HindeSight Letters #80 August 2021 Newsletter - FREE TO READ ARCHIVED EDITION

This archived edition of the HindeSight letter is completely free for everyone to read.

This is a taster of what you can get every month as a paid subscriber.

WHY SUBSCRIBE TO THE HINDESIGHT LETTER?

INVESTMENT INSIGHTS

Not only do we break down the reasoning behind our monthly share choices, we explain the methodology behind investing so you will learn more about strategies and how they impact your portfolio. Investing is like anything else, the more you know, the better you'll be at it and the better your decision to invest will be.

EMAIL ALERTS

You will also receive timely email alerts detailing portfolio changes to the HindeSight Dividend Portfolio #1, that covers FTSE350 stock as suggested by our Hinde Dividend Matrix and seasoned money managers. These are for immediate changes in opening or closing a position.

HINDESIGHT PORTFOLIO SELECTION

In our monthly HindeSight portfolio selection article we cover in-depth and in plain English, our reasons why we added the previous share to our portfolio with additional insights and performance data that's usually reserved for the trading floor.

OVERVIEW

Our overview features analysis, research & opinion on the latest news and current affairs and is a window into understanding factors that shape markets.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

CONTENTS

OVERVIEW

HINDESIGHT LETTER SURVEY

INVESTMENT INSIGHTS

HINDESIGHT PORTFOLIO SELECTION

OVERVIEW

I am planning a trip back to Scotland in the October half-term, the first in many years, for some time in the Highlands, although the only actual reservation made to date is a few days at the famous Inverlochy Castle, at the base of Ben Nevis, so still some organisation to do, on that front. Past holidays there used to be an ideal place for a rest, not just the spectacular scenery, but the lack of Wi-Fi connectivity and phone signal, allowed a real break from work and modern-day technology stress. Knowing my luck, the Marmiteian Nicola Sturgeon, (just a North-South issue?), has convinced UK central funding to supply 8G and 500mhz for the five people per square mile population since then, and I will be even more connected than on the English south coast, but I hope not.

