HindeSight Letters Free Content Weekend - Investment Insights Archive

Happy new year from all of us at HindeSight Letters.

This investment insights archive of the HindeSight letter is completely free for everyone to read.

This is a taster of what you can get every month as a paid subscriber.

Our new archive posts allow our subscribers to access valuable insights and analysis and a deeper understanding of market trends and investment strategies that were relevant at the time the HindeSight newsletter was published.

Additionally, reading archived newsletter content can give you a sense of the long term performance of the investments or strategies discussed which can be helpful in making informed investment decisions.

Furthermore reading our free giveaway content can provide historical context and help you see how market conditions have changed over time, allowing you to better anticipate future developments.

Overall reading our archived content can be a useful tool for gaining a broader perspective on the market.

INVESTMENT INSIGHTS ARCHIVE

Originally posted in November 2014

Financial markets provide constant fascination for individuals; each and every one of us derives, often subconsciously, certain needs or outcomes from them. These are usually personal and specific to the individual, but every now and again market participants can observe imitative or herding behaviour which can lead to the phenomena widely known as ‘bubbles’. Bubbles usually reflect a disconnect between fundamentals and human perception. The outcome of such disequilibria can lead to severe corrections, or even a ‘crash’ as the bubble bursts.

It is very clear that the interaction between central bankers and markets has become highly connected in an era of financialization. They are in the process of driving the herd into various asset classes, the antecedence to a bubble. I personally believe the risks of debt deflation are palpable but I also acknowledge that governments and central bankers can play this out likely longer than most would think. Other than the US where I believe fiscal continence has helped assist a recovery I firmly believe the world economy is stagnating because of QE and markets are goosed by financial engineering from cheap financing.

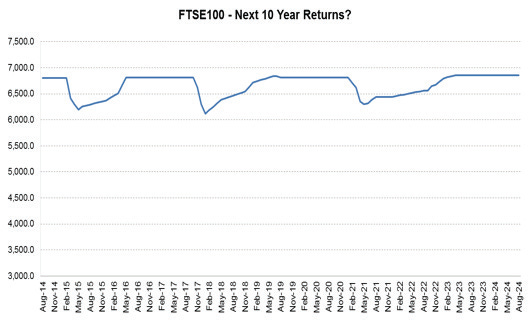

Mark Mahaffey believes that 10% corrections/rebounds such as we saw recently are more likely to be the norm for the next decade, as soothing central bank comments and ‘bubble’ money cushions markets.

The mere fact that we still fear another 2008 is probably why a massive collapse in prices won’t happen anytime soon but a word of caution - I am more in the school of Mandelbrot in this regard.

Markets have a memory effect whereby future price movements have a higher probability of repeating recent behaviour than would be suggested by a purely random process. At the moment I believe the memory and reverberations of market behaviour is driven by past credit cycles propagated by central bankers who never fully allow the cycles to complete from boom to bust. So the cycle heights either run higher and/or longer until such time as no amount of credit keeps the well oiled financial markets rising and the economy ticking over. This is a classic example of the law of diminishing returns - each new dollar printed exacts less and less return or output.

I would observe the recent 30% fall in crude oil prices as signifying the unwind of excess central bank monetization. I believe we have seen the egregious created by long speculative positions - financialized front end energy future contracts because of the ample liquidity provided by QE. This positioning has held energy markets higher and longer than expected in the face of resounding increases in future oil supply. This in turn created a self-reinforcing feedback mechanism of capital misallocation by both shareholders and abusive corporations. CEOs and their boards implemented reckless amounts of leverage and equity financing. It doesn’t matter what the trigger for the fall - geopolitical theories abound - the market was ripe for a clearing out of both stagnant positions and marginal oil businesses.

I expect to see over time oil trade at $55 to $65 a barrel as the long non-commercial (ie speculative) WTI and Brent Crude positions are still around 500 million barrels which is in turn twice the median for the period 2001 to 2008 just before QE was introduced. Note demand for oil in this period remained stable at 82 to 84 mm barrels a day with supply clearly having risen. The mathematical equation looks like this - solve for: ‘Oil Financialization’....= QE. QED.

