HindeSight Letters Investment Insights Archive - READ HERE

Our FREE archive posts allow our subscribers to access valuable insights and analysis and a deeper understanding of market trends and investment strategies that were relevant at the time the HindeSight newsletter was published.

Additionally, reading archived newsletter content can give you a sense of the long term performance of the investments or strategies discussed which can be helpful in making informed investment decisions.

Furthermore reading this content can provide historical context and help you see how market conditions have changed over time, allowing you to better anticipate future developments.

Overall reading our archived content can be a useful tool for gaining a broader perspective on the market.

INVESTMENT INSIGHTS ARCHIVE

Originally posted in October 2015

‘GOING NOWHERE’ AGAIN

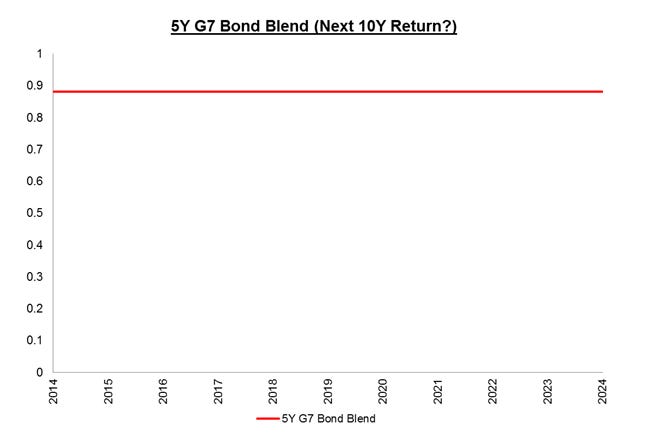

Last December, I sent out a blog entitled “Going nowhere”. The general theme expressed was a belief that passive investing in most asset classes would produce negligible returns for the next 10 years. As an old colleague used to say, “A blind hog will find an acorn every once in a while.” The last year has certainly been disappointing for investors so far. Two of the charts I used are presented below. I could have added that property prices are sharing a similar path.

With property, bonds and equities making up the majority of the invested wealth, this doesn’t bode well for capital or income needs. Some equities are still paying reasonable dividends, although these look increasingly under threat while bonds, cash and indeed property rental yields are historically low as interest rates are held down. On the other hand, the zero rate structure is potentially the main support for equity prices, stopping the regular 5-10% price declines from turning into larger routs.

Many wealth allocators looking at their models for the last 30-40 years might be happy to forget the last year or so and put it down to an anomaly.

A diverse portfolio of passive investment products, such as index trackers, are all the rage with the advisory community currently. Unfortunately, we might be better served to understand that since 1980, the climate for investment returns has never been more favourable. Interest rates have dropped from mid-double digits to zero, propelling bond returns most years. Equities and property, with occasional upsets, have risen several fold in that time and sit on an elevated plain of valuations, assisted by an ever-growing debt pile. The last 40 years may well be the anomaly that we will never see again.

