HindeSight Letters Investment Insights Archive - READ HERE

Our new archive posts allow our subscribers to access valuable insights and analysis and a deeper understanding of market trends and investment strategies that were relevant at the time the HindeSight newsletter was published.

Additionally, reading archived newsletter content can give you a sense of the long term performance of the investments or strategies discussed which can be helpful in making informed investment decisions.

Furthermore reading this content can provide historical context and help you see how market conditions have changed over time, allowing you to better anticipate future developments.

Overall reading our archived content can be a useful tool for gaining a broader perspective on the market.

INVESTMENT INSIGHTS ARCHIVE

Originally posted in December 2016

As an investment manager to a bullion based gold fund for the last 10 years, I often get asked about the price of gold and whether it is a good time to buy or sell it. As I believe that gold should be a permanent part of any portfolio, I am often concerned that most people view gold rather like a runner in the 3:30 at Newmarket. We have written in the past about the ‘Permanent portfolio’ or ‘Cockroach portfolio’ that has survived most crises, and a portfolio we believe should really be the starting basis for any investor.

25% gold, 25% equities, 25% bonds and 25% cash. Of course, these assets are going to move in price terms and clearly, there is an economic cycle where one should favour a larger percentage in those assets at times, as well as being respectful to the need for rebalancing. When gold was at its $1900 highs in 2011 and stocks were trading poorly, most permanent portfolio adherents should have trimmed their gold holdings and increased their stocks accordingly. But the need to have at least a starting portfolio allocation is key. Far too many people invest far too much in their ‘favourite’ stuff with scant regard for not only diversification, but also the need to adjust at crucial times.

When I was asked the same old question by an investor last week, ‘What do I think of gold here?’ (at a price of $1150/oz), I replied: “I would hold some gold at this level at a reasonable % allocation in your portfolio; it is not really rich or really cheap. It is 17% lower than earlier in the year, 42% lower than in 2011 and 8% higher than January 1st this year”.

At the end of last year, it became very clear that as gold dropped to close to $1050/oz, most gold mining firms were fast going out of business with supply and exploration totally drying up, so it is probably closer to the cheap side, if you put a gun to my head. I ended the conversation with, “As a current holder of gold of a standard % allocation in your portfolio, you don’t really have to make a decision on it. It is not a short-term bet.”

However, there are times when you definitely need to make decisions on your portfolio, when the valuations, the economic cycle and the environment demand it. Some recent extreme valuations have included:

• Anyone who has owned London prime real estate in the last two decades will know that the peak prices of 2014 are unlikely to be challenged for years to come. The stamp duty changes and the disappearance of many of the overseas buyers have seen offering prices drop 10-20% but more importantly, the level of transactions has fallen off the proverbial cliff, suggesting that willing exchange prices are far lower.

