HindeSight Investment #114 August 2024 - Newsletter - READ HERE

HINDESIGHT INVESTMENT EDUCATION NEWSLETTER

CONTENTS

OVERVIEW

INVESTMENT INSIGHTS

PORTFOLIO UPDATE

HINDESIGHT DIVIDEND UK PORTFOLIO

OVERVIEW

The story goes that at a dinner in Washington in 1974, economist Arthur Laffer allegedly scribbled a curve on a napkin to demonstrate his argument against US President Gerald Ford’s tax increase, the point being that there is a peak tax rate in maximising tax revenue but declines after. Ever since, there have been endless discussions involving the concept of the “Laffer Curve” with respect to tax collection.

As UK Ltd looks to the first budget statement in October of the newly elected Labour party, concerns about tax rises are at the forefront of the news and planning decisions. The first woman to hold the position of Chancellor of the Exchequer in its 800-year history, Rachel Reeves is now in the spotlight. With her master’s degree from the London School of Economics, one must assume that she has at least heard of the Laffer curve, even if others in the Labour party haven’t.

All we seem to hear about is the ‘£22bn financial black hole’ that was supposedly ‘unknown’, (yeah right) left by the Conservative government and how tax rises are needed to fund that gap and such their justification. Of course, politics is the dirtiest business of them all with lies and half-truths the norm, especially to achieve electoral success. Arguably, with the constant disappointment and length of term of the previous government, just showing up on July 4th would have seen Labour win convincingly. There was no need for the standard socialist slogans to tax the rich and give to the masses, such as taxing private education or rich ‘Johnny Foreigner’ non-doms that we heard while caving in to the unions’ wage demands.

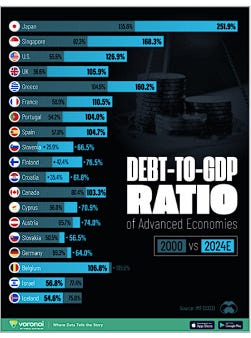

Most countries in the world are struggling with very high Debt-to-GDP ratios, usually seen in war/post-war times historically. Of course, the governments’ Covid expense could be compared to war-time, (barely mentioned during election campaigns as presumably doesn’t fit the narrative!) and the general growing indebtedness with left-leaning electorate promises, fuelled as well for a decade by low interest rates.

Interest rates have risen considerably in the last two years, so the cost for servicing this debt is another factor in the ascending spiral, (If you wondered why gold keeps going up, this is it!). No different to getting to your credit card limits, it’s very difficult to get out of this without very serious decisions having to be made on income and spending. The trouble is that hard decisions for the government to reduce their debt pile come with issues. Labour’s manifesto that there would be no tax rises on the ‘working man’, declaring that income tax, VAT and National Insurance wouldn’t rise, leaves far fewer options on the tax collection/income part. Getting more tax receipts from raising tax rates is quite tricky as ‘Arthur’ demonstrated especially if you are close to the peak of the tax collection curve. As the chart below shows, we are now heading to over 40% of GBP for tax receipts, only seen previously post WWII and the very dark days of the 1970’s Labour governments which would certainly seem to be peak-like, even to Stevie Wonder.

Many of the HSL readers are financially astute with long experience of overcoming issues, with the proverbial causes and consequences playing their roles and would understand the challenges that any business or Chancellor have. But, no doubt they would volunteer the same most obvious advice-Cut all unnecessary costs first and raise rates on the largest taxes by the smallest amount. Of course, the largest tax sectors are Income, NICs and VAT, which are not available to Labour from their manifesto-at least until people have forgotten and the other plan has failed miserably.

Leaving yourself with the far smaller tax sectors to fiddle with, brings obvious, or should be obvious problems because you have to change the game significantly and you are entering into very murky water. Tax collection with higher rates often declines because at every level people make decisions and very little remains status quo. Economics 1.01. Higher Prices= Less Demand, such that the higher prices with less transactions might bring lower revenue not higher. C’est la vie!

If we look at the potential autumn budget fiddling that has been discussed and threatened, the big ones are changes in;

• Capital Gains Tax rates from 28% moving to the income rate of 40-45%

• Pensions raids reducing both the 25% tax free allowance and the government top up for pension investments

• Inheritance tax, including agricultural and business enterprises

To continue reading the rest of the HindeSight letter please subscribe for the price of a cup of coffee per month, only £4.99.

Paid subscribers please scroll down to continue reading.

WHY SUBSCRIBE TO THE HINDESIGHT LETTER?

INVESTMENT INSIGHTS

Not only do we break down the reasoning behind our monthly share choices, we explain the methodology behind investing so you will learn more about strategies and how they impact your portfolio. Investing is like anything else, the more you know, the better you'll be at it and the better your decision to invest will be.

EMAIL ALERTS

You will also receive timely email alerts detailing portfolio changes to the HindeSight Dividend Portfolio #1, that covers FTSE350 stock as suggested by our Hinde Dividend Matrix and seasoned money managers. These are for immediate changes in opening or closing a position.

HINDESIGHT PORTFOLIO SELECTION

In our monthly HindeSight portfolio selection article we cover in-depth and in plain English, our reasons why we added the previous share to our portfolio with additional insights and performance data that's usually reserved for the trading floor.

OVERVIEW

Our overview features analysis, research & opinion on the latest news and current affairs and is a window into understanding factors that shape markets.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99. Our history is there for all to see, measure and research.

Visit hindesightletters.com for more information