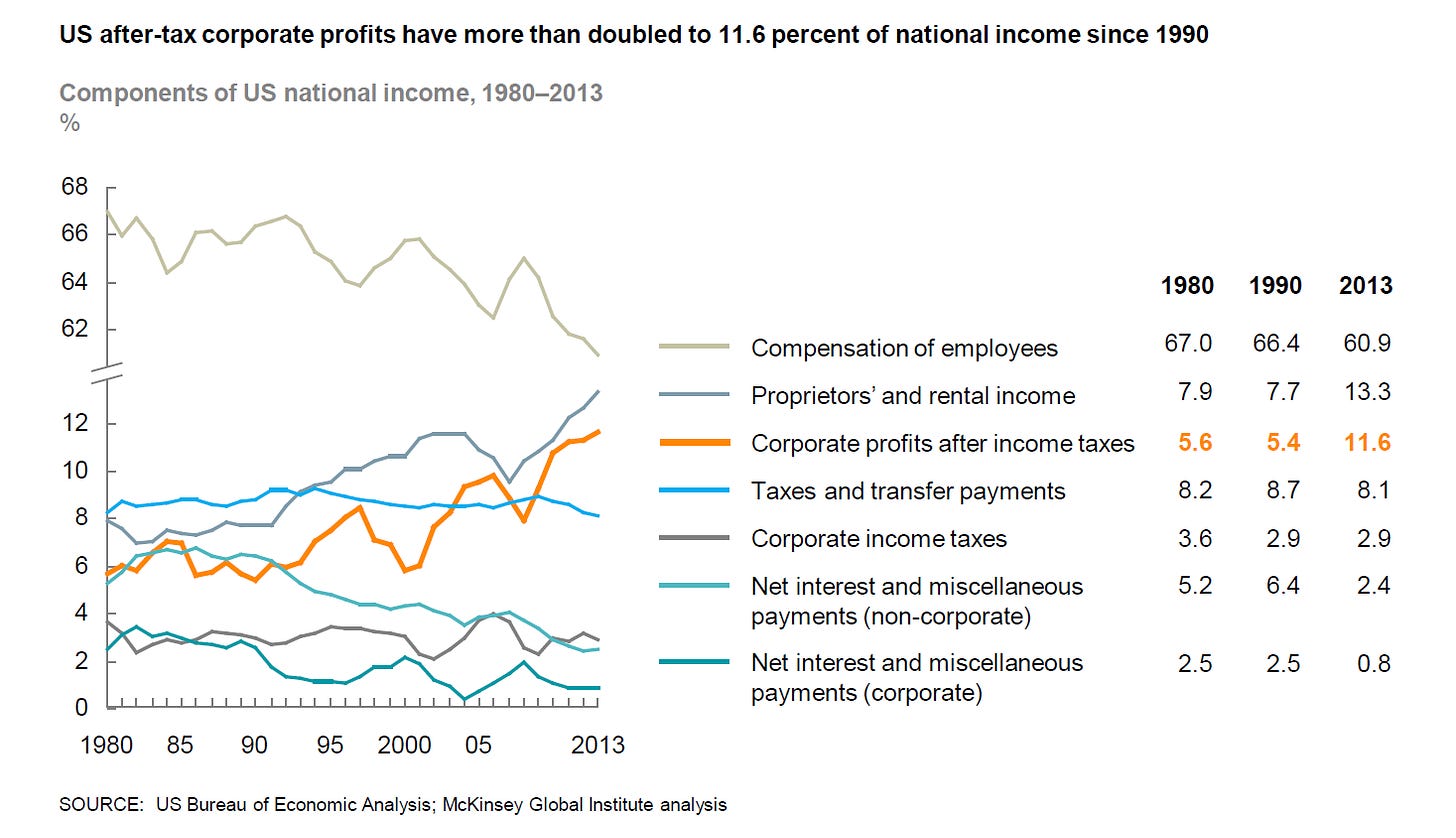

The recent McKinsey report on global competition tells us that corporate earnings, before interest and taxes, rose from 7.6% of world GDP in 1980 to almost 10% in 2013. With lower taxes and lower interest rates, the net income for corporates has increased by even more. The most important factors of this increase are the:

• Global revenue increase

• Lower cost of capital with ever lower interest rates

• Lower cost of labour

• Lower taxes

While the world, especially the emerging economies, added over a billion consumers with more to come, the last 30 years have seen the global labour pool increase by 1.2bn people at mostly cheaper labour rates.

As the below charts show, labour has not participated in the corporate gains. So, despite miraculous growth and despite low unemployment albeit 7 years post-crisis, labour feels less well-off FOR NOW.

Interest rates have dropped to zero or even negative as desperate the central bank policy continues to maintain growth at all costs. Unfortunately, the outcome of this extraordinary monetary experiment is not clear yet at this juncture.

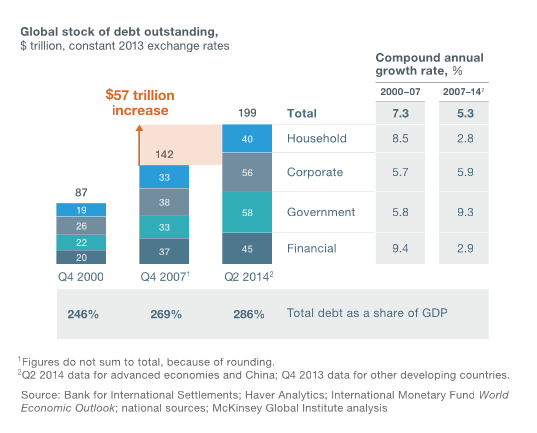

However, we do know that the debt expansion has been truly eye-watering. This is unlikely to end well. Since 2007, we have taken on an additional $57 trillion in debt over all sectors. So much for lower rates enabling an easier debt repayment schedule!

The last 40 years may well be the anomaly, both in the fabulous investment climate and the possible reasons behind it. The going nowhere possibility, where we muddle through and have to accept low to zero passive investment returns may well be the best scenario. The worst is some reversal of the last 40 years.

Demographics has become the new catchword for many doomsters, citing future catastrophes. Indeed, some of the numbers are very concerning. While Germany is in the midst of the current refugee crisis, many are oblivious to its horrendous population cliff. With one of the worst fertility rates, the 2014 population of 81.1million is on a path to fall to 68-73 million by 2060 even with a reasonable immigration scenario. Germany is by no means alone.

While the world population will continue to rise over the next two decades, the workforce may not. In many countries, nearly half of today’s workforce will be over 55 by 2025. The US worker median age rose from 34.6 years in 1980 to 42.4 years by 2013. With more competition for labour and an ever-ageing population, most of the positives for global profitability may well be reversed. Already we are seeing signs of wage inflation, albeit tepid at the moment, but they are there nonetheless. Will wage inflation pressures potentially force central banks to raise those ultra-low interest rates? Governments, already heavily indebted, will face similar increased financing costs to corporate and individuals with increased taxation an obvious choice to maintain services to its greying populace, as well as heavy duty cuts.

Fund managers and investors, professional and retail, face a very hard task in the coming years. We have a growing debt pile that is barely sustainable at zero rates, supporting a hugely inflated asset bubble of equities, property and bonds. The favourable economic and investment winds are turning and threatening catastrophic weather for many.