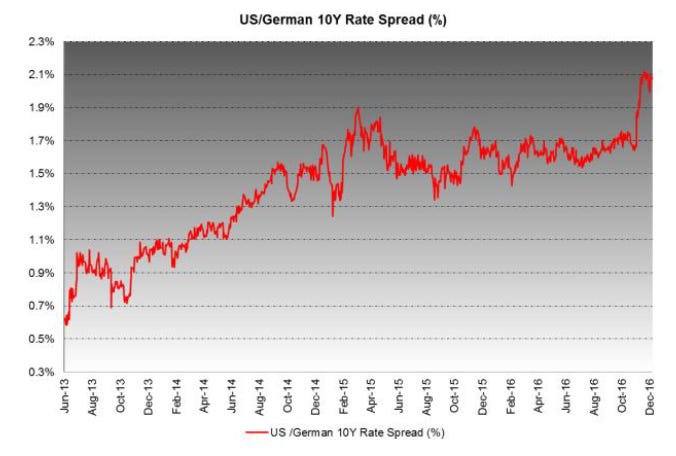

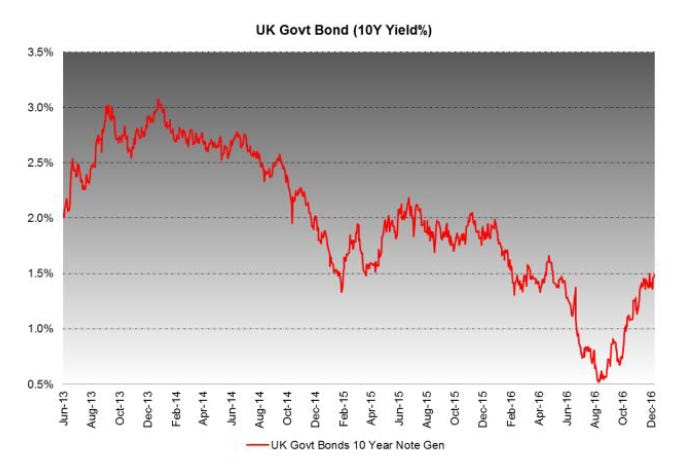

• Bonds, especially government bonds saw their yield lows in the summer, the true extreme peak was no doubt the negative yield issuance of some European corporate bonds. The long 30+ year bull market is over and the price drop looks only just to have begun. The US bond market is leading the rout, but I expect others to follow in due course, including all corporate bonds.

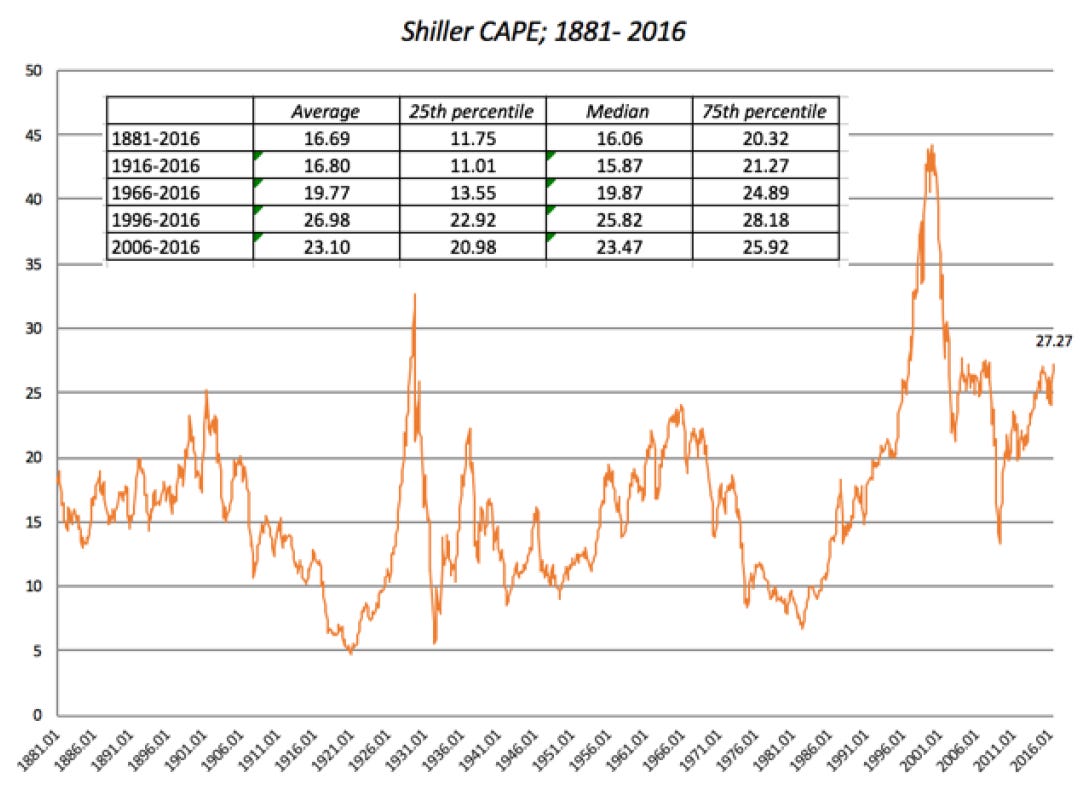

We believe that world stock markets, which have benefitted from ultra-low interest rates, are potentially at risk of a reversal in fortunes as a result of the struggle with very high price/earnings multiple valuations and rising rates. None is more at risk than the US stock market, which in currency terms is the richest in the world by far.

