HindeSight Letters #88 May 2022 Newsletter - FREE TO READ ARCHIVED EDITION

This archived edition of the HindeSight letter is completely free for everyone to read.

This is a taster of what you can get every month as a paid subscriber.

WHY SUBSCRIBE TO THE HINDESIGHT LETTER?

INVESTMENT INSIGHTS

Not only do we break down the reasoning behind our monthly share choices, we explain the methodology behind investing so you will learn more about strategies and how they impact your portfolio. Investing is like anything else, the more you know, the better you'll be at it and the better your decision to invest will be.

EMAIL ALERTS

You will also receive timely email alerts detailing portfolio changes to the HindeSight Dividend Portfolio #1, that covers FTSE350 stock as suggested by our Hinde Dividend Matrix and seasoned money managers. These are for immediate changes in opening or closing a position.

HINDESIGHT PORTFOLIO SELECTION

In our monthly HindeSight portfolio selection article we cover in-depth and in plain English, our reasons why we added the previous share to our portfolio with additional insights and performance data that's usually reserved for the trading floor.

OVERVIEW

Our overview features analysis, research & opinion on the latest news and current affairs and is a window into understanding factors that shape markets.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99. Our history is there for all to see, measure and research.

CONTENTS

OVERVIEW

HINDESIGHT PORTFOLIO SELECTION

INVESTMENT INSIGHTS

OVERVIEW

The “Roaring Twenties”, was a period in America leading up to the stock market crash of 1929 and subsequent depression. A period, characterised by technological advances and prosperity, with new inventions for transport and communication. While it wasn’t necessarily seen in Europe, as the post WW1 era brought its own challenges, the recent two decades today, worldwide, have seen much comparables. Maybe, future historians will ascribe a term to these times, “The Raging Naughties”? The global world that we have enjoyed in the last twenty years, has benefitted from falling inflation, and efficient supply lines for most products with an increasingly connected world population. Interest rates have been super low or zero, with easy access to capital, as prosperity and ‘wealth’ have soared.

Unfortunately, that is no longer the case and may not be again in most people’s lifetimes, although we may not have fully realised this yet.

The huge central bank money printing experiment, seemingly, to provide ‘perpetual’ growth, created a huge tinder box, but the spark that has ignited the inflation crisis we are seeing today, will largely be attributed to the Russian/ Ukrainian war. It certainly gives the central bankers, their best excuse, “It wasn’t our fault, it was Putin’s” etc. Coupled with other factors, such as China’s zero Covid response and Brexit and we aren’t in a great place and no doubt, it will get much worse before it may get better.

Prices are rising sharply, everywhere and the topic matter is vast, but, for this article, my focus is on one of the most basic human needs, “wheat”, the most staple food supply.

During both twentieth century world wars, food supply lines suffered dramatically, most notably due to shipping being severely restricted, as a result of submarine warfare, and food prices soared, and real shortages in Britain, led to official rationing for most food stuffs. In fact, one of the reasons for decision for the failed Gallipoli campaign, in 1915, was to access grain exports from the Russian Empire, which included Ukraine at the time, after the Ottoman (Turkish) empire’s entry into WW1, on Germany’s side. Fast forward, 107 years, and once again, we are discussing breaking a blockade in the Black Sea, to obtain much needed wheat supplies from Ukrainian silos, with Russia now controlling access.

The current situation is not great, by any means. Russia and Ukraine are huge exporters of wheat, supplying almost 30% of the world’s wheat demand. Russia is also the largest exporter to the world of fertilizer. At this present time, there are 22 million tonnes of Ukrainian wheat from the 2021 harvest, sitting in silos, unable to get out of Odessa, the main export port in the Black Sea, with the logistics of rail passage west, described as “completely unrealistic” by most sources. Also, as you would expect, the war has obviously disrupted spring plantation at this time, with estimates for the 2022 Ukrainian yield down by 20-40% in production terms, but, however reduced it is, there is no available storage.

Meanwhile, the rising price and availability of fertilizer has farmers as far away as Brazil, planning smaller cultivation due to these much changed commercials. A proverbial sh*tshow.

Despite the West’s very ‘principled’ imposition on Russia of huge sanctions, it should have been abundantly apparent that imposing sanctions on a country that provides a significant quantity of energy and food supplies may not work out as planned, assuming there was actually a plan! Now, with severe heatwaves in Pakistan and India, affecting wheat harvests as well, India has banned even their small export potential, while Pakistan, is agreeing to buy Russian wheat, amid a collapsing and inflation ravaged economy as it appeals to the IMF for a $36bn bail out. Should it be any surprise that Russia is suggesting that the current wheat and food crisis could be resolved with the lifting of sanctions, however outrageous that suggestion seems to principles.

