HindeSight Letters #86 March 2022 Newsletter - FREE TO READ ARCHIVED EDITION

This archived edition of the HindeSight letter is completely free for everyone to read.

This is a taster of what you can get every month as a paid subscriber.

WHY SUBSCRIBE TO THE HINDESIGHT LETTER?

INVESTMENT INSIGHTS

Not only do we break down the reasoning behind our monthly share choices, we explain the methodology behind investing so you will learn more about strategies and how they impact your portfolio. Investing is like anything else, the more you know, the better you'll be at it and the better your decision to invest will be.

EMAIL ALERTS

You will also receive timely email alerts detailing portfolio changes to the HindeSight Dividend Portfolio #1, that covers FTSE350 stock as suggested by our Hinde Dividend Matrix and seasoned money managers. These are for immediate changes in opening or closing a position.

HINDESIGHT PORTFOLIO SELECTION

In our monthly HindeSight portfolio selection article we cover in-depth and in plain English, our reasons why we added the previous share to our portfolio with additional insights and performance data that's usually reserved for the trading floor.

OVERVIEW

Our overview features analysis, research & opinion on the latest news and current affairs and is a window into understanding factors that shape markets.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99. Our history is there for all to see, measure and research.

CONTENTS

OVERVIEW

HINDESIGHT PORTFOLIO SELECTION

INVESTMENT INSIGHTS

OVERVIEW

OVERVIEW

“So, let us not be blind to our differences--but let us also direct attention to our common interests and to the means by which those differences can be resolved. And if we cannot end now our differences, at least we can help make the world safe for diversity. For, in the final analysis, our most basic common link is that we all inhabit this small planet. We all breathe the same air. We all cherish our children's future. And we are all mortal.” - JF Kennedy

Full speech: https://kr.usembassy.gov/john-f-kennedy-american-university-address-1963/

Eight months after the Cuban missile crisis and six months before his assassination, John F. Kennedy gave this address to the American University in Washington, DC. (10 June 1963) Most historians will agree, that if there had been another US president at the time or Kennedy had listened to the hawks in the US establishment, WWIII may well have started then.

In any war, the politicians, empowered by the administrations, make the decisions but the victims are always innocent civilians, with the most innocent of all, being the children. The picture of the empty prams, a few weeks into the war, representing the first 100 children who have died in Ukraine, has been the most powerful image for me, of this current crisis.

Unfortunately, we have do not have a truly inspirational human being like John F. Kennedy, at this time, whose belief and desire for peace by any means was insurmountable. Our current political leaders on the world stage, seem truly pathetic by comparison, yet, are happy to make decisions that must surely have him turning in his grave.

If, the only goal was to promote world peace, and prevent bloodshed, and cherish our children’s future, the decisions would be different from those being made today. But, geo-politics is the dirtiest game of all.

Was a limited war in Ukraine, actually a planned event by the powers that be, with senseless killing and refugee displacement, an accepted means to bypass diplomacy as part of some end game? Surely, like most wars, had different decisions been made by the current leaders, the outcome would have been a different one to today.

Unfortunately, I feel obliged to try and understand more and think more, although I can see the easy conscience of planting a yellow and blue flag in the garden and condemning Putin and Russia to war crimes with the invasion of Ukraine, without much more thought. But, what are the politicians and governments of the world thinking and planning, it clearly hasn’t been to prevent more immediate bloodshed. A few thoughts of my own opinion.

The USA

Biden- I really must stay awake more and concentrate on what comes out of my mouth.

The Establishment- The plan is to maintain US hedgemony around the world, with the US dollar, remaining the reserve currency so we can keep issuing trillions of US debt, which will never be repaid. We need to bleed out the Russians, force a regime change, and contain them, while showing China who is boss, so they don’t try the same game with Taiwan, (Pity, we outsourced all our production to them). Keep the war going longer, allow more weapons to be ‘sold’, force the Europeans to cough up more cash out of their budgets for US-led NATO.

Russia

Putin-My country needs a strong dictator like me, the decadent west needs to realise that a country with huge mineral and agricultural resources and 7000 nuclear weapons cannot be pushed around, and should be respected. They have called my bluff or knowingly provoked me into a real war with Ukraine, which should always have been part of Russia and a loyal partner.

Establishment-The days of US dollarisation and global superiority are coming to an end, the East with China and India will become the dominant powers in future years. The world is fragmenting again into the new world order.