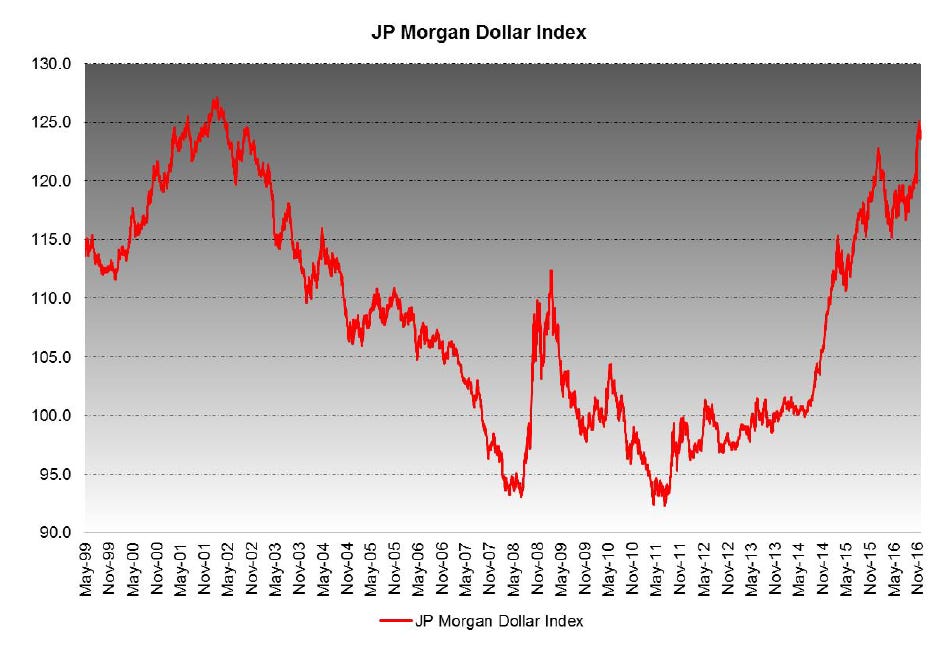

The USD dollar against world currencies is back to the highs of 2000.

As a foreign holder of US stocks, you may be well advised to cash in your chips here and move to increase your cash holdings. The current frenzy has all the hallmarks of a blow-off top similar to historical peaks in 1987, 2000 and 2007.

Closer to home, I am surprised that little has been written about the new rules, which I believe will bring the bull market in buy-to-let property investments to an abrupt end. For as long as I can remember, anyone and everyone could have become a landlord. The strategy was simplicity itself:

• Find a willing bank to lend you as much of the purchase price as you could at a good rate, albeit higher than a residential mortgage

• ‘Do up the property’, market it and rent it out at an ever increasing rate

• Offset the lower mortgage finance against the rental income, say -3% and +5%, net +2%

• Sit back and enjoy the positive cash flow, paying a small amount of tax and watching the value of your capital grow every year

• Repeat, by mortgaging some of the increased equity of the existing properties to buy another property.

Many buy-to-let empires have been built over the years and have been staggeringly lucrative, and there has been more than enough space for the smaller investor. But as with most great business ideas, either competition or the government move in and the game changes. Newcomers to the market enter to try and replicate the obvious success, but the government usually moves in because it sees an easy tax revenue to collect or it wants to ‘protect investors’ in some guise.

