HindeSight Letters Investment Insights Archive - READ HERE

Our FREE archive posts allow our subscribers to access valuable insights and analysis and a deeper understanding of market trends and investment strategies that were relevant at the time the HindeSight newsletter was published.

Additionally, reading archived newsletter content can give you a sense of the long term performance of the investments or strategies discussed which can be helpful in making informed investment decisions.

Furthermore reading this content can provide historical context and help you see how market conditions have changed over time, allowing you to better anticipate future developments.

Overall reading our archived content can be a useful tool for gaining a broader perspective on the market.

LIMITED OFFER. GET A 90 DAY FREE TRIAL OF OUR PREMIUM SUBSCRIPTION & MAXIMISE YOUR INVESTMENT POTENTIAL

INVESTMENT INSIGHTS ARCHIVE

Originally posted In February 2017

INVESTMENT INSIGHTS

Last month, we promised that we would update readers on our portfolio thoughts.

Whenever I read the New Year’s portfolio choices, either in The Investor Chronicle or in IFAs’ literature, I am always surprised at the typical 100% invested nature with virtually no cash holdings.

They always advise the need to have enough in case of a six-month emergency, but never as an investment portfolio choice. Is it because of the way they are compensated or just their investment style?

Currently, I have 50 percent of my investable portfolio in cash – Treasury Bills to be exact – with no bank risk.

I must be an idiot. You would have thought I’d have learnt more in my 32 years as a trader and investment manager.

Why do I hold so much cash at this time?

I have worked hard to build up the capital. I have never received any financial help from others in any way since my 16th birthday. I have also worked in the financial markets as a trader since 1984, seeing market events first hand with booms and collapses in all asset classes, stocks, bonds, property and commodities. As such, I might be warier than most about what future events can do to my capital.

Straightforward common sense dictates that the cheaper we pay for something, the better the returns will be.

• Buying bonds that yield 10% is better than buying them at 2%

• Buying property valued at three times income multiple is better than buying it at ten times

• Buying commodities at zero premium to extraction cost is better than three times premium

• AND BUYING STOCKS AT PRICE/EARNINGS RATIOS of 10 is better than buying at 25

The very basic chart below demonstrates that downward sloping line of future returns relative to price paid in Price/Earnings terms. You can substitute in any of the above yields, income multiples or extraction premiums and get the same downward line relative to returns.

Currently, I am worried that many of the asset classes will produce a return worse than cash in the short to medium term horizon and so holding 50% cash is my chosen portfolio allocation.

Trust me, if bonds were at 8-10% yield and stocks were trading with single digit p/e, I would be fully invested, and more so, and the discussion about cash would be irrelevant. That is not the case at all today.

STOCKS ARE NOT CHEAP

I think it’s better to start with this introduction because it’s important to realise there will always be people, retail or professional, who are bullish on stocks – always. They were bullish at the highs in 2000 before a 50% decline in price and they were bullish in 2007 before a similar decline. I don’t know whether they are just eternal optimists in everything they do, with little respect to the facts, or it’s specific to the stock market.

But when I write ‘Stocks are not cheap’ and challenge a perma-bull, I can at least get them to agree and we can start off the discussion, rather than starting at far more extreme levels.

One of the most common ways to look at the stock market or compare single stocks is to look at the Price/Earnings ratio.

With seemingly only two moving parts, Price (of the stock) and Earnings per share, it is straightforward enough to see that if you are able to find a company making £1mil a year in profit, which was valued at only £2mil, then it is a great investment. In effect, you would own the company for free after just two years of earnings. Of course, this rarely happens.

Unfortunately, earnings are not constant in most companies and, as such, there is much up for debate using price/earnings ratios as a key yardstick.

• Trailing (historical) earnings are earnings that have actually been recorded

• Forward Earnings are estimated earnings for future years and, as such, are subject to change

• Cyclically adjusted earnings: most industries and the stocks in them operate in cycles – the good times and the bad times, when earnings range from good to bad accordingly. By adjusting for the cycle, we can get ‘average’ earnings.

A recent set of charts sent to me from an ex-colleague at Pantheon Economics tells one side of the story.

These charts use trailing earnings, which suggest that current valuations across the board are clearly in nosebleed territory. The payout ratio is the amount of dividends paid out relative to earnings. Clearly, paying out 108.9% of earnings is not sustainable.