Ukraine

Zelensky- My people are dying and fleeing, should I feel betrayed by Russia, US and NATO, for leading us into this conflict with our lands as the killing field, and now, they just give us enough weapons to keep going, but they won’t do more.

UK

Johnson- Thank God this war turned up, I thought I had had it, with my Downing Street Covid parties. Now time to play the ‘statesman’ which I desperately want to be.

Establishment- Side with the US and Europe as usual, especially post-Brexit, show them how much we hate Russians with cash, (Limit for Russians in UK now, at £50,000 in bank accounts). Watch sanctions turn into confiscation, with mob-led hypocrisy and vague legitimacy.

China

Xi- The party and our country are playing for the long game, how naïve the US and west was to let us produce all their goods. While they day-traded Tesla options, amid crumbling infrastructure, we have been expanding our Belt and Road initiative, following the old Silk Road, where we have access to all the resources with our partners, mostly across land, so we are protected from sea travel exposure. In the future, we will see a new order, with our Eastern partners, with China as the leader. For now, we keep watching the war from the sidelines, understanding more of our enemy.

There are only bad options now, but what is the least bad option.

All of the parties involved need to look to resolve this war, to stop the killing and destruction and potential escalation, with the least bad option. I think it is very telling that the US, NATO or Europe have not believed that it is important for them to be pressing for ceasefire, negotiations and peace talks, while making sure the gallant Ukrainians have just enough US and NATO weaponry, to carry on. Strangely, only French Prime Minister, Emmanuel Macron, is prepared to talk to Putin, and try and understand how the world can stop this war. Is he out of the loop on the grand master plan being played out?

Before the current conflict, and really before the 2014, Russian annexation of The Crimea, the west have heard the grievances of Putin and the Russian people. Whether, it is in the school playground, in a work environment or in the world of geo-politics, listening to the grievances of our adversaries is understood to be the base of resolving arguments. Not listening, not discussing or being unable to show compromise, leads to inevitable negative outcomes, never more serious than the issues of world war.

It would appear that the previous grievances are broadly the same as the discussions currently going on at the regular peace negotiations;

• That NATO should declare that Ukraine would not be admitted as a member and Ukraine should amend their constitution

Sources: Wikipedia & Zerohedge

• That the US and NATO would refrain from building up its missilery and arms in the expanded East countries that were previously Soviet satellite countries

• That Ukraine would be a neutral country, like Finland or Sweden

• That Ukraine would agree to the territorial claims, namely the annexation of Crimea and recognising the Donbass region, currently in south-east Ukraine as autonomous.

Whether these were/are legitimate requirements for preventing/continuing the war, by Russia, they have been rejected without any negotiation, primarily by the US-led NATO and Ukraine who believed that the US-led NATO would absorb them quickly as members, leading to a face- off or potential escalation. This seems to be at the root of the current crisis, especially considering the US and the UK intelligence services, apparently, had clear evidence that Russia was actually serious on the alternative of war and invasion, while the Ukrainians seem to have been more surprised. I draw from this, either a poor choice of bluff in this high stakes poker game by the geo-political analysts with its tragic consequences or, unfortunately, an actual intention to allow the war to occur and play out.

So now, even with thousands dead, cities flattened and huge population displacement, the negotiations are without any co-ordinated policy with the western governments, leaving the Ukrainians to their own devices, while the western governments have imposed the most extreme sanctions, creating hatred and mistrust for years to come. It seems farcical, that Roman Abramovich, the rich Russian oligarch, who the UK have just hounded out, ‘relieving’ him of £3bn on the way, seems to be more involved in peace mediation at this time that the rest of the western politicians put together. I have no idea how history will judge our actions, but even now, the levels of ineptitude and insanity seem widespread. We have disrupted supply chains for energy and food products, the prices, for which, were already rising due to money printing insanity, are now sky-rocketing higher, impoverishing millions around the world to varying degrees. Sanctions that vastly affect the sanctioners way of life as well as the sanctionees, surely are not the best of strategies. No doubt, Russia had planned to expect harsh sanctions. As the old saying goes, “A Russian doesn’t take a dump without a plan”. It requires far more preparation than arranging a piss-up on Friday night at Downing Street, with a few wheely fridge suitcases.