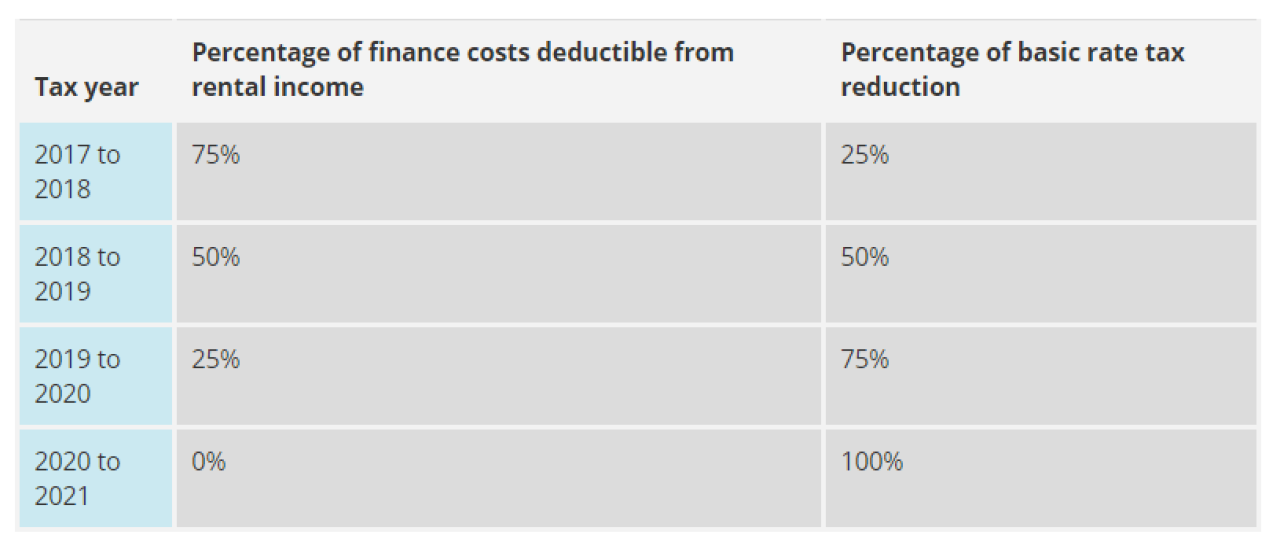

In April this year, 3% stamp duty was added to all second home purchases. This tax grab has wide-ranging implications, not only for buy-to-let investors, but also for marrying couples who change their residences. Not content with that, the government has decided to tax more of the golden goose by reducing the ability to offset mortgage interest against rental income over the next three years.

The final nail in the coffin was when the Prudential Regulation Authority announced new stress tests for lenders for BTLs, raising the current levels of lending limits from 125% of rental income at 5% to 145% at 145%. This means a yearly rental income of £12,000 that previously allowed a loan of £192,000 (12000/1.25/ 0.05), will only allow a loan of £150,000 (12000/1.45/0.055) under the new rules.

The new tax and regulatory regime means that the landscape will be different within a few years. As a result:

• Costs of purchases have increased

• The amount of loan potential has dropped substantially

• All rental income will be taxed with no finance offset.

The buy-to-let investment will now be negative carry (annual loss) because after tax income will be lower than the mortgage costs, so this shortfall will have to paid by the landlord, who will continue to hope that the capital value of the properties goes up. The assumption that landlords will just increase rent is flawed as rental levels are subject to affordability, and with wages unlikely to immediately rise this needs to be taken this into account. This is not ideal for the banking sector either, as 15% of the current UK loan books are buy-to-let mortgages.

I think the smart move is to steer clear of this for the time being or exit completely as one of the largest investors has done very recently. (Until possibly the government realises the error of its ways and reverses some of these changes.)

Summary

Our portfolio holds 16 stocks but has a higher cash holding, which reflects our belief that there is less value at this time in many stock markets and their components. The Hinde dividend value strategy, as the name suggests, has parameters based on buying companies that are cheap where the future value is perceived to be higher than the current share price. With stock indices buoyed by zero interest rates and election euphoria, the number of investments that meet the parameters is quite small at the current time, despite the dispersions of gaining and losing stocks being ominously high.

We generally believe that at this juncture in the economic cycle and level of valuations that the risk of capital losses far outweighs the meagre income (often paid out of capital anyway) or capital gains. This includes bonds, stocks especially US ones, and indeed buy-to-let properties.

As such, we will be viewed as having a very defensive strategy because we hold large safe cash equivalents, such as UK T-Bills and a reasonable percentage of gold, while having low allocations of stocks and bonds. Generally speaking, we believe we will be able to buy many asset classes and stocks in the future that are cheaper than they are today and patience is warranted.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

Visit hindesightletters.com for more information

.