Our new archive posts allow our subscribers to access valuable insights and analysis and a deeper understanding of market trends and investment strategies that were relevant at the time the HindeSight newsletter was published.

Additionally, reading archived newsletter content can give you a sense of the long term performance of the investments or strategies discussed which can be helpful in making informed investment decisions.

Furthermore reading this content can provide historical context and help you see how market conditions have changed over time, allowing you to better anticipate future developments.

Overall reading our archived content can be a useful tool for gaining a broader perspective on the market.

INVESTMENT INSIGHTS ARCHIVE

Originally posted in February 2019

Successful investing over the long term, like most pursuits, requires a certain amount of time, dedication and experience. Risks and rewards invariably go hand-in hand and understanding those aspects will help the quest greatly. But history shows us there are indeed better and easier times to invest in different assets and, generally, across the whole spectrum. Unfortunately, current times are not ideal by any stretch of the imagination, and it is very important to keep this at the forefront of any investment thought process.

• Exceptionally high valuations across multi-asset classes

• Declining growth patterns across many continents

• Rising inflation, especially wage inflation

• Declining monetary liquidity

We remain at super-high valuations on equities by most metrics, with the US stock market defying gravity yet again. The muted decline reversed sharply last year when the Federal Reserve raised rates as they got frightened off by President Trump and levels are sky-high again. With interest rate and bond yields remaining negligible for income or capital gain, it is key to understand that severe downside risk prevails once again.

GDP growth is falling across the globe, while wage inflation is gaining traction, adding to concerns. Any hope of liquidity maintaining support seems unlikely.

The chart below shows global monetary liquidity heading much lower, which historically correlates with large collapses in equity values.

Excerpt from 2011 HindeSight letter

Investing With a Crystal Ball

The legendary investor Jim Rogers used to say that you only had to make a decision on one asset class every ten years to enjoy unbelievably high investment returns and that diversification and over-trading were the way to min. The table below emphasises this.

Now this is of course with the benefit of Hind(e)sight, but one would have only needed to make 4 investment decisions over the last 40 years to make a mind-blowing return of over 175,000%. Undoubtedly the volatility and drawdowns of this strategy would have at times been unbearable, but it illustrates the point that all that is needed to make superior returns is to be in the right asset class at the right time (and make sure you're not in the wrong asset class at the wrong time). The better informed you are, and the more knowledge you have of valuation and economic conditions, the more you can then aspire to trade with the gods. For mere mortals, it still shows some diversification is certainly wise.

I wrote the above commentary in 2011, but clearly, if you switched out of gold back into US equities in 2010, you would have made another whopping 180% in your single asset class choice since then. I have brought this excerpt out many times since its original writing for this newsletter to demonstrate the point. Of course, there have been other asset classes than equities or gold making stellar returns, but the decision-making process still relies on whether the asset class is cheap enough for a ten-year investment with no portfolio diversification.

If you had held gold from 1980 to 2000, instead of Japanese equities, you would have lost 70% of your money, with no yield either. Likewise, if you had held Japanese stocks from 1989 to 2000, you would have lost 75%.

I believe it is a far harder decision today, amidst the superhigh valuations driven insanely by extraordinary money printing, to identify a major asset class that beckons a stellar ten-year return and could be considered cheap. Clearly, you should avoid being passively in the equity market at century high valuations or bonds at negligible yield if you want to hang on to your hard-earned wealth. But it seems so hard to accept that holding cash, which earns nothing, is an investment option.

What is cheap enough to own for ten years?

I will give you my two best bets for 2019-2029. One has the potential for yield and currency and capital appreciation, the other is a complete cycle re-rating.

