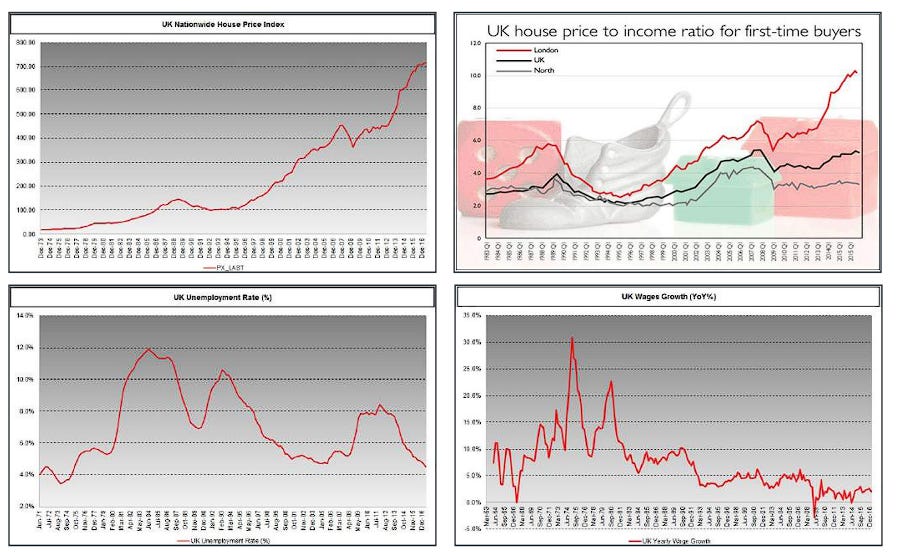

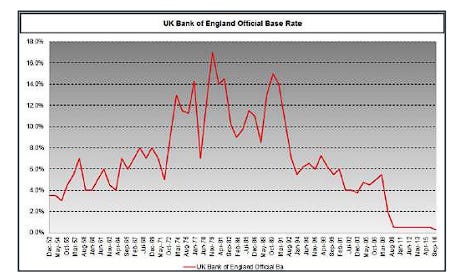

Historically, one of the best examples of property wealth is in the UK where we have seen the housing market benefit enormously in the last two decades in price terms, up some seven-fold in many parts. In 1996, the income/ house price ratio was a low 2.5X, an excellent and rare starting place. Interest rates have steadily dropped since then, especially since the 2008 crisis, while the population, employment and, most importantly, wages have continued to grow.

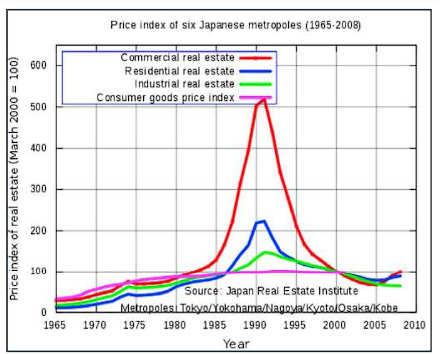

Today, the UK housing market is as expensive as it has ever been, arguably in bubble territory. While British people tend to see the property markets as bullet proof, there have been several cases in recent times of substantial wealth loss in property, in the US, Spain and Ireland especially. However, the ‘peak’ property bubble and subsequent blow-up award goes to Japan in 1989 when, allegedly, the 3.4 square kilometres of Tokyo’s Imperial Palace and gardens was worth more than all the real estate in California combined.

In India, the growth in GDP per capita has seen property prices rise to ‘expensive’ levels in price/earnings multiples, competing with global hotspots, but if we focus on the importance of the income/multiple factor and cost of credit with the growing population, it would suggest that a continued uptrend should be expected.

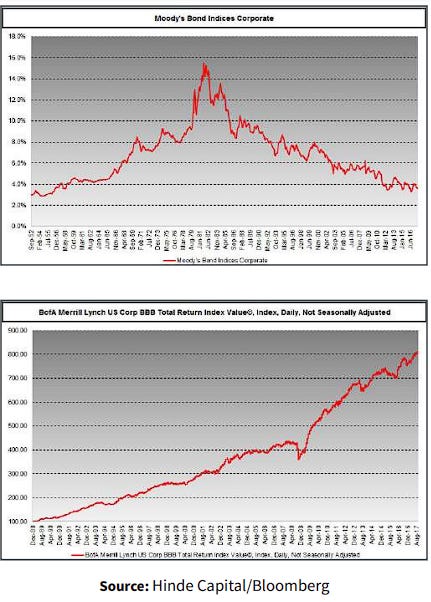

Bonds and fixed income securities are mainly issued by governments and large corporates to help manage their finances. They have become, in recent years, one of the cheapest forms of funding with the extraordinary monetary policies of Quantitative Easing, QE. By employing zero and even negative interest rate structures and mass balance sheet bond purchases, the world’s central banks have created a true bubble valuation in much of the developed world.