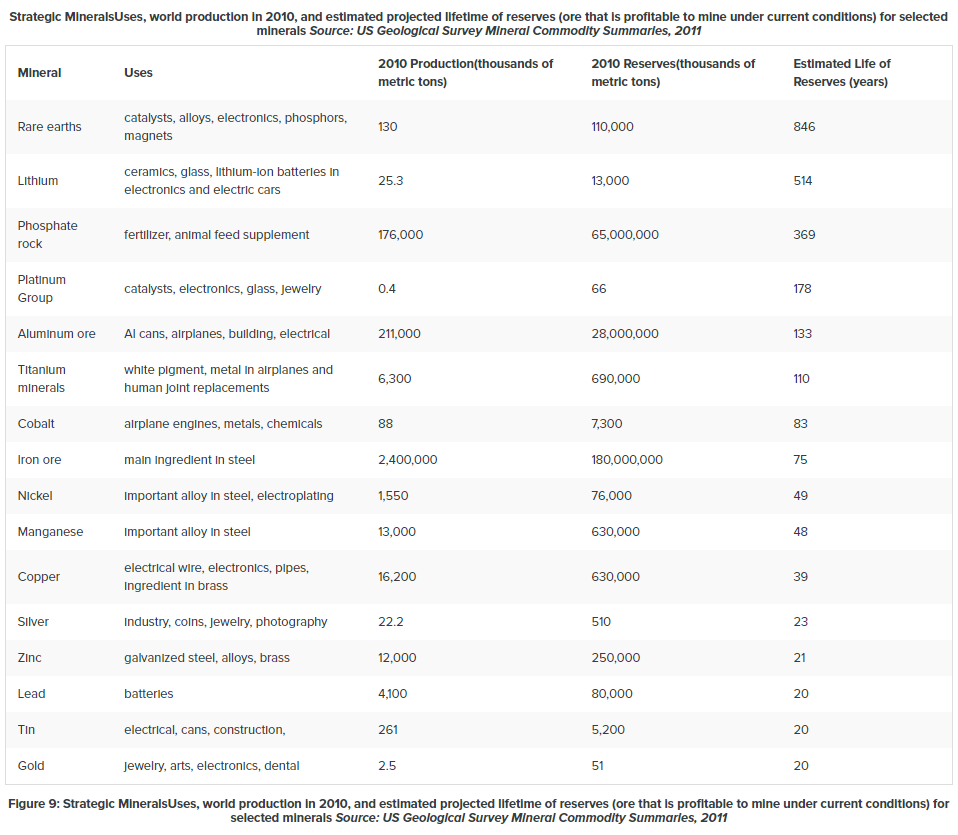

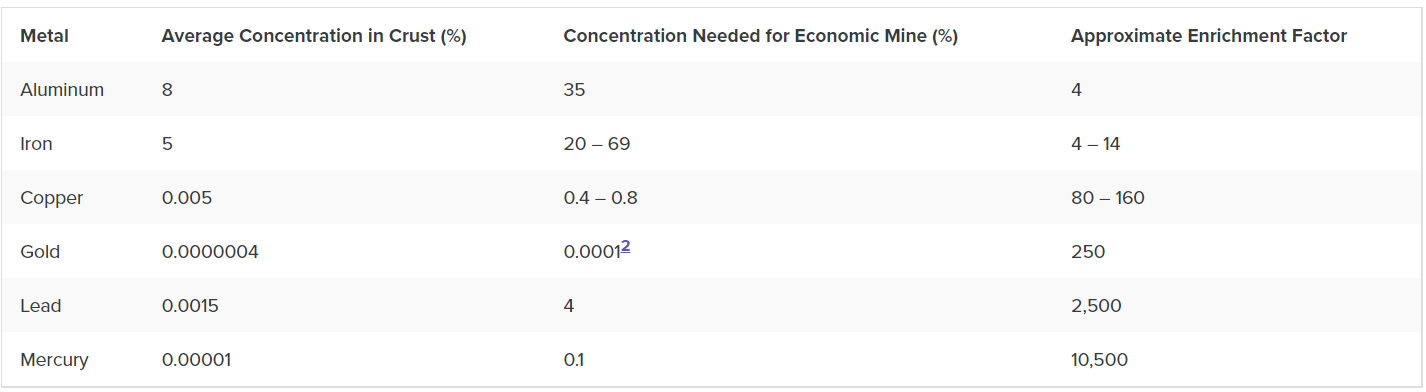

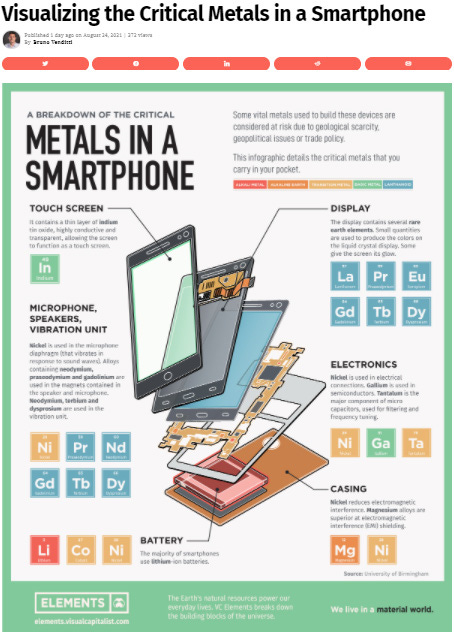

But, I am unlikely to make it to the Orkney Islands this time and will miss a chance to revisit Skara Brae, Europe’s best preserved Neolithic village, estimated to be 5000 years old, roughly at the end of the Stone Age. During that era of some three million years, man’s access to materials was limited. The Bronze Age that followed, lasted 2000 years, was defined by the ability to smelt copper and tin, primarily to make bronze tools and artefacts. The low smelting point of tin at 231.9°C and relatively low 1085°C point of copper was well within the reach of the temperature range of the ancient fires, but it was only in the first millennium BCE, that the smelting point of iron of 1535°C was achieved , enabling the use of iron and steel to put civilisations on the real road to development. We are still digging iron and copper out of the ground 3000 years later, as a bedrock to man’s need for industrialisation and advancement. Of course, today’s needs for modern technology, requires many more materials to be found in the earth’s crust, dug out and processed.

