HindeSight Letters #83 December 2021 Newsletter - FREE TO READ ARCHIVED EDITION

This archived edition of the HindeSight letter is completely free for everyone to read.

This is a taster of what you can get every month as a paid subscriber.

WHY SUBSCRIBE TO THE HINDESIGHT LETTER?

INVESTMENT INSIGHTS

Not only do we break down the reasoning behind our monthly share choices, we explain the methodology behind investing so you will learn more about strategies and how they impact your portfolio. Investing is like anything else, the more you know, the better you'll be at it and the better your decision to invest will be.

EMAIL ALERTS

You will also receive timely email alerts detailing portfolio changes to the HindeSight Dividend Portfolio #1, that covers FTSE350 stock as suggested by our Hinde Dividend Matrix and seasoned money managers. These are for immediate changes in opening or closing a position.

HINDESIGHT PORTFOLIO SELECTION

In our monthly HindeSight portfolio selection article we cover in-depth and in plain English, our reasons why we added the previous share to our portfolio with additional insights and performance data that's usually reserved for the trading floor.

OVERVIEW

Our overview features analysis, research & opinion on the latest news and current affairs and is a window into understanding factors that shape markets.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

CONTENTS

OVERVIEW

INVESTMENT INSIGHTS

HINDESIGHT PORTFOLIO SELECTION

OVERVIEW

It is over 30 years since I was last in Russia, in the last days of communism and the Soviet Union. By February 1991, two years after the fall of the Berlin Wall, Mikhail Gorbachev, the final General Secretary of the Communist Party of the Soviet Union was fighting a losing battle in the orderly transition of the once superpower to the new Russia status, as the country’s infrastructure virtually collapsed, overnight.

In hindsight, it may have not been the most ideal time to spend three weeks in the Leningrad winter, (St Petersburg), visiting my Russian language tutor but I have many memories of my time there, that are unforgettable. One such memory is attending two ballet performances. At the first, a few days after I had arrived, I joined several hundred others in a vast theatre, everyone wearing full Arctic clothing throughout, (I had learned earlier in the day, that -40° is the only temperature that is the same in Celsius and Fahrenheit). Long before I had made it to a seat, I was virtually overcome by the overwhelming combination of dreadful body odour and shoulder height smoke levels from the foul cheap Soviet cigarettes, Paparosi. My tutor had knowingly insisted that I pick up as many mini-soaps as I could carry at Heathrow, such was the short supply in country, that they were the ultimate bartering commodity, which I used to great benefit, mainly for taxi journeys throughout my stay.

On my second visit to the theatre, on the penultimate night of my time in Leningrad, while the crowds were the same, I had become so accustomed to the ‘atmosphere’, I didn’t notice the smell at all, it was just, normal!

While I am often accused of random anecdotes by my peers, many are thought provoking, for me, at least. Human beings seem able to become accustomed to virtually anything, good and bad, in a relatively short period of time, accepting the prevailing wind as the norm, forgetful of the quite recent past, as if it has little relevance any more. While some excuse must lay in one’s own life’s experiences, there does seem to be less reliance on the historical evidence than I believe it justifies.

In October, some of the most renowned global hedge funds, saw their biggest losses ever, primarily, in the interest rate markets, notably in GBP, stung by ‘miscommunication’ from the world’s central banks, with ‘dramatic’ re-pricing of rate expectations. At a recent dinner in London with some old brokers, I remarked, not on the ability to lose money on a wrong trade, but at the extent of those losses, for what seemed like a quite mundane affair in scale of movement. “Too many big swingers, (traders) under the age of 40, who have never seen a rate rise, got carried away” was the general response. It would definitely seem to have merit that a mere, “will they/won’t they” move 15 basis points could inflict such losses. Normality in the interest rate market these days, with the central banks pinning rates to zero, amid continual money printing, suggests that almost any movement is deemed too large. It seems a far cry from sitting at my trading desk in September 1992, when UK interest rates were hiked 2%, from 10% to 12%, at midday, with an announcement that they would go to 15% overnight, as Norman Lamont and his merry men tried in vain to keep GBP in the European Rate Mechanism bands. You should have seen Short Sterling moves that day, you were lucky to get 15bps as a bid/offer!