Top Fertilizers Exports by Country

Below are the 30 countries that exported the highest dollar value worth of fertilizers during 2021.

(Source: Worldstopexports.com)

1. Russia. US $12.5 billion (15.1% of total exported fertilizers)

2. China: $10.9 billion (13.3%)

3. Canada: $6.6 billion (8%)

4. Morocco: $5.7 billion (6.9%)

5. United States: $4.1 billion (4.9%)

6. Saudi Arabia: $3.6 billion (4.4%)

7. Netherlands: $2.9 billion (3.5%)

8. Belgium: $2.63 billion (3.2%)

9. Oman: $2.6 billion (3.1%)

10. Qatar. $2.2 billion (2.6%)

Humans get most of their daily calorific requirement from wheat. It is the basic staple for most countries, with some, far more reliant than others. So, first we have had a huge surge in wheat prices, as demand outstrips supply, leading to immediate shortages in poorer nations and threatening starvation. With Russia as the main exporter of fertiliser, prices are also rising, meaning that farmers are less able to cultivate acreage creating the loop for even more shortages going forward. Of course, the US who leads NATO by the nose, has far more ability in autarkic self-sufficiency in food and energy, so, “we’re alright Jack”, mentality currently prevails…

Closer to home, we are bombarded daily with news that food prices are rising in supermarket chains, with “Pasta up 50%” etc with more and more people discussing food insecurity, amid general cost of living crisis. Maybe, the one small nugget of good, will be addressing the obesity crisis, (they didn’t have this issue in the 1950’s, as you can imagine), but, for far too many of the world’s population, it will poverty, starvation and rising civil unrest. They are already burning politicians’ houses down in Sri Lanka.

At the World Economic Forum in Davos, Henry Kissinger gave a speech. At 98 years old, he is still a legend, with memories of his policies of détente between the superpowers in the 1970s and the embracing of China at the time, despite being a very rural country at the time. But, his speech was seen by today’s politicians as potentially an appeasement to Russia, and heavily criticised. His message was simply a quest for peace, through immediate negotiations and diplomacy, and potentially, compromise on terrain, before things got more out of hand, with an escalation that is dreadful to contemplate. Kissinger knows better than most, a pragmatist and a visionary even at his advanced age. There are no good options, however, principled they may be, just less bad ones.

The trouble is we don’t have a very good line up of world politicians at this fragile time. Lot’s of domestic and personal agendas and not much clue about history and how delicate the balances are.

I watched Madeleine Albright’s funeral, recently. A true legend, as the first woman US Secretary of State. Hugely knowledgeable about geo-politics and able to speak five languages. I wonder what she would have made of this, probably more in favour of intervention than I would be, but not in the US neo-con camp, knowing that they don’t have to live in Europe, it’s just a battlefield chess strategy to them.

But, we have Boris Johnson, and the UK foreign secretary, Liz Truss, who couldn’t look more out of her depth, in my opinion, if she was in the Mariana Trench, as the frontrunner if Boris’s Party gate antics see his demise. Dominic Cummings, the ex-PM’s advisor, doesn’t have much of a good word to say about anyone, but his recent comment about Liz Truss was “She’s about as close to properly crackers as anybody I’ve met in Parliament”. I imagine that takes some real doing with our current showing, both sides of the commons!

We face more challenges, and unfortunately, I can see things getting far worst, as the world tries to feed itself and avoid real escalation. And clearly, we need better politicians, who have a tenth the wisdom of Kissinger.

https://www.zerohedge.com/economics/

pakistan-verge-inflationary-collapse-pleadslarger-

imf-bailout

https://time.com/doomsday-vault

https://www.zerohedge.com/personal-finance/they-can-print-money-they-cant-print-food

https://www.economist.com/europe/2022/05/18/how-to-unblock-ukrainesports-to-relieve-world-hunger

Visit hindesightletters.com for more information.

HINDESIGHT PORTFOLIO SELECTION

Blowing your own trumpet as an English person is not seen as a particularly attractive trait, unlike in the US, but on occasion, it is a firm reminder of the main reason, why the HindeSight Model Portfolio was created originally; To invest in large cap, FTSE 350 stocks greater than £1bn, (no minnow growth stocks allowed) that are undervalued, potentially at low points in the sector and company cycles, that are typically, still delivering substantial dividend income. Too safe and boring, for some, but for long term compounding, we have had good success.