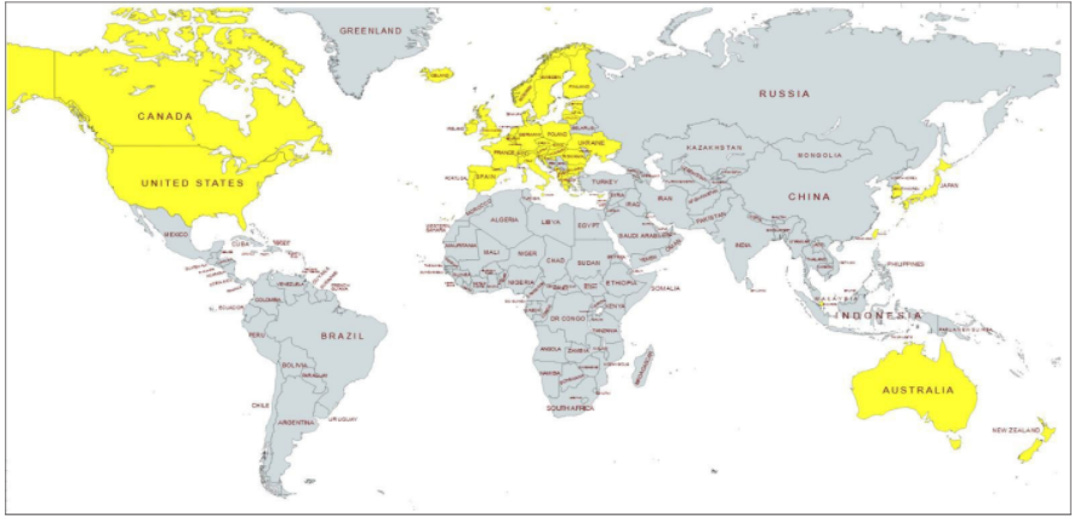

The vast majority of the world, (in grey) are not imposing sanctions on Russia currently. A quick glance suggests that at least 5bn out of the 7bn world inhabitants are free to do business as normal. Even the Europeans are allowing oil imports, because they have to. Let’s see how Russia’s demand to be paid in rubles pans out, after all, they have the oil, we need it. How little imagination is needed to see a gold-backed ruble or gold-backed yuan, being the new reserve currency, with most trade being done and the arrogant west, being locked out of the new world trade.

The headlines appear to suggest that Zelensky and the Ukraine are willing to address some of the grievances that Russia had, even if the West isn’t. But, after all, it’s their country and their people that are being attacked, so it’s not a game for them. I’m sure, the issue of sovereignty of Crimea and the autonomous regions of Donbass are more difficult to swallow, and no country, however, newly independent wants to give land away, but, borders (and border wars), are much more fluid and less clear in middle Europe. Clearly, treaties and negotiations, with the primary focus on stopping the killing and creating hatred for future killing, must all be considered. Treaties, or referendums by vote, to promote stability, as times change, to update the world maps and borders. Recognising new areas, whether it’s Kosovo or Montenegro, after civil wars in Yugoslavia, came down to preventing genocide on religious and tribal lines. I found this You-tube video watching the European borders change over the last 1000 years, an interesting perspective. We are just part of this timeline, despite our belief that our existence now is different.

All we can do is hope, that common sense, and have a common belief that there is better way forward, where the purpose is only to stop the war. Let us not just see the actions of Russia as terrible, but also understand that the West’s reactions to this, as very poorly judged, that the re-armament of Western Europe led by the US, is an escalation that makes death and destruction, now and in the future more likely than less.

...we all inhabit this small planet. We all breathe the same air. We all cherish our children's future. And we are all mortal.”

Unfortunately, the more you look, the more hypocrisy by our current world leaders you find. Here are a few of the links that just have you shaking your head in disbelief, maybe it’s better just not to bother.

Visit hindesightletters.com for more information

HINDESIGHT PORTFOLIO SELECTION

SHARE OF THE MONTH MARCH 2022

HOMESERVE

Bearing in mind the rather fortuitous timing of our portfolio change on 14th March to add Homeserve Plc Ltd, I will be brief on the summary as the stock is already up 35% at this time on news of a pending takeover offer.

I have long learnt to not ignore a top five ranking in the HindeSight model, that screens all the FTSE- 350 index companies, with greater than £1bn market capitalisations. Often, the mid/long-term value that the model perceives at that time, is associated with short-term bad news, that maybe fully priced in. The usual red flag test is simply, a solvency one. The analysis of Homeserve resulted in a decision to add the stock to the HindeSight Portfolio immediately, (rather reinforcing the option to have the premium version of HindeSight Letters App, at £3.99 a month, to get live portfolio changes than wait 10 days, for the free version-Sorry, for sales pitch, the marketer forced me!)