Our need for minerals and Earth’s materials is clear and ongoing. Our four billion year old planet has been blessed with sufficient resources to advance mankind’s development, within its crust. Deposits in varying degrees of concentration are still embedded, awaiting extraction. Some, like aluminium and iron are widespread and abundant, others far less so. Locations of these concentrated ore deposits, often follow the world of tectonic plates and volcanic activity, targeted by mining companies that can be profitably extracted with the engineering capability of the day. Much of the decision making comes down to the simple analysis and cost;

• “How many grammes of material can be got by shifting X tonnes of rock, and processing it?”

• “How much does it cost to do so, what is the current market price to sell it?

While new discoveries of mineral deposits are growing increasingly rare, technological advances and more importantly commodity price increases are the main dependants driving production. An underground gold deposit averaging 1g(gold) per tonne(of rock) is unlikely to be profitable with the gold price at $1000/ oz, but may well be at $2000/oz. The old chestnut of supply and demand, but as the demand for certain long-term materials like copper grows with our population expansion and quest for industrialisation, it must be obvious that prices must generally rise as the resources are finite. The stories of burglars stealing lead from church roofs or copper piping and exploration under the Arctic waters stem from the same vein, demand drives higher prices and behaviour.

There is much talk about Rare Earth minerals, used in many modern appliances, some 17 silvery-white soft metals, including yttrium and scandium. However, despite the name, they are in quite abundance in the ground, although because of the lack of economical exploitability they are considered sparse. Plus, the fact that until recently, China had a huge percentage of the world’s processing plants for them.

Bearing in mind that the latest full US Geographical Survey, (at least that I can find) is from 2011, suggests that the life of reserves of some assets are in low double digits, with copper due to run out in 2049, about the same time maybe, as Tesla becomes ‘profitable’, there is room for concern. Of course, some minerals like gold aren’t truly depleted, just recycled with little lost. The gold on the ring on your finger may well have been mined 2000 years ago, and processed many times since.

No wonder that China with its huge population that is industrialising at an incredible rate is scouring the world to acquire mineral deposits at any cost. I remember our late mining engineer at Hinde Capital, Paul Burton recounting stories of being in the desolate lands of South America, far from civilisation, only to come across lone Chinese agents, on bicycles, asking directions to the closest copper mine!

South America and especially Africa, typically rich in mineral deposits have seen vast ‘investments’ by China who have a long-term plan in motion. Unfortunately, some time in the near future, trade wars will lead to greater disputes when the resources really do dry up and price no longer acts as the balancing force. In the meantime, understanding some of these mechanics can provide investment opportunities within the commodity markets.

https://elements.visualcapitalist.com/critical-metals-in-a-smartphone/

HINDESIGHT LETTER SURVEY

We recently asked some of our long-term readers who are often kind enough to send complimentary remarks after reading the monthly letter, what they liked/didn’t like in an effort to improve our humble scribbles. The general replies could be summarised as such;

“Love the historical references and the thoughts in the Overview, always feel I learn something”

“Not just the usual finance guff, trying to sell me some crypto scam”

“Typically, just scan or don’t read the Stock Selection, but invariably will understand the HindeSight Model’s stock allocations have a strong methodology and often adjust my own portfolio on the alerts received on the app”

With those thoughts in mind, we will try to continue with the historical references and linking them to current day, with their relevance for finance and investment, We will also place the stock selection at the end of the letter, in a more summarised style. Additional comments are always welcome.

