HindeSight Letters Investment Insights Archive - REWIND BACK TO COVID EDITION

Our new archive posts allow our subscribers to access valuable insights and analysis and a deeper understanding of market trends and investment strategies that were relevant at the time the HindeSight newsletter was published.

Additionally, reading archived newsletter content can give you a sense of the long term performance of the investments or strategies discussed which can be helpful in making informed investment decisions.

Furthermore reading this content can provide historical context and help you see how market conditions have changed over time, allowing you to better anticipate future developments.

Overall reading our archived content can be a useful tool for gaining a broader perspective on the market.

INVESTMENT INSIGHTS ARCHIVE -

Originally posted in April 2020

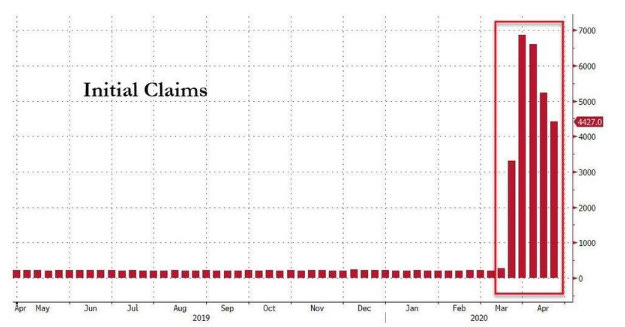

Everywhere across the world, quarantine and social distancing restrictions have seen businesses close with the inevitable surge in unemployment. In just five weeks, 30 million Americans in the US have filed as jobless. This has SO FAR wiped out the entire 22 million gains, and some, since 2009.

Food bank charities that were serving 1 in 7 of the population, pre-crisis, have seen those numbers double as pay checks and government cash have failed to materialise.

Weekly Initial Jobless Claims

Up to nine million workers in the UK are expected to be furloughed with 80% of the wages, up to £30,000, covered by the government. With over 30% of the workforce idle, the country’s economic output is falling off a cliff face.

Looking at these charts, it would be naïve to assume that the economy will bounce back later in the year, especially when there can be no immediate plans for so many of those economies restarting. Restaurants, concerts, sports events and plane travel will be lucky to restart in 2020, let alone get back to full capacity. Who is really going to take a holiday flight anytime soon?

In the 1920s and 1930s, both sides of the Atlantic saw the events of the General Strike and the Great Depression dictate the times, with unemployment reaching 25% and bankruptcy raging. These events changed the people who lived through them – ‘they had looked into the abyss and the abyss looked back,’ as the saying goes. Their patterns of behaviour, not just spending and investing, but their focus on what was important changed. Many people, who are now being forced to stay at home are no doubt having the same experience; valuing their family time much more and realising that their prior habits of gratuitous consumption were just that. As a result, we will spend less, travel less and enjoy the simple things in life more, for years to come. It is no bad thing, apart from the fact that the economy wouldn’t work at all well if people changed their habits that drastically.

Of course, with the world’s stock markets not having dropped far from their lo"y valuations of earlier in the year, you wouldn’t necessarily believe it. Legendary investor Howard Marks quipped, “We’re only down 15% from the all-time high of February 19th, and it seems to me that the world is more than 15% screwed up.”

In the US, we have the usual suspects of huge market capitalisations ‘saving’ the day but across the world, the financial system seems to be holding up well?

Enter the one-trick ponies of the central banks. PRINT MONEY. And that’s it.

The world has changed dramatically, for the worst. We are seeing the largest drop in revenue and earnings ever, but the central banks believe they can stop the tide by printing money and ‘fool’ us that the economy will bounce back. With a growing mandate, they will soon be able to buy every asset class across the spectrum, which will just sit on the growing balance sheets. Analysts are now referring to the US system as the ‘Feasury’ because there is no noticeable difference between the Federal Reserve and the US Treasury. It is becoming the same in other countries as the political needs and independence of central banks increasingly blend together.