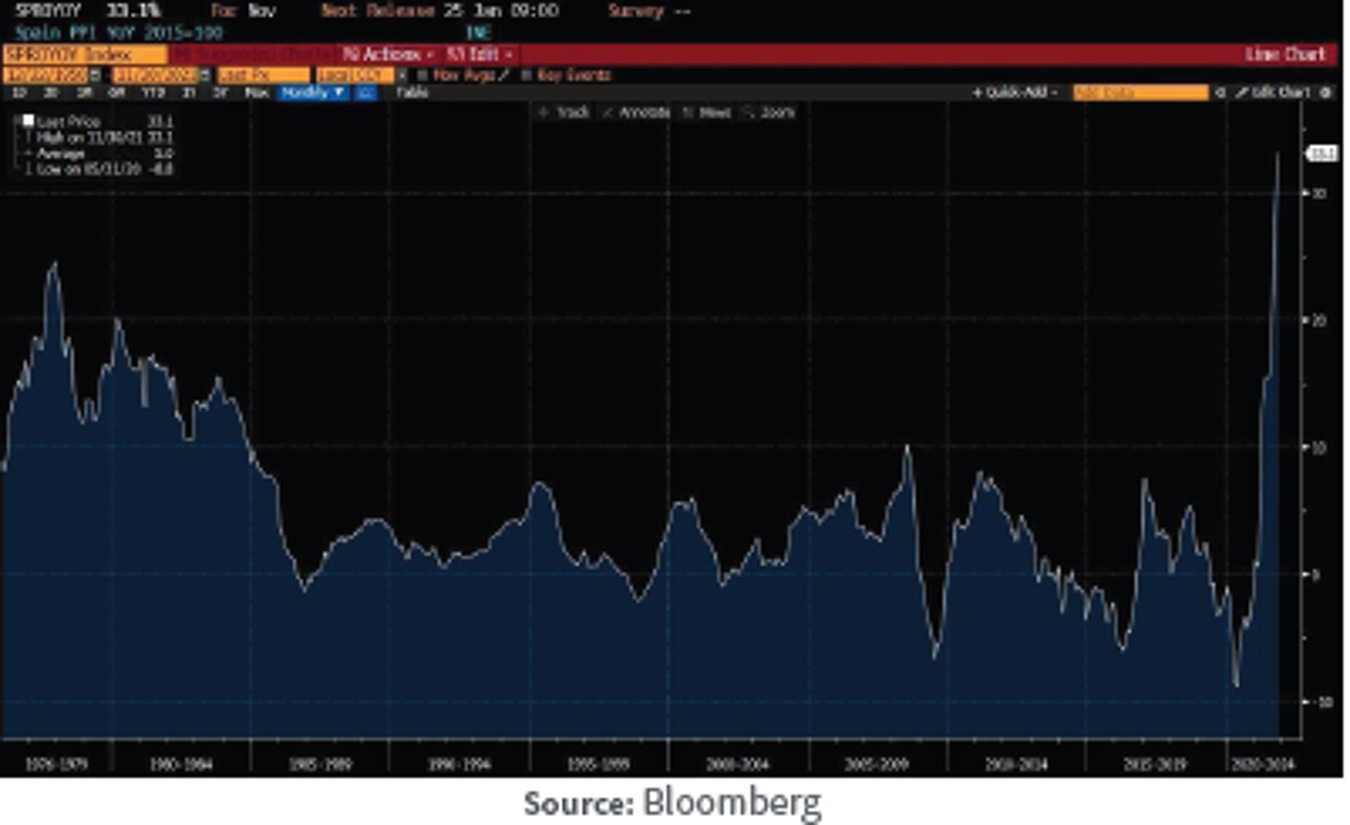

Even the albatrosses circling Antarctica are ‘aware’ that inflation is rampant. Our esteemed Federal Reserve governor, Jerome Powell, has finally admitted that it may no longer be ‘transitory’ in true blind hog finds acorn fashion. Prices across the board, in goods and services are rising rapidly, even wages, the last bastion are being pushed up. No longer contained to ‘Banana Republics’ but widespread across the global. Look at the lunacy of a recent Spanish Producer Price Inflation print!