INVESTMENT INSIGHTS

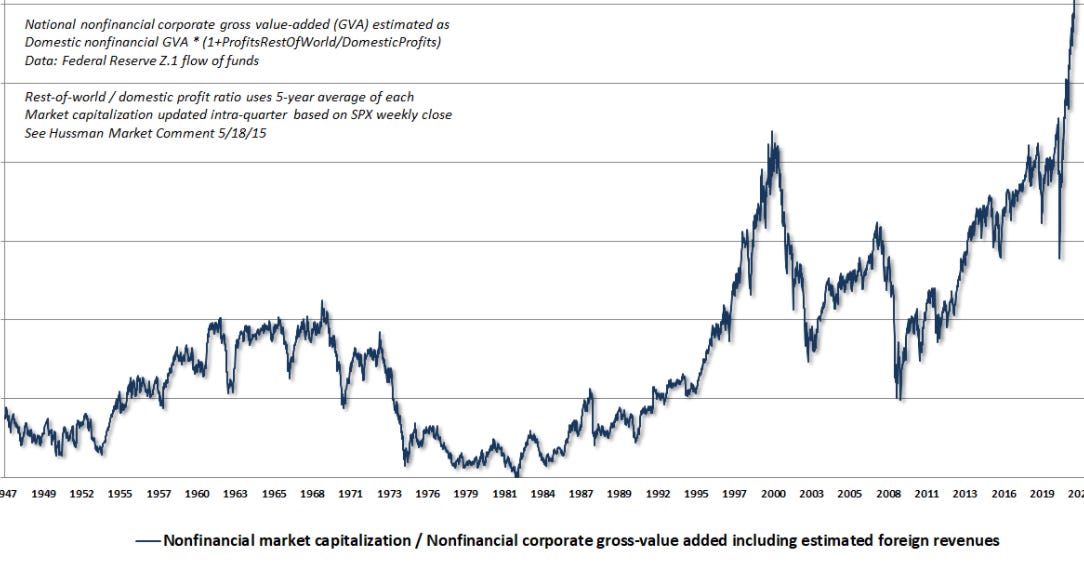

The tulips are still in full bloom it would appear, as equities fuelled by cheap money and beyond rampant speculation, soar through the heavens of historical valuations by any metric ever used since the Stone Age. Even the most ‘rigged’-(preferred Fed inflation Personal Consumption Expenditure) Price Index, PCE is at 3.6%, levels not seen in 30 years, while Federal Chairman Jerome Powell spouts “transitory” until he is blue in the face. It reminds me of the Woody Allen sketch, where he is caught in flagrante delicto, in his mistress’s bed, “Deny, deny, deny”. During the great “Price Revolution” of 1500-1600, inflation averaged a mere 1-1.5%, but this still saw average general prices rise 3-4X over the century, (£1*1.015^100). Don’t even think of doing that at 3.6%, (oh ok, then, prices go up 35-fold in 100 years) but for most people, outside of dubious statistics, would welcome ‘just’ 3.6%. Good luck with that one.

Overpaying for headline revenue, (earnings no longer relevant), is widespread. Look no further than the current bunfight between two US private equity groups for Morrisons, (MRW) supermarket, which has driven the revenue/market cap ratio to 2.55, (£18bn/£7bn) from 3.7 in March when it exited the FTSE100. Asda was sold last year Hussman Strategic Advisors ISSUE 80 - AUGUST 2021 9 for close to £7bn with £22bn revenue, (Rev/Mcap=3.3), leaving just Sainsbury’s and Tesco, (both HSL holdings), ‘in-play’. The fact that you can buy SBRY for not much more than MRW, (Rev/Mcap=3.8) and get almost double the revenue to MRW clearly means one is incorrectly priced. One thought springs to mind, that MRW’s share price will hold up until the deal closes then it might well be a free-for-all. Even TSCO trades at 3.30 ratio with the largest revenue of £60bn and UK market share. Of course, maybe the UK population is poised to double in the next few years or we are all going to eat twice as much? In today’s world, everything is possible.