In recent years, despite the turmoil of Covid-19 and the Ukraine invasion, the Portfolio has been going through a far better than average sweet spot. Since 2014, there have been 112 Additions to the portfolio, with 102 Closed positions.

• The last 10 closed trades have seen an average of +44% returns, with a 10-0 win/loss ratio within a 356 day average holding period, (Annualised Returns, +45%)

• The last 20 closed trades have seen an average of +34.4% returns, with a 18-2 win/loss ratio within a 250 day average holding period, (Annualised Returns, +50%)

But, the last ADD and CLOSE of Homeserve, (LSE:HSV) has been the best stock performance in the eight years of the HindeSight Model Portfolio, with a +69% return, in just 58 days, (Annualised return, 440%).

Of course, it was particularly fortuitous, that a large North American private equity fund decided it was their next target for acquisition, just days after the ADD alert, but the methodology for selection, was the same. The ADD was at 656p on 14th March and the CLOSE alert was at 1109p on 11th May. Enough of the bugle…

This month has seen two ADD changes to the Model Portfolio, Sainsbury, (LSE:SBRY) and ITV, (LSE:ITV), which are clearly in the straightforward defensive camp, and have featured in the portfolio many times before. SBRY, was closed only recently, but since that close has fallen 25%. It has been seen three times before, 3/2016, +30%, 1/2017, +23%, 1/22, +44%

Costs are rising everywhere with inflation led by money printing, accelerated by Ukraine war and supply/sanction issues. At the core, food and energy costs as well as rent are eating into disposable incomes dramatically. There is some belief that the high saving rates that benefitted from the Covid-19 lockdowns will be used to plug some of the gap, but, it is inevitable that we will see reduced demand across the board, for all products, luxury or necessity. Even for food retailers like Tesco or Sainsbury, at the basic level, “everyone still has to eat”, should expect lower sales, and worsening margins as people will trim higher price food off their weekly shop at these stores or seek out the discount retailers like Lidl and Aldi. This expectation is certainly part of the fall in stock price since last 2021, it may have further to go, but arguably, with a dividend yield of 5% now, and the lower price, there is a reasonable margin for safety. Knowing that a recession is coming, the urge to buy any stock, isn’t straight forward but cheap defensive staples with positive carry does have merit.

ITV has appeared twice in the HSL Portfolio; 3/2019, -15%, 11/2020, +48%

The current sell-off, to 70p, equals early Covid lows, and is a reflection of the market’s concern of the large investment required to keep up with the streaming competition of the likes of Netflix, (obviously Netflix stock price, not doing so great, either). But, the current price, again with a 5% dividend yield puts the P/E levels at cyclical lows for this stock, assuming no growth expected. For me, even a whiff of less bad news, could easily see this trade back at the 100p level, on a mean reversion pull which is greater than 40% retracement. Again, it is a large cap stock, with a long history, at cyclical metric lows, paying an above average dividend, so an ADD to the Model Portfolio at this time is a very typical selection.

Visit hindesightletters.com for more information

INVESTMENT INSIGHTS

Legendary investor and philanthropist, George Soros, wrote in his book, “The Alchemy of Finance” in 1987, “There are two trends, the rational trend and the irrational trend”, and suggested that in order to be a truly outstanding market speculator that you had to be able to observe both and profit from them. Easier said than done for most, including myself.

In rather simplistic terms, I believe that the “irrational trend”, is invariably some new investment asset that gains popularity during a time of falling/low inflation with very easy monetary policy. The “rational trend”, relies more on valuation, traditional growth metrics and historical precedent.