Of course, at some future stage, inflation as a % growth should taper off, but the high ‘achieved’ price levels will no doubt remain. It’s not exactly rocket science when you expand the monetary base in every country to infinity over the last two decades, but there are considerable dangers that history has shown us, when this ‘policy is employed’. Unfortunately, the older you get, you come to realise that the ‘wise people’ in charge, in politics or central banks, haven’t got much more of a clue than you have, arguably less, for most lack experience in the real world, with academia as their reference point.

In the real world, the chart below, is straight forward, but should be very concerning to all. Inflation rates are rising above bond yields, in style. In the US, but it could be almost any country currently, CPI in Q1 2022 is estimated at 7%, with 10 year yields still at 1.5%, a whopping 5.5% negative spread. Historically, there has typically been a positive spread of 3+%, so that bond holders enjoy some protection from the inflation rate. Clearly, at the zero bound, when inflation and interest rates are very low, there is some argument for merging, but when inflation gets out of the stalls and heads for the races, all bets are off.

What is most likely to happen?

• A new higher price level, some 40-50% greater than in 2019, to equate to the monetary base expansion, where the inflation rate tails off and heads back to zero? Bond, equity and property prices remain at nose-bleed valuation multiples, continuing to provide ‘wealth illusion’ to the masses

• Interest rates gradually move higher as the allknowing and supremely competent central bankers, withdraw some of the last two decades excessive liquidity, without any problems, making Harry Houdini’s best escapes seem like two bob tricks.

• Market interest rates dramatically rise to inflation rates or higher, starting with the longer duration rates, as investors demand a better return profile to account for the risk to capital.

The problem is, like football betting, with only the three possible outcomes, win, draw, loss, it’s just a % attribution to each, and the significance of the outcome that is relevant. Having a ‘job’ where betting is an inherent part, I have to assign some probabilities to the three outcomes above.

(1) seems to be assigned a high % by the investment community, just the continuation of the ‘norm’, although I’m not certain at all, how (1) can be a permanent condition.

Clearly, the likelihood of (2) must be pretty low for obvious reasons, that Alice in Wonderland would understand better than Jerome Powell.

(3) where interest rates rise dramatically closer to the inflation rate is given far less probability by the market than history would dictate is reasonable, either because of complacent conditioning/recency bias or maybe an actual understanding that it will challenge every aspect of our economies and illusionary wealth. In the vein, “it’s so horrendous to imagine, I’m not going to think about it” suggests a true head in the sand mentality. But, unfortunately, this latest disaster in the Sterling interest rate markets rather points to complete complacency on this front, than full comprehension. When I bought my house in London in 2001, with inflation at 5%, my ‘great’ interest only mortgage rate was 6.4%. Imagine if all mortgages re-priced to there today!

Whether it’s property markets that now trade on 10x multiples of income rather than 4X historically pre-2000, equity markets at huge Price/Earnings ratios or bond prices that trade at -5.5% real yields, every aspect of our society is priced off zero interest rates amid manic speculation, which are totally reliant on low inflation, which we no longer have!

Talk about tipping point. While none of this inflation risk seems to be priced into asset prices at these valuations, it is all happening with the backdrop of a global pandemic and vastly increased geo-political risk with a US centric empire most certainly on the wane.

Fearful is the word that most springs to mind as we enter 2022.

Visit hindesightletters.com for more information

INVESTMENT INSIGHTS

I have used the legendary Kenny Rogers words from his iconic song “The Gambler”, a few times over the years in the HindeSight Letter, but in my own head, it rings more often.