“It may be the greatest collective error in the history of investing to pay extreme multiples for extreme earnings that reflect extreme profit margins and extreme government subsidies, while imagining that those multiples also deserve a 'premium' for depressed interest rates that reflect depressed structural economic growth.” -hussmanfunds.com

Maybe, a time to tune into the AC/DC classic, with the splendid lyrics,“My balls are bigger than yours”.

https://www.azlyrics.com/lyrics/acdc/bigballs.html

Of course, there is every chance, in true style, the ‘astute’ private equity group winner can extract cash out, sell off the properties and laden the companies with debt, long before someone else is holding the bag, but the difference will have to be made up at some time, between today’s ‘value’ and future value.

I remember well the time in 2008, when Mr-Sir-Mr-? Fred Goodwin at Royal Bank Scotland and Barclays ex-CEO, Jon Varley fought it out for the prize of paying almost $100bn for ABN-AMRO, before finding that the realised value was probably negative, all done and dusted. Jon Varley, out-pipped by a few billion ‘won’ the lottery, as RBS and then the UK taxpayer paid the heavy price. If I had been asked at the time, I would have suggested less arrogance and more due diligence, the same advice for today. The observation that ABN wasn’t much more than a local bank in the Netherlands, with some peculiar investments in US mortgage products proved closer to the mark, strangely enough. Having left Greenwich Capital several years earlier, it came as little surprise to myself or any of the traders, whose main memories of Mr-Sir-Mr-? Fred Goodwin were of his key focus on having sloping top filing cabinets to prevent us from putting trading and risk books on top of them. Funny old world.

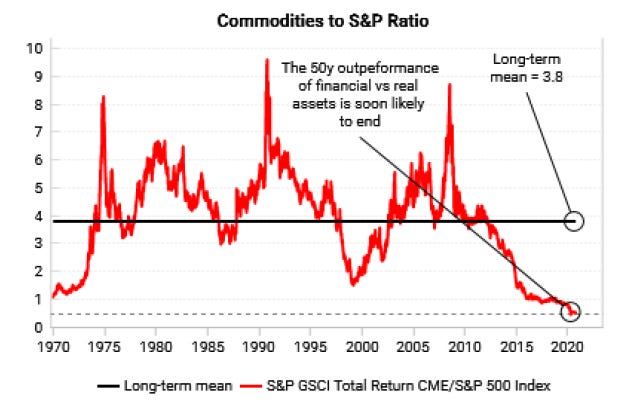

Despite my belief that the current HindeSight portfolio is very defensive, the understanding that even staples like supermarkets can be driven to wildly inflated values, naturally concerns me. There are few sectors that seem cheap and uncorrelated but the additional of BHP Group this month, at least passes some muster. Commodities are cheap, have been for a while and despite the length of the boom-bust cycles, they do actually provide the means in the long-term of providing humanity for materials that will no doubt be used for years to come. More in the actual stock section.