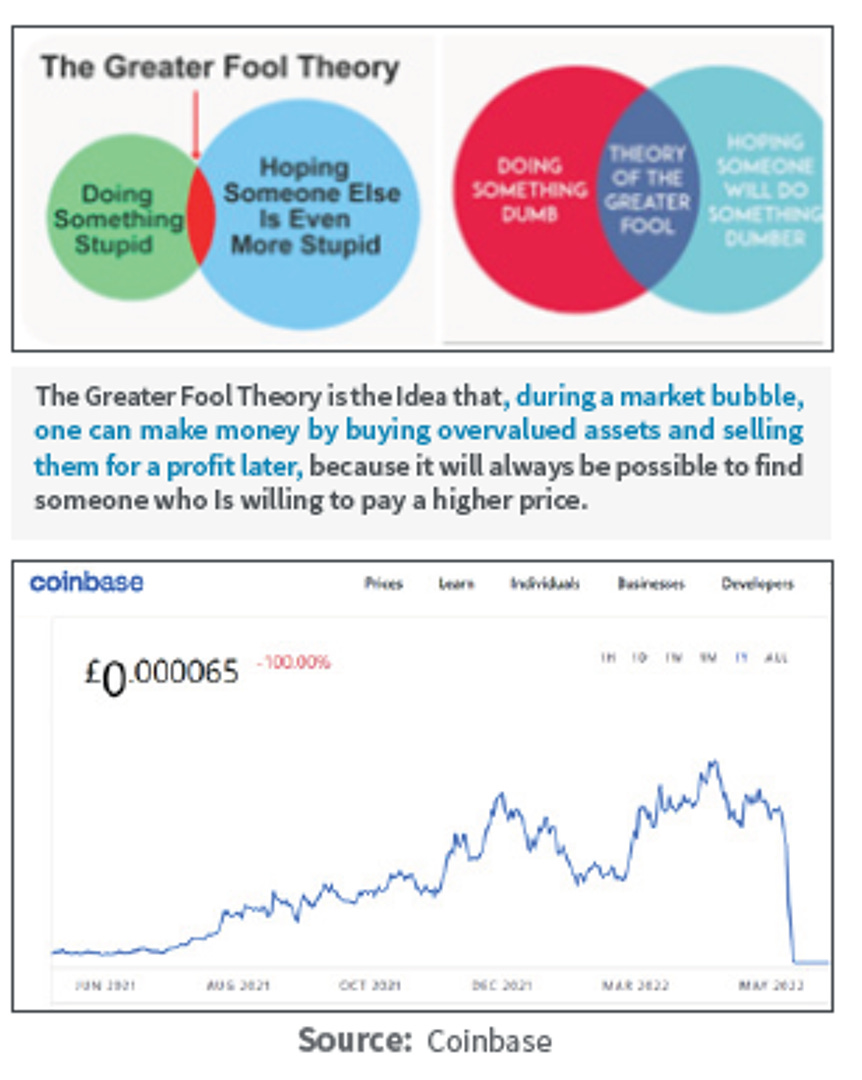

While history is littered with periods of irrational trends, arguably the crypto-currency mania of recent years is right up there. But, again this month, as another cryptocurrency dropped 99%, market participants had to re-learn that irrational trends often end abruptly, when they hit reality.

Luna, a cryptocurrency, a token of the Terra Labs platform, out of South Korea, collapsed to effectively zero in the space of a few days. Easy come, easy go….

Mike Novogratz, of Galaxy Investment Partners, who has very much succeeded in trading this crypto space, to date?, amassing a large fortune, no doubt regrets his tattoo timing a few weeks before! It is estimated that the size of the Crypto ‘Wealth’ has shed $1.7trillion of the late 2021 value of $3 trillion with immediate and potentially long-term significant consequences for the industry, and even an overlap to the larger asset classes.

The whole world of Crypto, and the amount of individuals who are now actually employed in this market place, not just investors, is truly mind-boggling, but, it is often partly based on a loose premise, that there is a need for monetary transactions to take place outside of the regulated banking system. Of course, I can see the need for this if you operating a ‘dark’ business, or even to avoid sanctions, (maybe it’s all part of the master plan by the Russians, Chinese, North Koreans, et al), but that comes with real inherent risks for investors and those employed people, alike. The fashionable words of “Ecosystems and protocols” all exist within a huge marketing spend, involving the collective advancement of belief of expansion, but it has shown the ability to go to zero, too. Isn’t that almost the very definition of a Ponzi scheme?

As much as the regular banking system has been slow to develop in terms of the digital world, especially in terms of access, transaction ease, and costs, notably for FX transactions,(I would easily argue that most people, find banking services less efficient that 20 years ago) they do provide a far greater safety net for their depositors than Crypto holders. There are only about 180 real currencies in the world today, but at last count on Coinbase, one of the biggest Crypto platforms, over 1400 crypto-currencies listed. That should be a concern, in itself. Over time, I believe there will a catch up and merging of the all the incredible technological advances that the cryptocurrency development has pioneered and the regulated traditional banking system, as we are starting to see in the Central Bank Digital Currency, (CBCDs) advancement.