• India bond markets

• Gold/Silver mining stocks

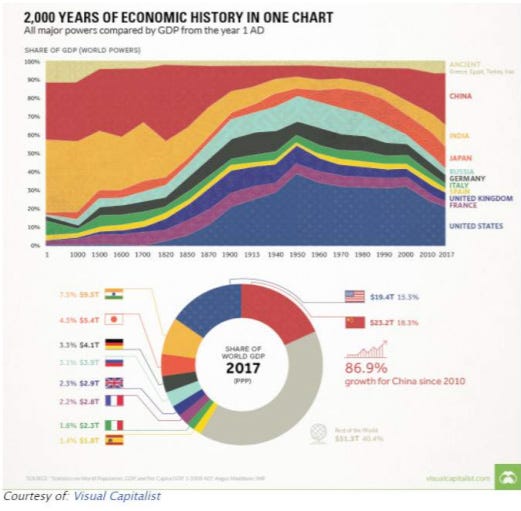

We have written about the amazing opportunity for India in the quarterly India newsletter over the last few years. In our minds, the combined equity and bond markets o!er the same amazing decade as the 1990s did for the US. My favourite chart is still the development of GDP across history.

Within five years, India will have the largest population in the world and, most importantly, a growing working age population – a very rare phenomenon with today’s demographics.

If you invest in India bonds, whether it is government, corporate or a hybrid, you are firstly doing that by investing in a ‘cheap’ currency; great for US investors, slightly less so for UK investors.

Secondly, you can receive and roll up a strong yield. Indian bonds yield across the spectrum range from 6.5%-13%. We all remember that if we compound at 7%, it takes 10 years to double your money.

I not only expect it will be possible to gain a 100% income roll up, but I also believe the currency will strengthen and the general level of bond yields will fall, as ‘emerging’ country inflation falls more in line with ‘developed’ country inflation. This will bring three potential sources of value: rolled-up income, capital appreciation with lower yields and currency appreciation when it is moved back to the host country in 2029. I don’t think I am sticking my neck out much here. Unfortunately, for most people, investing a large percentage of their wealth overseas will be the toughest decision of all. Understanding that very expensive home country equities are far riskier will be a hurdle.

Gold and silver mining stocks have become a forgotten market. Most of these stocks – junior and major caps – trade on the Canadian stock market with some other country listings. As an asset class, they are by far the cheapest. The metrics to measure them in 2011, at the highs of the metals last bull cycle, are no longer used. They have, in all effect, become penny stocks, beckoning insolvency. Companies with no debt and hundreds of ground claims with in-situ metal values in the hundreds of millions are going for single digit market caps.

The indices, GDX mining and GDXJ junior mining have fallen by up to 80% in the last eight years and these are indices. Imagine how many actual companies have fallen the full 100% and closed! Canada is the land of bandwagons – boom and bust, pump and dump – in stock market practices, which have long since been outlawed by developed countries. Last year, all the brokers were raising money for crypto mining hardware. Recently, they have raised money for cannabis companies that now have ridiculous valuations and will no doubt overpromise and under deliver. At a conference in Canada, one analyst presentation showed that 82% of ALL Canadian public listed companies (not just mining) had negative net income! (That’s a loss to you and me.) But you get the picture. There has been no financing at all, to speak of, into smaller mining companies and the larger companies are failing to provide any real profit potential at these metal prices.

While I can clearly see the ‘cheapness’ of this asset class at the moment, in relation to the metal prices, and I believe the metal prices will have to rise as production falls o! the proverbial cli!, there is a concern that the whole model is potentially broken.

As a result, I would not buy single stocks, only the indices. Often, when there is so much negativity and only extreme pessimism prevails, these are true cycle bottoms.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

Visit hindesightletters.com for more information

Hi

I read the Hindesight letters with interest but i have a couple of questions:

1) I read somewhere that you publish a "share of the month" (as well as the changes to the portfolio), but I haven't seen one yet (I signed up in Feb/March timeframe). Are these share picks published separately?

2) There's a mention of the Equity Model Portfolio in one of the newsletters - is this the same as the Dividend UK Portfolio 1? This begs the question - is there more than one newsletter and / or more than one portfolio (I'm aware of the permanent portfolio)

kind regards,

Andy