Source: Variant Perception

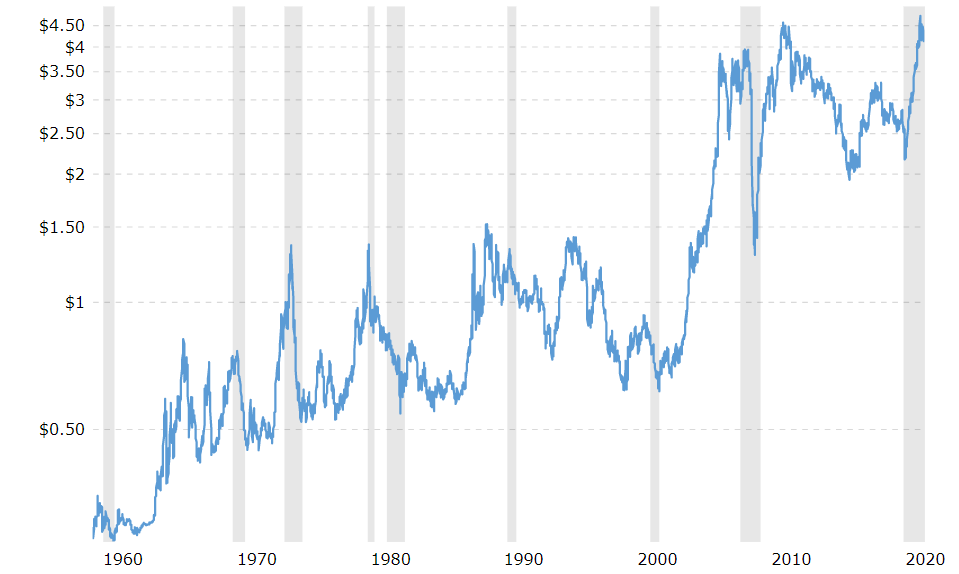

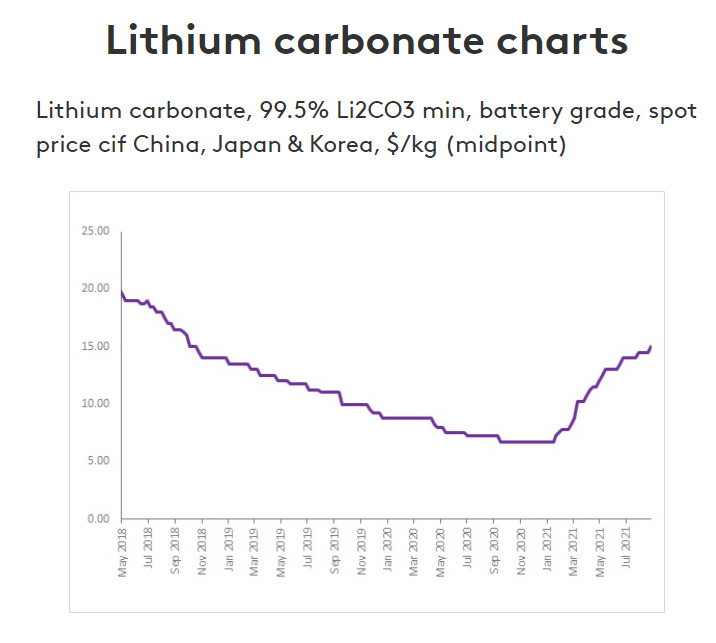

Copper price chart

Iron Ore price chart

HINDESIGHT PORTFOLIO SELECTION

Before the recent decision to unify the share structure in its Australian home market, BHP was the second largest UK FTSE 100 company at £120bn, £44bn rev, £18bn in earnings.

BHP, formerly BHP Billiton, is the trading entity of BHP Group Limited and one of the long-term global mining companies. The other large miners in the FTSE, Rio Tinto and Glencore have more volatile share prices, so BHP seems a perfect commodity rebalancing addition for the HS portfolio.

The cyclical reasoning is straight forward. The company’s financials are clear, a huge dividend yield of 9.6%, with a large final payment on Sept 2nd, ex-div date of 6.4% backed by solid earnings and cash flow. The 2021 Price/Earnings ratio is 13.10, undoubtedly benefiting now and in the future from rising commodity prices.

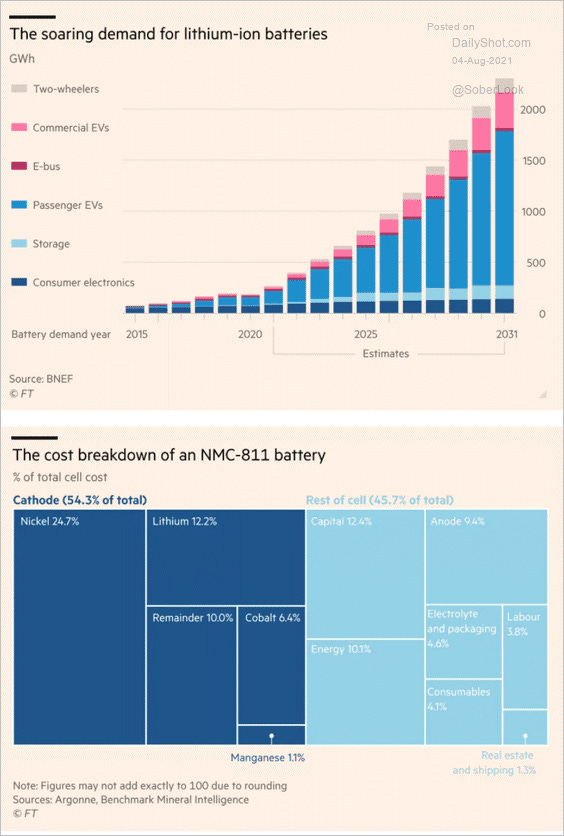

I’m sure there are ESG investors out there who can’t buy a giant mining conglomerate, but happy to invest in Electric cars that need the copper that BHP produces, but you know the sad state of affairs of this type of thinking, but it ticks some boxes for some people.