For the bond investor, receiving a fixed coupon over the lifetime of the bond provides a known cash flow and barring an actual default, a known repayment amount. The price of the bond over the lifetime will reflect the prevailing level of interest rates, usually dependent on economic growth and inflation and the likelihood to default.

The best time to invest in bonds and fixed income securities is when interest rates and bond yields are high, accompanied by strong economic growth and/or high inflation at the peak of the cycle when change is likely to happen. The usual reference point for fixed income investment is to monitor real interest rate, which is the actual interest rate you are receiving less the inflation rate. The result is the yield an investor receives, in excess of his loss of purchasing power. In the US bond market, an example of one of the ‘peaks’ was seen in 1980 when interest rates were almost in double digits with sky high inflation.

In the US and many western developed markets, bond prices and, more importantly, the total return of bonds, which includes price appreciation from yields dropping and regular coupon payments, has been on a near 40- year bull market. Even in periods where interest rates were rising, such as the 1994-1996 tightening cycle, the 6-8% compounding coupon was sufficient to mitigate the capital loss to a great degree.

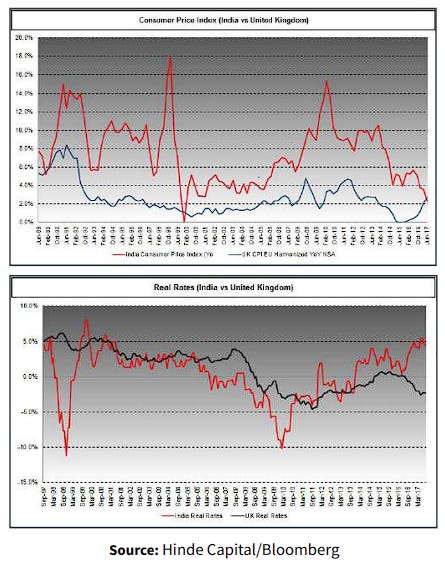

Clearly, the current investment opportunity for fixed income investment in many developed markets is appalling, with negative or negligible yields from Japan to US after a period of excessive money printing, potentially leading to inflation. But the rate differentials with India are very compelling.

With converging inflation rates, the comparison of real rates between the UK and India is particularly grabbing.

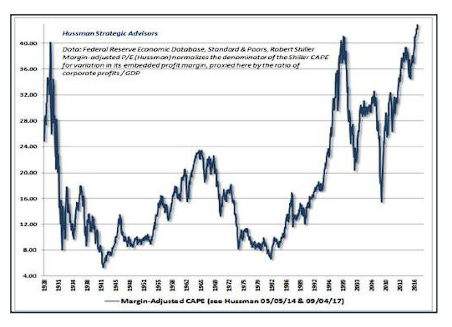

Investing in the equity of companies is understood to be far more exciting than investing in bond markets. Everyone has the chance to be the next Warren Buffet, the legendary stock investor from Nebraska. Endless analysis of companies big and small, stable or growth has been going on for decades as fortunes have been made and lost.

The bottom line of every analysis ultimately comes down to:

• Are the sales/revenue going up or down?

• Are the costs and, hence, the profit margins rising or falling?

• What multiple of those earnings are investors prepared to pay for the company?

While different stocks behave differently during the economic cycle and large growth periods tend to help all stocks, just as most stocks decline in recessions, the bottom line analysis is still intact.

The best time to invest in stocks is near the bottom of a typical economic cycle when price/earnings multiples are low or before a period of sustained growth of earnings.

Yearly returns of SP500 index in United States

In India, the equity market has tripled since 2008, with many developed stock markets doing equally well. The difference is that while US stocks are now richer than any time in history on margin adjusted Cyclical Adjusted Price Earnings ratios, Indian stocks are benefitting from an incredible surge in earnings growth, keeping Price/ Earnings Growth levels low.

Emerging markets have histories of boom and busts, high growth, high inflation rates and huge swings of foreign capital into and out of the country, making investments high risk despite the potential for high reward. We should not be naïve to assume that India is not prone to future crises or will be unaffected by any developed market sell off.