HomeServe is a British multinational home emergency repairs and improvements business based in Walsall, England. Established in 1993, it is now listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. HomeServe operates in the United Kingdom, United States, Canada, France, Spain and Japan,(Wiki).

If there hadn’t already been a potential take-over offer, I would no doubt, be suggesting the possibility here. A company that has rising revenue, rising margins, rising dividends with strong growth potential in the USA, who has taken a one-off write down on a UK investment which saw the shares re-rate from Price/Earnings of 30X to less than 15X over the last 18 months, is very attractive either stand-alone or for acquisition.

The question now, at 877p, is;

• How much take-over bid is priced in?

• How much can the stock price fall if no bid

comes in?

If there is a bid, or even a bidding war, that is acceptable to the shareholders, I imagine it will certainly be in the 1100-1200p area, so I will assume that at any move closer to these levels pre- announcement or even post-announcement, the margin of safety will certainly have gone.

Visit hindesightletters.com for more information

INVESTMENT INSIGHTS

As much as though the world’s central bankers will be happy to blame the current inflation mania on the Ukraine situation, the reality is that, it is the spark, to the massive amounts of money printing and low interest rates powder, that they have been in charge of, over the last few decades, ‘to keep the party going’. Well, the carefree days of globalisation and production outsourcing, are over. Supply chains are shortening or being hugely disrupted, and the world is fragmenting. Whether it ends in a new world order, with Russia, China and the East, possibly with Africa, more separate than much of history, only time will tell.

Rising inflation is everywhere, from food products, to energy and precious metals and of course wages lag far behind. The effects on people’s disposable income and their current wealth beliefs will become a main focus for most.

Our recent two decade mania has priced everything, from property to equities, bonds to small companies emergence and government debt ability on low/zero rates with low inflation. Which we no longer have and it looks like the fire is only just starting in the theatre.

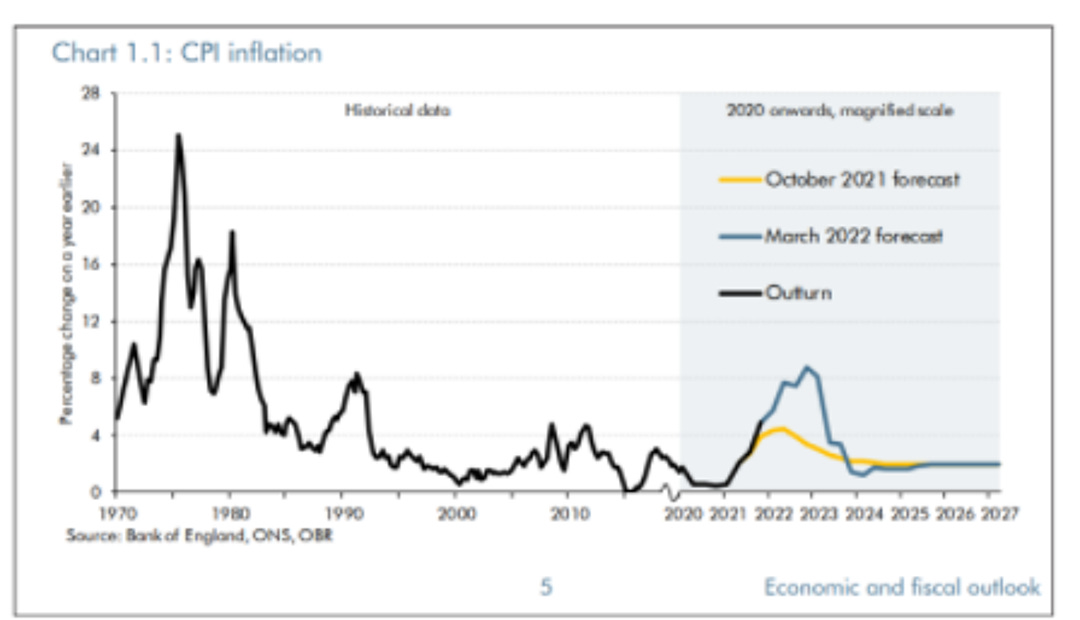

Borrowing in 2022-23 is then £16 billion higher than we forecast in October, at £99 billion (3.9 per cent of GDP). That reflects record-high debt interest costs of £83.0 billion, double our October forecast, and near-term rebates and tax cuts that inject £17.6 billion into the UK Government report, Office of Budget Responsibility, March 2022

https://obr.uk/docs/dlm_uploads/CCS0222366764-001_OBR-EFO-March-2022_Web-Accessible-2.pdf

A much missed point on inflation is, that it is a rate of change, not a price level. If inflation rises by 10% in year 1, then ‘falls’ to 5% in year 2, (a result of base effects, nothing rises for ever), the price level still goes from 100 to 110 in year 1 and then 110 to 115.5 in year 2 and so on. While the central bankers can cheer that inflation may be less of a problem, constantly higher prices are still creating serious issues in the real world.