The only question now is the trade-off between cheaper oil and the initially destructive unwind of energy sector leverage. The extractive industries are a major supplier of employment and growth in the world. The commodity recess will drag growth down. But I readily concede that a fall in oil prices of this magnitude is beneficial to the cost of living standards and a boon for corporate margins which in the medium term will support economic growth.

The oil sell-off thus may have contributed to the rebound in US stock markets and the Republican success in the US Mid-Term elections. Markets may well believe that we will get more responsible policy decisions, but I would point out the Republicans dislike the Fed’s unconventional ways so political pressure will come to bear, which will cause some equity volatility.

In reality the real kicker came when Japan dumped another 30 trillion yen on the world. I suspect the Japanese Government Pension Fund (GPIF) was already buying US shares a week before the BoJ QQE (Qualitative & Quantitative Easing) announcement on the 31st October as they have increased foreign equity holdings from 12 to 25% maximum limit. Brilliant - the BoJ prints and the GPIF willingly dispenses it.

All asset prices are becoming engineered by this supply of credit induced by excessive central bank monetisation, but what is worse is the seeming tedium of vocal manipulation by said central bankers. The incessant ‘Bubble Babble’ accompanied with bazookas of ‘Bubble Money’ clearly explains the differing fortunes of these markets. Causation is intuitive. Central bankers speak and markets behave in accordance. For now it’s the only game investors and speculators play. What happened to the never seen, never heard central bank bean counters of national payment balances - manning crises from behind closed doors.

So whilst the markets may have been (mis)behaving recently it would seem much more apposite to refer to the (mis)behaviour of men (and Chairwoman) employed by central banks. For there has been a highly disconcerting but predictable ‘Bubble Babble’ of non-elected central bank officials including Madame Chairwoman Yellen trying to stymie market falls in stocks and bond prices.

Simply put, every time bond rates rise or stock markets fall central bankers opine on their forward guidance suggesting rates will be on hold longer or even hinting at further injections of ‘Bubble money’ ie QE.

I am actually not sure which is more disconcerting the staged dialogue of central bank cohorts regularly chancing their hand in the market process or the feckless response of market participants salivating like Pavlovian canines for their next meal - which as we know one day will fail to arrive - but the drooling will continue unquenched nonetheless.

Both are behaving like reckless gamblers. Officials don their poker faces to mask their clearly desperate utterances of ‘there is more ‘money’ where that came from - we have not folded yet’. Likewise the market participants seem ready to chance just one more roll of the die.....one of these days and it is coming, these utterances and responses will not stop a steeper fall in the markets. First St. Louis Fed President James Bullard stepped in to assuage anxious markets. On the 16th October, the day that marked a ‘V’-shaped bottom in the stock markets he said in an interview with Bloomberg News, that “Inflation expectations are declining in the U.S.... that’s an important consideration for a central bank. And for that reason I think that a logical policy response at this juncture may be to delay the end of the QE.” The market promptly rallied hard and QE was in the end completed. Job done for now until the ‘edge of tomorrow’ comes.

Then across the pond back here in the UK, the now Bank of England Chief Economist Andrew Haldane uttered his own reassuring words to the market. Haldane who sits on the nine-member Monetary Policy Committee that sets interest rates, said a “gloomier” outlook for global growth and the risk of stagnation meant that “interest rates could remain lower for longer, certainly than I had expected three months ago, without endangering the inflation target.” For the record Carney, or ‘Carnage’ as a market friend refers to him said the complete opposite less than a month earlier. Carney has since joined the dovish chorus and inferred rates will be on hold another year. He really is mischievous that Devil InCARNEYate as we prefer to call him.