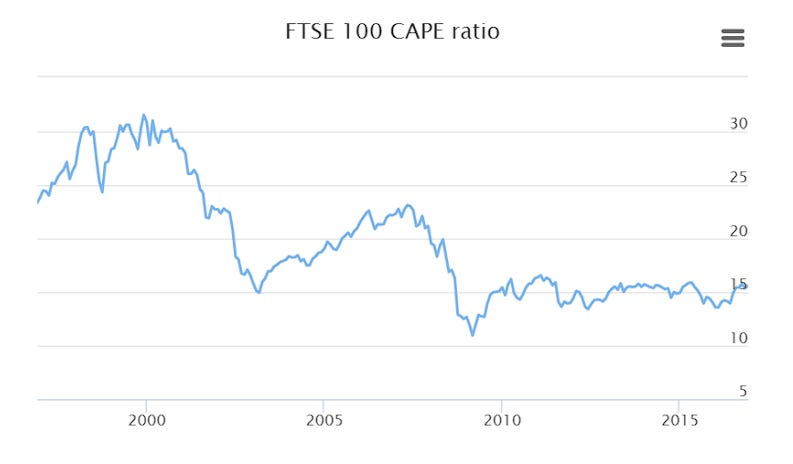

The perma-bulls will immediately challenge that outrageous claim of an imminent crash, using a 10-year CAPE ratio (Cyclically Adjusted Price Earnings), and the chart below may suggest we are much closer to fair value.

The problem, as is often the case with statistics, is that you can show a graph to prove almost any point you make. Using trailing earnings doesn’t allow for a cyclical pick-up in earnings and so might very well overexaggerate the point. Using forward earnings might well be far too optimistic, as earnings are much more often revised down than up, and using average earnings can smooth anything out far too often and make it look benign.

In addition, the problem with the FTSE is the skew, not just to the largest top 20 companies, but also the size of the largest sectors and their relative earnings. So, for argument’s sake, let’s just have a look at the trailing (actual) P/E ratios for the FTSE ex-oil/Gas and equal weight the components, rather than use the index market capitalisation weight.

Despite his dismal performance last year, the well-known fund manager Crispin Odey is a long-term market professional and was recently quoted as saying: “I like to find stocks where the price is stable but the company’s earnings are growing, that is a value opportunity. Unfortunately, in today’s markets, it appears to be the opposite, earnings are stable or dropping and the stock price is rising making everything more expensive.”

We have written before about our general outlook for earnings and the factors that often influence them.

Common sense and history tell us that when:

• Oil is rising, earnings usually decline

• When interest rates rise and the cost of capital increases, earnings decline

• When the labour market is tight and wages are rising, earnings decline

• Globalisation helps earnings, protectionism hurts earnings

And, unfortunately, that is the exact situation we have currently, not to mention the massive challenges in the UK for UK companies with Brexit, especially our large importing companies.

I have made a late charge to fatherhood, possibly only beaten by Rod Stewart and George Clooney, and am very fortunate to have a three-year-old son. One of his games is to take an egg out of the carton and hold it firmly while walking around the kitchen shouting, “I’m concentrating”. Obviously, the inevitable usually occurs.

This analogy is where my mind is with the current stock market valuation and any stock portfolio allocation. Even if we assume that our ‘permanent portfolio’ holds an average weighting of 25% stocks, there are arguably times to own less and there are times to own more. There are times to be rigid in value investing and there are times when a passive equity index will do a great job.

On the balance of all my charts and statistics, stocks are clearly not cheap. They might well be screaming rich, as rich as in all the other pre-crash times in history or more so. My view on earnings is negative for the reasons above, so if I thought the P/E ratios are too high now, God help us when earnings drop.

So, I have decided to hold fewer stocks than normal. I have decided to hold more cash than normal and I will be doing what my young son does and concentrate hard on making sure that the stocks I actually do invest in are very cheap with an inherent value derived from a strategy like the Hinde Dividend Value Strategy.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

LIMITED OFFER. GET A 90 DAY FREE TRIAL OF OUR PREMIUM SUBSCRIPTION & MAXIMISE YOUR INVESTMENT POTENTIAL

Visit hindesightletters.com for more information