“Don’t count your money while you are sitting at the table”

https://www.azlyrics.com/lyrics/kennyrogers/thegambler.html

As we enter the New Year, the ringing is louder than ever. I am more than a casual observer of the asset markets, but I would like to think I am not too far in the woods to see the trees, with a longer than average investment experience. I am crucially aware that;

• Interest rates and Bond yields are effectively zero, with an increasing guaranteed real loss as inflation rises, making the prices paid for this huge asset class, in the stratosphere

• Equity prices, on any metric, you like, are also in nose-bleed territory

• Average property prices are nearly 9X multiple, double the historical norm, with major cities at closer to 20X

Bearing in mind these asset classes make up the majority of perceived ‘wealth’, there’s not much rocket science needed to suggest that these “mark-to-market” prices are providing an illusion of wealth, that is less supported than at any time in history. Even the most optimistic pundit will agree that to start investing at this moment in history has significant headwinds to positive returns. Unfortunately, moving into or staying in cash, with rapidly rising inflation, is not ideal either as your purchasing power diminishes before your eyes with every CPI print.

It’s all well and good, Kenny telling us “Know when to hold ‘em, know when to fold ‘em”, but, if you have investments and appreciate cash is declining in purchasing power quickly, it’s not so easy, but, the first decision is to challenge every holding. Some will be a lot more straight forward than others.

Maybe, for your equity holdings, a quick use of the excellent Hargreaves Lansdown webpage would be a start, you could find a stock like Trust Pilot, with a market capitalisation of £1.24bn, that has n/a, (nonapplicable) under dividend yield and P/E ratio. This is because it doesn’t pay any dividends and has negative earnings, (can’t divide by negative number), that’s losses, in simpler terms. I don’t believe Trust Pilot has ever had positive earnings. It doesn’t help that Google Reviews are storming into this business, with far deeper pockets, who knows, they might buy Trust Pilot, otherwise it’s down to hope, which has never been the best of strategy. In this speculative mania of the last decade, there have been plenty of “high growth” companies, which have made early holders some good wedge, but I believe that time has come and gone, my friend. No dividends, no earnings, not for me.

Unfortunately, it’s too late to make a good decision for a stock like Peloton, the dream of Working-From-Home/ Working Out at Home. Whether these cycling machines are still being used for exercise or expensive coat hangers is largely irrelevant. The time to get out was almost exactly a year ago, when the Price/Growth multiple had priced in that most of the 8 billion of us on planet Earth was going to order one, the stock price is now down 75%, since January 2021. But, it’s not just Peloton, if the chart below is anything to go by, outside of the top 5 biggest Nasdaq stocks, the rest of the index is clearly fading fast. When you have highly challengeable growth priced in, which hasn’t happened yet, you need a lot of faith, blind or otherwise, in general.

The HindeSight Dividend Portfolio is only UK based, but there are clearly many other possibilities in the UK market and overseas, that offer attributes that I think are worthy at this difficult time. At least, the average dividend yield is about equal to the inflation rate, for now. But, even some of these true defensive stocks, could not necessarily be considered cheap and immune from a loss of speculative fever.

It’s a pity they don’t all look like Imperial Brands, 8.63% dividend yield with a P/E of 6.52, 60% lower than five years ago. Much more along the lines of margin of safety, if you are as fearful as me.

Apologies to readers for not painting a pretty picture from my point of view for investors, but on a positive note, maybe it’s for the best for the younger generation, whose wages are not only rising but have the longest length, who would actually benefit from a collapse in asset prices rather than being forced to start their wealth programme on historic highs. Maybe, they will get a chance on the housing market at 4X multiples again, rather than face a lifetime of renting as their only option.

And apologies also, for the merging on the November and December newsletter once again this year, many excuses but ultimately just like a dentist’s appointment schedule, gets later throughout the day/year.

Last and not least, it was nice to see another newsletter, that is actually dedicated to mining stocks pick up our old friend, Stakeholder Gold, (TSX.V:SRC), The Brookville Capital Report, https://www.brookvillecapital.com written by Simon Popple. It is a subscription service, but his results over the years have certainly justified the costs, hopefully he won’t mind me passing on the excerpt below. If Stakeholder is actually trading at Forward P/E of 1X, that might make it one of the cheapest stocks in the world.

