HindeSight Letters Investment Insights Archive - READ HERE

Our FREE archive posts allow our subscribers to access valuable insights and analysis and a deeper understanding of market trends and investment strategies that were relevant at the time the HindeSight newsletter was published.

Additionally, reading archived newsletter content can give you a sense of the long term performance of the investments or strategies discussed which can be helpful in making informed investment decisions.

Furthermore reading this content can provide historical context and help you see how market conditions have changed over time, allowing you to better anticipate future developments.

Overall reading our archived content can be a useful tool for gaining a broader perspective on the market.

LIMITED OFFER. GET A 90 DAY FREE TRIAL OF OUR PREMIUM SUBSCRIPTION & MAXIMISE YOUR INVESTMENT POTENTIAL

INVESTMENT INSIGHTS ARCHIVE

Originally posted In June 2018

Energy & The Economy

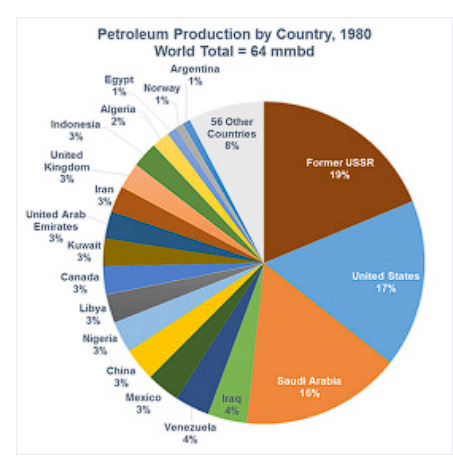

Oil has made a massive contribution to human society, including its demographics and economic and social development. Its availability to society is linked to the general trend of settlement and growth. An energy surplus enables society to create a division of labour, develop more specialised individuals and grow cities. It is less than 200 years since the first commercial oil was produced in Pennsylvania. This process of development has led to the continuous discovery and depletion of oil and fossil fuels as we look to the future of peak oil and its alternatives. The economic fluctuations of the world are highly correlated to variations in the price and availability of energy.

Fossil fuels still contribute to more than 75% of the total energy consumed by society. Despite widespread belief that new energy sources of renewables, such as solar, wind and hydroelectricity, are imminently due to replace fossil fuels and energy demands from transport will be swapped to electric, our reliance on the Earth’s crust materials may go on far longer than we had hoped. Economic activity requires physical work and a steady and consistent flow of energy to be cost-efficient and unfortunately, despite huge improvements, the costs to date of renewables (aided by large government subsidies) don’t really measure up. Of course, in time, I wouldn’t ever rule out the human ability to improve and advance, but that time is not soon.

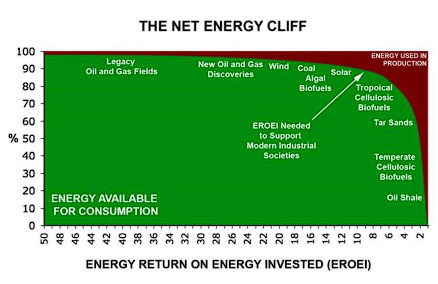

Energy Returns To Energy Invested

Energy Returns on Energy Invested is the ratio between the amount of usable energy generated to the amount that is invested to attain that usable energy. In theory, this is an efficiency ratio. So, as important as the total quantity of energy available might be, there is another side to the economic growth equation. It is equally important to understand the cost of extraction and what that means to different sectors of society. It is easy to complicate this term, but put in the simplest manner, the original huge discoveries in the Middle East, where there was an abundant amount of oil in the well, very little pressure (energy) was required to capture the black gold. Today, as wells deplete, this pressure drops significantly, and the extraction process requires water pumps to help force the oil up and the costs are correlated accordingly. Even with the ‘wonder’ introduction of shale oil, this does not help our EROEI efficiency ratio as the costs attributed to extracting through fracking is extremely high given that the process involves constant drilling with fast depleting wells. The issue of huge abundance but high costs is lost on most people.

The 20th century was marred by terrible wars and unprecedented increases in population that were all influenced by a ten-fold increase in our use of energy. A large proportion of the increase in economic activity has been induced by innovation, technology and the capitalist system. The overwhelming availability of low-cost energy for years has energised the unprecedented economic growth that we have seen. The success stories include Japan, Korea and China, where the economic growth has been matched approximately one for one with an increase in energy use. As we have entered more recent times, it has not been apparent that this rapid increase in energy we have seen can continue in the same manner. Production of conventional oil has been falling globally and many developed nations are having to import more and more energy from less developed countries. Economic growth in the OECD countries of Japan, Europe and the United States is much lower than previously and, in many cases, has ceased. There are many who suggest that while oil can continue to be produced, it is at an increasingly higher cost rate, driven mostly by a declining EROEI. This makes economic growth difficult, and if this trend continues then economies can only achieve further growth by increasing efficiency. If the EROEI for oil continues to decline and alternative resources fail to provide sufficient quantities of high EROEI then we will be moving towards the ‘net energy cliff’.

THE NET ENERGY CLIFF

Notice the dropping EROEI along the x-axis on the chart above as you go from oil through wind, coal, solar and then shale.

If the EROEI continues to decline over time, then the surplus wealth that is used to perform valuable activities within society would probably decline. Given this, we believe that declining EROEI will play an increasingly important role in our future economy and quality of life.