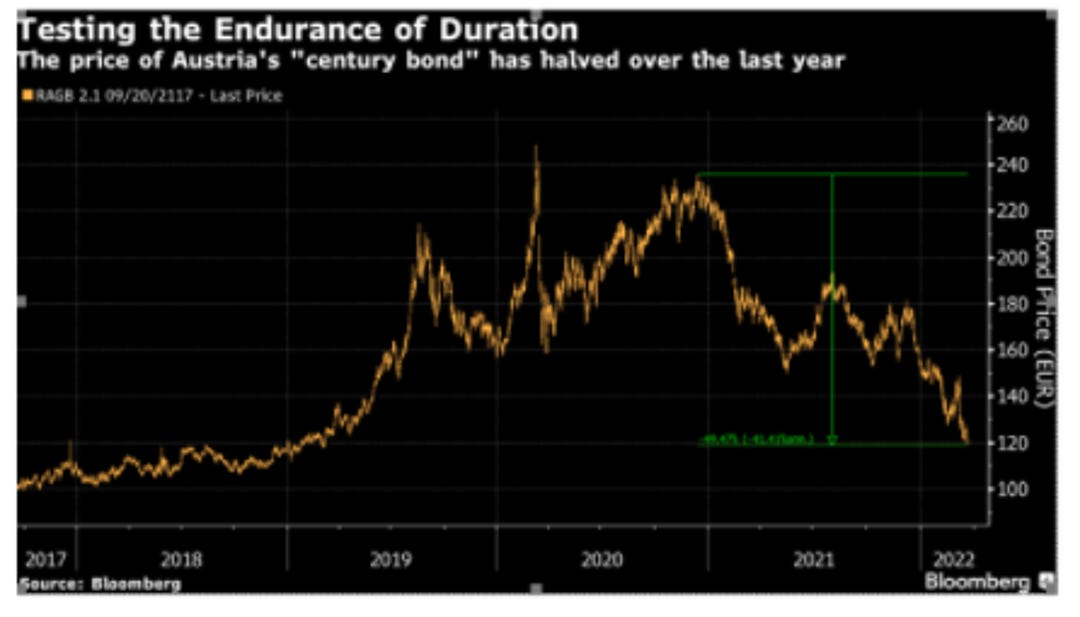

Rising interest rates are clearly bad for most fixed income investments, yields up, prices down, is just maths, the longer the duration, the worse it is. John Authers on Points of Return at Bloomberg, always has something good to view, like losing half your investment in 100-year Austria bonds, but it is widespread across the largest asset class. Guaranteed losses.

It’s just the timing of the feed through, that is unknown. I remember in 1987 as a young bond trader, other more experienced traders on the desk, expected the stock market to be affected from early in the year because of rising interest rates. It finally did in October, 1987, with a huge stock market crash.

At the moment, property prices and equity prices, are still supported to a great degree, by (blind) optimism, perhaps or just weight of money (printing), but surely time is running out. For these assets and the current lifestyle that lives on cheap borrowing, including government debt funding, there is more than a hint of the roadrunner classic moment. Although, I had lunch with a friend in London recently, who said that every Russian he knows, way down the food chain, is trying to liquidate their London property at 30-50% discounts, worried that it will get out of control. First cut, always the cheapest and all that.

Maybe, some of the Exchange Traded Fund options available nowadays where you can invest/bet on the other side, (rising rates) are worth more than a casual glance.

Source: https://etfdb.com/etf/TBT/#price-and-volume

I will not be surprised to see property and equity prices start to fade and then potentially crash, the higher the growth multiple in equities, the higher their debt levels, the more exposed they are. Hussman’s latest market comment, is titled “Quit while you’re ahead”.

https://www.hussmanfunds.com/comment/mc220325/

Maybe the historians of the future will look back on the Ukraine invasion, amid Western politician ineptitude as the pivot for the new world order globally, but within financial markets, and investment successes of the last 40 years, the change is already happening, with very little chance of the status quo.

Visit hindesightletters.com for more information