Then one of Greenspan’s offspring spoke. On the 7th November Yellen opined at a banking symposium held at the Banque de France. There at that historical bastion of monetary sobriety, she delivered her firmest sermon yet to her central bank disciples and canine friends; central banks - you should read this as ‘willing followers’ - (you) “need to be prepared to employ all available tools, including unconventional policies to support economic growth and reach their inflation targets”.

Yellen said in response to a question at the Q&A after her speech that before the 2008 financial crisis hit, the Fed had spent a great deal of time studying the prolonged period of weak economic growth and deflation in Japan in an effort to learn how to deal with similar problems.

She said amongst the lessons U.S. policy-makers drew from the Japanese experience was the need to quickly get banks on a sound footing and to guard against inflation persistently falling below the Fed’s 2 percent target.

“That was an important lesson from the Japanese experience that we have tried to learn from,” she said and indeed the chart below highlights the significant deterioration in market based inflation expectations in US (as with the UK). It shows that as inflation expectations near 2% for 5 year forward breakeven inflation rates, the central banks begin monetary intervention. So despite earlier protestations of normalising rates next year, QE 4 seems more likely on the cards in the US than rate hikes.

An Austrian economic scholar and market participant quipped to me - “after six years and trillions of dollars of intervention, the only truly unconventional policies that remain are those which practice sound money, official inscrutability, and an approach which is a good deal less Hjalmar Schacht and a good deal more Adam Smith.”

Although humorous, this is a deadly serious point to consider. As you will see from the economic charts in our HindeSight Investor Letter (see below comment) this enormous global experiment is not working. The overhang of too much debt and moribund growth continues to threaten national balance of payments and the well-being of populations.

Fed Fischer summed it up best about the efficacy of US 1.7 trillion in QE3 that just ended. “Even if you are living under a rock..you know that this gift of near-cost-free debt as measured in inflation- and tax adjusted terms has thus far been used primarily to finance stock buyback, increase dividends and fatten cash reserves and recently, finance mergers by the most creditworthy companies. For those with access to capital, it was a gift of free money to speculate with. One wag—I believe it was me—quipped that there was, indeed, a ‘positive wealth effect’… the wealthy were affected most positively.”

Fisher also urged the Fed to not return to bond buying if the economy falters again, saying, “Should the FOMC then try to compensate for fiscal authorities’ inability to act by provisioning still more monetary fuel, it may risk an explosion of speculative excess, or worse: an eventual inflationary conflagration, the debasement of money and the ruination of our economy and lifestyle.”

Sadly Fisher is to retire in March 2015 to a chorus of hate messages on twitter from ‘maddening’ market monetarists. If you read our Central Bank Revolution I and II - you will see our disquiet with disciples of this train of economic thought.

Many are beginning to understand that QE to infinity isn’t a joke anymore and is if to reinforce the point, Japan just embarked on QE 11.

I feel this is so important a topic to address that I continue this section by looking specifically at the evidence that Japanese QE is NOT working. This will be published at the Hinde Capital site in our HindeSight Investor Letter November 2014, titled, Bubbleology - ‘The Science of Bubble Money.’

WHY SUBSCRIBE TO THE HINDESIGHT LETTER?

INVESTMENT INSIGHTS

Not only do we break down the reasoning behind our monthly share choices, we explain the methodology behind investing so you will learn more about strategies and how they impact your portfolio. Investing is like anything else, the more you know, the better you'll be at it and the better your decision to invest will be.

EMAIL ALERTS

You will also receive timely email alerts detailing portfolio changes to the HindeSight Dividend Portfolio #1, that covers FTSE350 stock as suggested by our Hinde Dividend Matrix and seasoned money managers. These are for immediate changes in opening or closing a position.

HINDESIGHT PORTFOLIO SELECTION

In our monthly HindeSight portfolio selection article we cover in-depth and in plain English, our reasons why we added the previous share to our portfolio with additional insights and performance data that's usually reserved for the trading floor.

OVERVIEW

Our overview features analysis, research & opinion on the latest news and current affairs and is a window into understanding factors that shape markets.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.