In order to maintain your wealth, capital and income, you will need to work harder and be smarter than in the past. Passive investments, such as my particular pet hate, the equity index trackers, will come to be used by only the laziest investors, who will lose exactly what the index loses, plus those “cheap” fees.

I am writing this today, Monday, October 19th 2015. Twenty-eight years ago, on Monday, October 19th 1987, as a young 23-year-old trader, working on the US Treasury desk of Midland Montagu Securities, I saw my first equity market crash. Many fortunes were lost that day but the market recovered ultimately as the underlying economic structure was intact. Today, I fear that we are standing at the edge of the crumbling cliff with no such underlying support.

Investors, instead of accepting a passive strategy need to adopt a dynamic strategy, namely trading and hedging. As onerous as that may sound, simple strategies can be employed to adjust the risk/reward of your investment portfolios accordingly. Over the coming months, we will regularly update readers to provide a framework to navigate the best investment path. Broadly speaking, we will focus on 3 categories:

• Knowledge/education

• Understanding investment exposure and risk

• Strategies for controlling that risk

Everyone has to start somewhere and apologies if some of these suggestions sound straightforward, but a good a place to start increasing knowledge is to add to your reading list. We would suggest:

• Reading the weekend ‘Financial Times’

• Reading the weekly ‘Investors Chronicle’

• Ordering a copy of ‘Reminiscences of a Stock Operator’ by Lefevre, detailing the stories of legendary speculator Jesse Livermore

• Signing up for a full subscription to the HindeSight Newsletter.

Write down all your investments, property, bonds, equities, schemes and pension plans. Then try to group them into market exposure by asset class as best you can. Start to record your NAV (net asset value) of your total portfolio quarterly or even monthly.

The first and easiest example of risk for many is often stock market risk. Most people have exposure to this, either in their pension funds or equity schemes, like an ISA or single stocks in a broker portfolio. Let’s just assume you have worked out that you have a stock portfolio of £25,000 at your broker account, £25,000 in an equity scheme and £100,000 pension pot, which you understand is broadly 50/50 bonds/equity. You are roughly exposed to £100,000 in equity risk. The older you are, the more the pension pot seems to tend towards 100% and vice-versa. The young might often ignore this distant exposure.

While reports are only sent out quarterly at best in most cases, so actual visible valuations may not be possible on a live basis. Everyone should be aware that the FTSE 100 index dropped from 7000 on May 1st to 5800 on August 24th, roughly a 17% loss. On a £100,000 starting portfolio, this is a whopping £17,000 loss. Of course, you are in it for the long term and it always comes back, doesn’t it?? Understanding your exposure is very important to being able to accept or mitigate these risks.

Giving investment advice is rather like giving any advice and I find the old adage quite appropriate:

“I don’t give advice, a wise man doesn’t need it and a fool doesn’t take it.”

But I will tell you one of the most basic strategies that I use for my equity exposure. In recent letters, we have written about the summer/ winter equity seasonality effect with much better investment returns coming in the winter period.

“Sell in May and go away, don’t come back to St Leger Day”

The St Leger Day’s race fell on 12th September this year, with the FTSE 100 index having lost 12.6% from May 1st to September 12th and has since recovered 5% since then. While such large moves don’t happen every year, being out of the market for the summer and enjoying the holidays has historically been a smart move in protecting your wealth.

Clearly selling all your equities and buying them back 5 months later is not that wise or in fact easy. However, what is relatively easy is to “Hedge” some or all of your equity exposure at times when you would like to mitigate/reduce that risk.

These days, it is much more straightforward. You open up an account with a Spread Betting firm and take out that hedge accordingly.

I have been trading my own account for over 30 years and I can save you the trouble of looking around for the best spread betting firm. It is IG, the new brand name for IG Index which has been around since 1974. They are head and shoulders above the competition in my opinion. Not only are they the best spread better but you can in fact run your stock broking account at IG at the same time, if you wish, although not essential.

Of course in order to trade, you will need to open up an account and fund that account with enough money to cover your margin which will vary according to the market movements which again at first sounds scary but it is not. It can be risk reducing not risk increasing.

So in the very basic terms, on May 1st this year say you believed you had exposure of roughly £100,000 in your equity basket primarily in UK stocks, you could have decided to hedge that for the summer by selling £100,000/Index price of 6960 = £14.4/per point (units) of the FTSE 100 Dec future equivalent.

At the low point on August 24th, your £100,000 exposure would only be worth £83,000 as the worries about the collapsing Chinese economy sent shivers through the market. However, your hedge of short £14.4 a point would have been in profit by 6960-5800 (index low price) = 1160 points X £14.4 = £16,704. You would have completely protected your portfolio during those troubling times. You then can then buy back the hedge on St Leger day for example and benefit from some of the subsequent recovery. This is just one of the many ways that the average investor with more knowledge and more work can dramatically increase their odds at investment success over time.

Naturally, there are some hurdles to overcome in understanding the jargon and exact methodology but IG provide training videos and their excellent brokers are at hand to help as well. Also any subscribers to the HindeSightLetters service can email in to us and we will do our best to help.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

Visit hindesightletters.com for more information