HindeSight Letters Investment Insights Archive - READ HERE

Our new archive posts allow our subscribers to access valuable insights and analysis and a deeper understanding of market trends and investment strategies that were relevant at the time the HindeSight newsletter was published.

Additionally, reading archived newsletter content can give you a sense of the long term performance of the investments or strategies discussed which can be helpful in making informed investment decisions.

Furthermore reading this content can provide historical context and help you see how market conditions have changed over time, allowing you to better anticipate future developments.

Overall reading our archived content can be a useful tool for gaining a broader perspective on the market.

INVESTMENT INSIGHTS ARCHIVE

Originally posted in April 2018

Philosophers have long debated whether greed is a natural or acquired human trait, but maybe the analysis should be focused on impatience to consume. Our history shows us that anyone who has the ability to spend tomorrow’s earnings today, rather than wait, does just that. Whether it has been a medieval monarch, the perennial vote-chasing politician, or the majority of the developed world’s populace, it’s a sad fact.

In the UK, the numbers are truly astounding, but we don’t really take much notice. Mortgage debt, student debt, car leases and credit card debt are just part of the human desire to ‘live’, it would seem. But are we heading for a debt crisis for real?

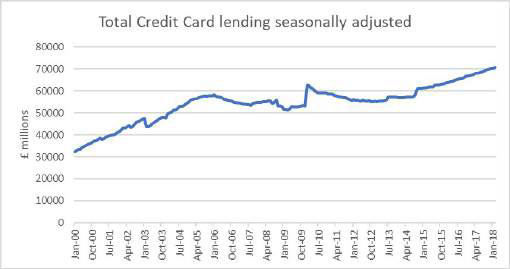

The unfortunate statistics in every category show rising levels of total debt and worryingly high growth rates of debt.

With one in six consumers reportedly, ‘maxed out’ on one or more credit cards, we are in a pretty precarious place. The level of interest rates for our different types of debt varies dramatically. Mortgage rates are still ultra-low with the average around 2-2.5%, but credit cards can be as high as 26%.

While most people’s mortgage is their largest single debt, it is often not their largest monthly repayment. A £200,000 mortgage, fully repaid over 25 years is £900 a month, but the interest only mortgages that are still outstanding are only £220 a month. Compare that to the £20,000 credit card debt where monthly repayments are close to £500 at 26% APR, JUST to stand still!

There is a sizeable spread between unsecured debt at 26% APR for the worst credit cards and secured mortgage lending, but the credit card issuers face two large margin detractors: fraud, which last year cost over $25bn, and debt write-offs for defaulters.

But two statistics stood out in the latest money charity articles, bringing some positivity to the issue. Only 56% of credit cards had interest bearing balances and because of this the average credit card interest rate across the spectrum was only 18%.

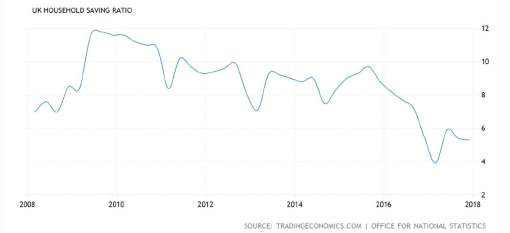

Changing people’s attitude to debt is far too great a challenge. Whether it’s out of necessity to barely survive or the need to consume in order to ‘live’ life today and to hell with tomorrow, we will continue to indebt ourselves. Saving for a rainy day seems like an old wife’s tale to many nowadays.

But what we can advise is, spend some time getting your monthly credit card interest bill down. Google ‘Compare zero interest credit cards’ and you may get a screen like this:

Do everything you can to transfer your balance from your current high interest rate credit cards to zero or low rate cards. And don’t give up if at first you don’t succeed. There is always a new deal, with lower credit score requirement if you wait. But obviously, bear in mind that these teaser rate deals – designed to get you to transfer over – only exist because the credit card companies know that when the deal runs out, you will probably still be in debt and too lazy to change and will start paying them the interest that you currently do to another provider. Why not beat them at their own game and use the zero percent deal to pay off your debt? Just a thought.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

Visit hindesightletters.com for more information