Let’s face it, the world has been mining copper for 3000 years, it will be doing for a long time yet and the reason for owning commodity companies will always be relevant, unlike TrustPilot or some such newcomer, which has got every chance of not surviving the next bear market/sanity check. BHP produced 1.72mil tonnes of copper last year, second only to Chilean state-owned mining company Codelco in terms of output. With plans to grow production in the years ahead, it will be at the forefront of this market place for the foreseeable future. Some estimates suggest rising demand of 0.7mil tonnes a year by 2040, clearly either increased output or rising prices will benefit BHP’s bottom line.

BHP Price chart

Source: Factset

I will sign off this month with a light-hearted extract from up North, I thought worthy of sharing.

From a recent copy of The Yorkshire Herald Buttock Tattoo Terror Lands Rotherham Pair In Hospital.

A furious row has broken out between a local tattoo artist and his client after what started out as a routine inking session left both of them requiring emergency hospital treatment.

Furious film fan and part-time plus-size XXXL model Tracey Munter (23), had visited the 'Ink It Good' Tattoo Emporium in Wellgate, Yorkshire last week, to have the finishing touches applied to a double buttock representation of the chariot race scene from the iconic 1959 film, Ben Hur.

Tattooist Jason Burns takes up the story.

"It was a big job in more ways than one", he told us "I'd just lit a roll-up and was finishing off a centurion’s helmet. It's delicate, close up work. Next thing is, I sense a slight ripple in the buttock cleavage area just around Charlton Heston's whip, and a hissing sound – more of a whoosh than a rasp – and before I know what's happening, there's a flame shooting from her arse to my fag and my beard’s gone up like an Aussie bush fire."

Jason says he rushed to the studio sink to quell the flames, only to turn round and see Tracey frantically fanning her buttock area with a damp towel. The flames had travelled down the gas cloud and set fire to her thong which was smoking like a cheap firework.

"To be honest", said Jason, "I didn't even realise she was wearing one. You'd need a sodding mining licence and a torch to find out for sure. She could have had a complete wardrobe in there and I'd have been none the wiser."

Jason and Tracey were taken to Rotherham District Hospital accident and emergency department where they were treated for minor burns and shock. Both are adamant that the other is to blame.

"I'm furious" said Jason, "I've got a face like a mangeridden dog and my left eyebrow's not there anymore. I don't know about Ben Hur – Gone With The Wind would be more appropriate. You don't just let rip in someone's face like that. It's dangerous."

But Tracey remains both angry and unrepentant.

"I'm still in agony," she said, "and Charlton Heston looks more like Sidney bloody Poitier now. Jason shouldn't have had a fag on the go when he's doing close up work, there's no way I'd guff on purpose. He'd had me on all fours for nearly an hour. I can only put up with that for so long before nature takes its course My Kev knows that I give him my five-second warning, and I'd have done the same for Jason, but I didn't get chance – it just quietly crept out."

Ted Walters from the South Yorkshire Fire and Rescue service wasn't surprised when we asked him to comment on what had happened.

"People just don't appreciate the dangers," he told us. "We get more call outs to flatulence ignition incidents than kitchen fires these days now that people have moved over to oven chips. We have a slogan 'Flame 'n fart – keep 'em apart'. Anyone engaging in an arseinking scenario would do well to bear that in mind in the future. On behalf of the entire Fire and Rescue service, we wish them both a swift recovery."

You couldn't make this up if you tried!

Visit hindesightletters.com for more information