In the real world of Depression-like unemployment and cratering GDP, it is harder to fathom the disconnect and the final outcome. Long-term petroleum geologist, Art Berman, reminded us that, “Energy is and always will be the currency of life. GDP is proportional to oil consumption.” We only have to take a look at the current chaos in the oil market to understand that GDP is looking decidedly poor.

On April 20th, oil for May delivery traded at NEGATIVE $40/ barrel! The current oil crisis has focused on the price wars between Saudi and Russia’s supply, with the US shale producers also on stage, but the reality is simple. With no driving or flying over the summer period, the demand part of the equation has fallen away drastically too. With the world awash with oil, every single storage facility, on and offshore, is nearing capacity and hence we saw a sharply negative price for the first time in history as the ability to take delivery was impossible for many. Closures and production cuts will inevitably follow, it can’t come soon enough for the producers. At these sub $20/barrel prices, every one of them is losing money hand over fist. The Saudis need $85/barrel to balance their budget, good luck on that anytime soon.

Both the oil price and unemployment rate do indeed tell us the fragile state of GDP for real. The other reality is the growing indebtedness of our nations.

The problem with resorting to printing money every crisis, large or small, is that very soon you will, historically, arrive at a hyperinflationary/debt deflation fork in the road, where both paths will lead to poor outcomes for the majority. With supply chains being hugely disrupted, globalisation challenged as borders remain closed and a surge of xenophobia, especially towards the largest manufacturer, China, we can only expect prices to rise.

Unlike after the last crash, when there was a ‘beneficial’ rise in prices of asset classes, it is likely to be in goods and services this time, an altogether less pleasant experience. Ask anyone in Argentina! Maybe the silver lining will be that nations will look to be either more self-sufficient and bring manufacturing home or more diverse. Kyle Bass’s recent discussions highlighted the ridiculous situation where 90% of the pharmaceutical ingredients of US antibiotics and 100% of their blood pressure medicine are produced in China. Outsourcing to that degree of insanity – to squeeze every cent of profit – will surely now change. But nationalism over globalisation brings with it lessons from the past; trade wars have far too often become real wars.

Closer to home, the UK stock market looks far more attractive than its heavily concentrated US counterparts. Many well-known names are still down 50% or more from their late December levels. The HindeSight portfolio has recommended high cash levels in recent years with the lofty valuations which have served it well. We will continue to recommend according to the model, but we see no reason to rush in fully at this stage. The final chart (below) is especially relevant to the US market. It is concerning that far too many people, probably as a result of the anchor and recency bias, believe in the ‘return to normal’ in their lives, as well as their investments. We are not convinced.

Many macro commentators who are far smarter than me, like Raoul Pal of GMI, are also using the 1930s Great Depression as the best historical comparison for future guidance. The argument that the central banks didn’t want to – or couldn’t – provide enough financial stimulus then, unlike today, seems to be weak considering the magnitude of the current drop off in demand and the reduced power of the banks, with interest rates already at the zero bound. Macro or proprietary traders were originally able to trade either side of the market, long or short, across the asset classes, with their only allegiance being to the expected profitable side. In the last decade, those skills seem to have been forgotten to a great extent. There has been far too much focus on long only and passive investing from the smallest investor-trader to the largest. Until February 20th, this was arguably the correct strategy. Watching eight years of gains in the world’s stock markets, like job gains, lost in a mere four weeks reminded me of the complacency of the buy and hold promoters. Those days have passed. Over the coming decade, prosperity and wealth preservation will require all market participants to be nimble and think more of trading than long-term investment. The equity markets could well have multiple failed rallies years before the final low is in. In the long term, the bond markets with zero or negative returns have only risk priced in, and could literally go either way at the hyperinflationary/debt deflation fork. Over the coming years, the ability to understand the change that has occurred and learn from it will define who will be the winners and losers more acutely than ever.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

Visit hindesightletters.com for more information

.