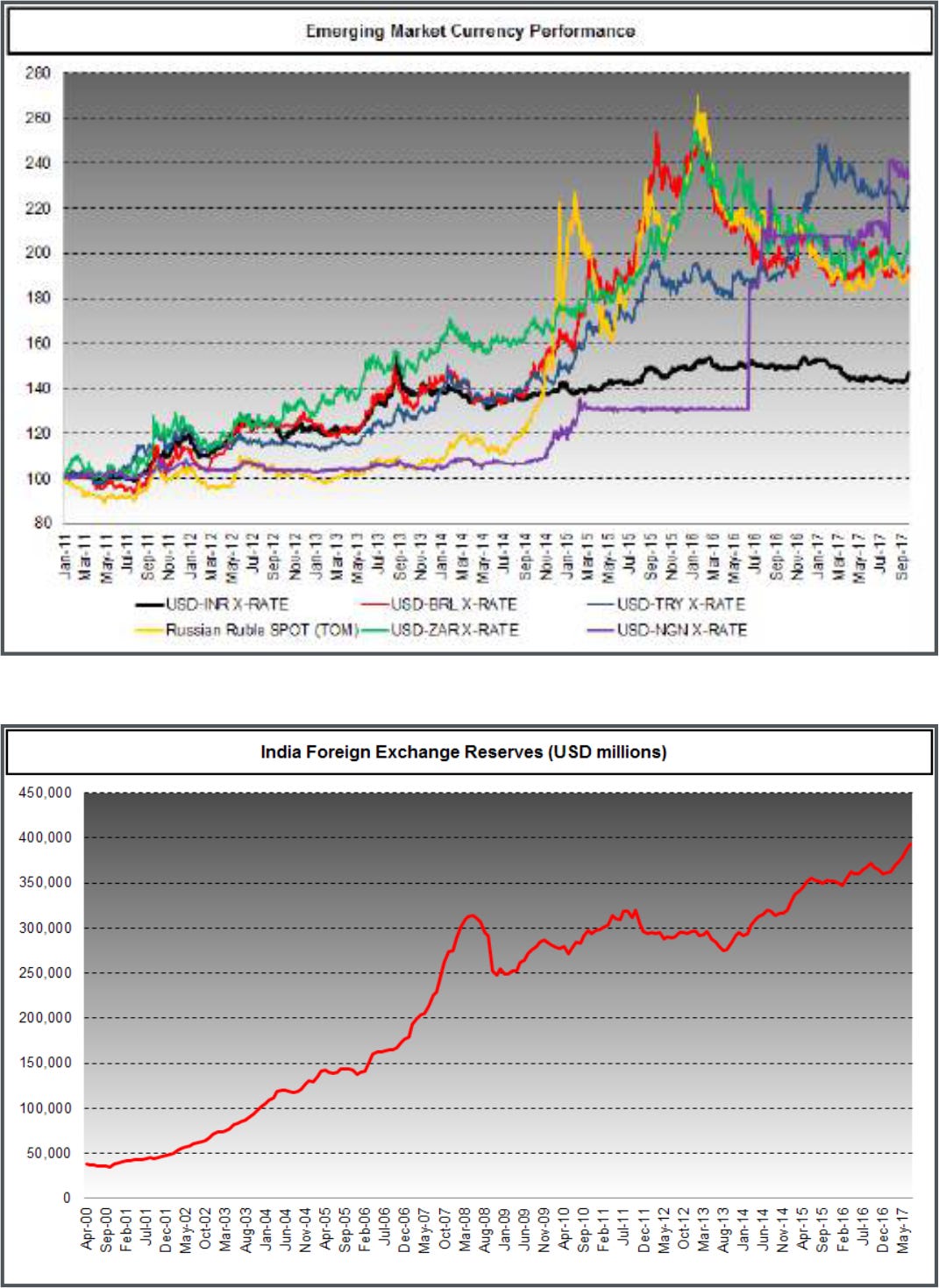

However, if we look at three typical gauges of risk in the emerging world:

• Currency performance

• Foreign exchange reserves

• Current Account deficit

We can see from the charts below that India has fared well, in comparison. Its currency has been far more stable than many other emerging currencies in the 2013-2015 crisis, while the oil price slump (India is a huge importer) has massively helped the current account deficit.

As we can see below, India’s middle class will rule global consumption. The investments they can make in the Indian market alone are some of the best opportunities, not just compared to today’s low returns in developed markets, but also historically

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

LIMITED OFFER. GET A 90 DAY FREE TRIAL OF OUR PREMIUM SUBSCRIPTION & MAXIMISE YOUR INVESTMENT POTENTIAL

Visit hindesightletters.com for more information