I presume most people were also surprised to learn that Coinbase’s investors’ crypto holdings on their platform would form part of the asset base of the company, rather than a liability, in the event of default, unlike a regular bank account, as Coinbase’s share price nosedived as well. In the event of a bank going down, the central bank of the country, would typically guarantee depositors, to a monetary level, although in extreme cases, such as the Cyprus crisis in 2013, and regulation that has been brought in, under the radar since, there is actually a bailing potential where depositors did and no doubt in the future, may have to take a large haircut, along with the bond holders, to help re-capitalise the banking system.

You will often hear the words, “Momentum” and “Value” with regards to investing and the old adage, “The market can remain irrational longer than you can remain solvent”. All are aspects of how difficult it is to be the expert speculator that George Soros describes, profiting from any market direction on a constant basis. When I used to sit on a trading desk all day, every day, watching every broker trade go through, it was far easier to be attuned to the weight of momentum moving the market much higher or lower than “value” dictated but it is still easy to be drawn in, by recency bias to assume the recent past is the norm, rather than the aberration.

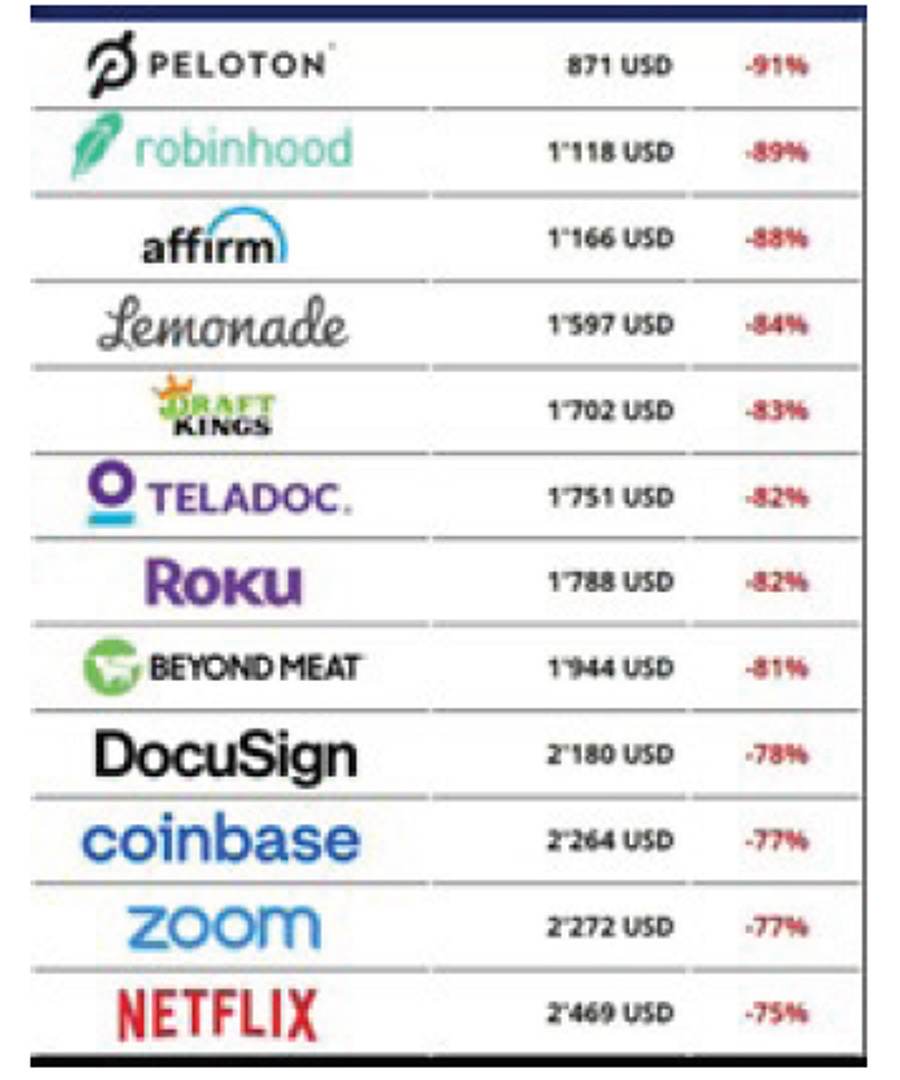

I am not surprised at all, to see the extent of collapse of many of these ‘growth’ stocks and cryptos, carried by momentum far above any inherent value. It’s one thing for me to call Bulls**t for stocks like TrustPilot, (Transfer) Wise or others at last year’s valuations, but being able to profit in the upside, under the greater fool theory, then exit, and even short, before reality value sets is the Holy Grail of speculation. And as my old friend David Zervos used to quote on his Bloomberg header for many years, “Being early=wrong”. This recent article from Zerohedge on Paul Tudor Jones is worth a read, from a macro trading perspective.