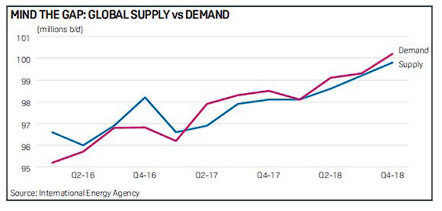

Over the past year, we have seen a tightening of oil market supply. With political trouble across the world affecting several oil-producing nations, countries such as Venezuela are set to produce even fewer barrels of oil with some suggested that it could be as much as a 20% drop. With Libyan and Nigerian oil production also stalling and a potential return to sanctions between Iran and the United States, the current global situation is creating upward pressure for oil prices.

In today’s world, there is no price level that satisfies both exporters and importers. Currently, exporters are becoming happier with the higher oil prices to recoup some of their losses from the slump of below $30/barrel in recent years. OPEC members have been holding back production to help deplete their current oil in storage. This has helped to lift the price, in contrast to before when they seemed to be trying to put the shale producers out of business. This is only one side of the equation. From an oil importers’ perspective, it appears they can only bear the price at just above $70. Currently, there is a demand for 100 MMb/d, yet on the supply side, the industry needs to replace 4-5MMb/d production every year due to declining production in mature basins. As a result, there are talks that the United States and Russia have quietly asked for an increase in production to help stabilise the price.

With OPEC and Shale executives set to meet in June 2018, the most topical discussions will be on how to cooperate with each other as the price crisis last year has made them realise that the only way to achieve a balance is by working together rather than against each other. Ultimately, the only reason these two groups are meeting is that we are now at a point where a continued rise in oil prices will cause major issues for the global economy. With interest rates expected to rise across the world and oil prices spiking rapidly as they have done over the past year, the global economy will find these headwinds harder to overcome in the coming months.

Depletion Rate vs. CAPEX

It is not a secret, but we are running out of new oil. Oil exploration companies last year found the least amount of oil since 1940. New discoveries have fallen every year since 2014 when oversupply caused a crash that cut its price by more than 50%. This crash forced many upstream producers to reduce and, in many cases, stop their spending on exploration, helping to exacerbate the lower discoveries. On top of this, it is reported that explorers are finding fewer oil resources per field and the last time an oil & gas company added to their reserves by the same amount that they were able to produce was in 2006. With a lack of discovery, we must digest the fact that this could lead to severe supply shocks going forward. A whopping $450bn a year is a number often mentioned for the needed capex to replace the 6% annual well depletion. When oil prices were in the doldrums under $30/ barrel a few years ago, many companies, including the majors, cut back on this essential spending.

Current Situation: Oil price doubling with more to go?

Oil recently touched over $70/ barrel, a far cry from sub- $30/ barrel in late 2015. At that time, most analysts were convinced that the new-found shale gas would cap oil prices below $50/ barrel forever. Pessimism was at a high and the gold/oil ratio had blown out to levels that had never been seen before.

There is a clear fundamental story around why the situation is improving within the sector. From the supply side, there is significant stagnation after years of underinvestment due to OPEC’s price crash production cuts. Even with a strengthening dollar, crude oil prices have risen more than 40% this year. Donald Trump’s decision to take the United States out of an international agreement to halt Iran’s nuclear ambitions has opened the door to a fresh wave of sanctions against the Islamic republic and its exports. This previously happened in 2012 and the impact on supply/price was profound. If you then consider the situation in Venezuela, where the economy is collapsing along with its oil output, we have very quickly bypassed a balanced market and gone into deficit.

New oil discoveries are at their lowest level since the 1960s. This has helped the demand side of the equation to catch up and we are now significantly undersupplied. It has taken several years for demand to catch up and now it will take at least the same amount of time for an oversupply situation to occur. It is important to understand that the threat of electric vehicles to the traditional combustion engine has been overblown (we currently produce 60mm cars globally on a yearly basis. Fewer than 1mm are electric). We are moving in a trajectory that will see electric cars eventually overtake traditional vehicles but not for some time. The speed at which this change will occur has been overhyped by global marketing machines, with the governments leading the charge.

Spike in oil prices > Rise in Inflation > Rise in Bond Yields / Interest Rates > Lack of economic growth

Oil plays a significant part in the economic cycle. It induces economic growth at the right price and then eventually contributes to the bust. During recessionary periods, oil prices fall quickly as demand drops, encouraging renewed consumption and the cycle begins again.

Rapid rises and falls in oil prices have a serious impact on the global economy. As prices rise, consumers’ energy bills, both personal and businesses, become a larger expense, forcing many to cut back on their discretionary spending. Soaring oil prices also see a large wealth transfer from consuming to producing economies. Since savings rates in producing nations can typically be ten times more than what they are in major oil consuming economies, there tends to be a shift in purchasing power, leading to weaker global demand. Aside from a drop-in retail demand, one of the biggest impacts that oil price shocks have on the global economy is the spike in inflation they cause, usually accompanied by a rise in interest rates. This tends to deliver a large blow to economic growth. In 2008, we saw a very similar picture where the oil price went from $35 per barrel to just under $150 per barrel, which saw US CPI triple. Interest rates very quickly caught up with inflation, as they always do, and ultimately had a significant impact on the mortgage market. We should be concerned by the chart below which shows that every time there has been a rapid doubling of the oil price, a recession is not far behind.

Large importing countries, such as India, are highly geared to the oil price and we are already starting to see the impact of high prices taking effect. Inflation is starting to rise, and as a result, the bond yields are rising with hikes in interest rates. On the other hand, Russia, as a producer, is seeing a substantial improvement in its outlook as oil prices rise; its GDP is turning up, and its budget shrinking.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

LIMITED OFFER. GET A 90 DAY FREE TRIAL OF OUR PREMIUM SUBSCRIPTION & MAXIMISE YOUR INVESTMENT POTENTIAL

Visit hindesightletters.com for more information