FROM THE BROOKVILLE CAPITAL REPORT, DECEMBER 2021

STAKEHOLDER GOLD

If you cast your mind back, you’ll remember that Stakeholder Gold are a very unusual mining company. Because they’ve already got one very profitable quarry that is generating cash. There are really two pieces of news you need to take on board. Firstly, on 29th November 2021 they announced their 3rd quarter earnings. The upshot being that for the nine months ended 30th September they reported revenue of CAD$2.3m and a gross profit of CAD$1.8m. Given the gross profit for the last quarter was CAD$0.7m. They may be able to achieve a gross profit for the year of CAD$2.5m. This annual gross profit forecast is very much guesswork and should not be relied upon.

What I particularly liked about this announcement (see the link below) was this quote: “We have secured 3 additional quarry sites in Minas Gerais for exotic stone extraction and anticipate being able to report increasing production and profitability throughout 2022”, stated Christopher Berlet, President and CEO of Stakeholder.

Here is the link: https://stakeholdergold.com/stakeholder-gold-announces-q3-earnings/

So I’m hoping they will be able to generate even more profit (and cash in 2022). Which brings me on to the next topic. If these new quarries perform similar to the first quarry, then Stakeholder could be trading (at 80 cents) at less than 1X forward earnings in the next couple of years. We’ll see, but this alone makes it attractive at today’s price.

Perhaps this is why there has been such consistent buying of company shares by insiders as evidenced by filings on SEDI (System for Electronic Disclosure by Insiders). Management certainly seems interested in buying their own company shares at these levels.

Take a look at this link: https://ceo.ca/src

The second bit of news is more about “no news”….bear with me. They also own 100% of the Ballarat Gold Project in the White Gold District of the Yukon (see the initial write up on this). And there’s been no news on this. I’d expect them to either do some exploration or sell it….but they’ve done neither. I think that next year they’ll probably do one or the other. Fortunately, as they’re generating cash from the quartzite business they are in no hurry to sell the asset. Similarly, they may decide to use some of this cash to carry out some exploration (without needing to dilute shareholders – which is quite unusual for a Junior Mining company). This exploration can really go one of two ways. If the results are good, then the asset is likely to attract more interest…and command a higher price. But if the results are bad, there’s unlikely to be any interest. It’s high-risk stuff. But given the results of some of their neighbours, it may be a risk they’re happy to take.

Visit hindesightletters.com for more information

HINDESIGHT PORTFOLIO SELECTION

Tate & Lyle has been a UK household name for a century, primarily as a sugar producer after the merger of Henry Tate & Sons and Abram Lyle & Sons in 1921, but it has long since diversified into a global supplier of food and beverage ingredients to industrial markets. Its expertise in turning raw materials such as corn and tapioca into ingredients that the industry requires in bulk has seen Tate & Lyle provide consistent revenue and earnings over the long term. Earlier in the year, the company announced that it would further split/diversify with 50% of its primary products division being sold to a US private equity group for £940mil. This will see a special dividend of £500mil returned to Tate’s shareholders in due course.

https://www.msn.com/en-gb/money/companies/tate-and-lyle-to-be-broken-up-in-%C2%A3940mprivate-equity-deal/ar-AAM3lir (link currently unavailable)

As a constituent of the FTSE250, it saw 2020 revenue and earnings at £2.9bn and £245mil respectively, and the latest data shows 19% revenue increases since, supporting the £3.06bn market capitalisation.

It is not a surprise that the HindeSight Model is picking up stocks like Tate as additions at this time, adding to the defensive, income producing nature of the portfolio. With inflation rising, as yet to be joined by interest rates and bond prices, high ‘growth’ stocks seem very rich and potentially very unsupported with the current and forward macro components. Tate & Lyle, is a clear defensive staples choice, but with a dividend yield of 4.8% and a P/E of 12, at the lower end of a long-term low volatility cycle offers opportunity over the next 12 months. Tate & Lyle has only appeared once in the HSL Portfolio over the years, in 2015, with a 21% return.

As the share price history below shows, there is nothing ‘exciting’ about this stock if your investment strategy wants growth and high risk/reward scenarios, but in many ways, it should be looked as a corporate bond alternative, without the interest rate risk. We have discussed before that when inflation is very much in play, that large cash holdings, aren’t recommended but being ‘forced’ to invest, at general high levels of everything, mean risk of capital loss is far greater. We are happy to add an income, defensive stock that sells staples at this time.

Visit hindesightletters.com for more information