https://www.zerohedge.com/markets/lessons-trading-great-paul-tudor-jones

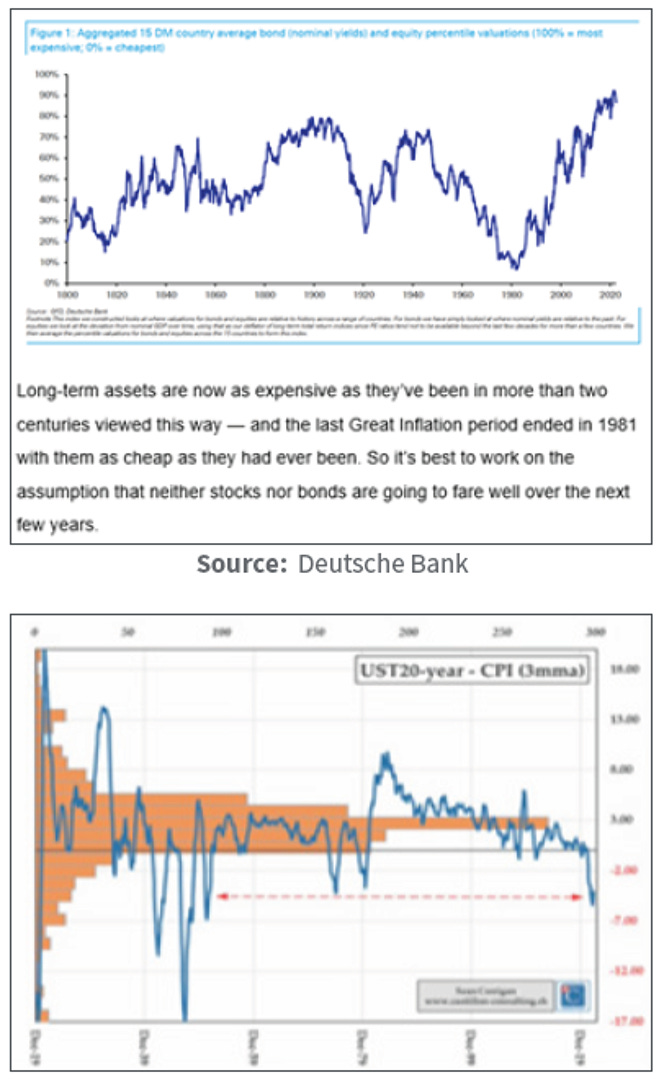

Below, are two charts that I think are relevant to keep at the very front of your mind, for the foreseeable future as inflation rages, and sales, margins and disposable income decline, the first from Deutsche Bank and the second from our old friend, Sean Corrigan, who writes the excellent commentary for Cantillon Consulting. www.cantillonconsulting.ch (Long time since we were drinking in the upstairs bar at the Magpie putting the world to rights, Sean! Hope all well with you). Even with the recent collapse of some of the most overvalued assets, we are still a long, long way from the norm, in terms of valuation and ongoing stability for assets, especially bonds, stocks and property. Investors should tread very carefully in these times and question everything, the years of easy passive investing that started in the 1980s lows and have been the prevailing trend of buy-and-hold are over, and we sit on a precipice.

With a last word from Bank of England Governor, Andrew Bailey, who is doing a ‘sterling’ job, after his tenure at the Financial Conduct Authority, stating that “Nothing different BoE could have done to prevent double digit inflation”! I would suggest some light holiday reading on economist Milton Friedman, who unsurprisingly mentioned, “Inflation is always and everywhere a monetary phenomenon”. What should anyone have really expected, when you set interest rates to zero for years and print money like a small Weimar Republic, oh yes, double digit inflation. Economics 101.

We're a long way from 'normal'

Long experience - as well as the sort of empericial evidence presented here - reveals that real yields 2-3% are sufficient to allow some sort of sustainable balance between saving and investment, between spending today and waiting on hopefully greater future satisfaction.

Such a yield lies 600-700 bps above today's Stygian depths. Imagine how hard the climb back to those sorts of levels will be.

Source: Cantillon Consulting

Visit hindesightletters.com for more information