HindeSight Investment #104 September 2023 - Newsletter - Read Here

CONTENTS

OVERVIEW

INVESTMENT INSIGHTS

PORTFOLIO UPDATE

HINDESIGHT DIVIDEND UK PORTFOLIO

OVERVIEW

For someone who doesn’t get off the reservation much these days, I find myself apologising again for the late delivery of this month’s letter/rant. Last weekend, I attended the very best European party event, in my opinion, once again. That of the Octoberfest in Munich. Obviously, the drinking ability of youth has now been replaced by the wisdom of age and experience and knowing your (changing) limitations!

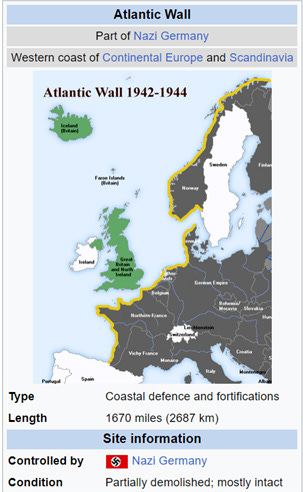

As Clint Eastwood’s classic Dirty Harry line went, “A man’s got to know his limitations” makes perfect sense, but unfortunately it is far too rarely adhered to in real life. Being with our friends again in Germany and especially drinking in the HofBrauhaus beer keller, (Hitler’s old stomping ground), the inevitable discussions regarding WWII arise. One such topic was the amazing feat of engineering by the Axis powers to build the fortified Atlantic Wall between 1942-1944. Stretching from Biarritz to Northern Norway, some 2000 miles, with bunkers and gun emplacements every five hundred metres or so. Even the remnants today are truly incredible, but in 1944, they would have been jaw-dropping in scale. Unfortunately, the invasion of Russia saw Hitler’s ‘limitations’ and the subsequent downfall and collapse of the Third Reich. Of course, back in the UK today, it appears our limitations/abilities are somewhat less on the engineering side, still attempting to repair the 1/3 mile long, Hammersmith Bridge, (closed-four years on), with no end in sight!

But, that’s local authorities and parish politics for you. Piss-up and brewery etc. I have my own painful experiences interacting with my ‘dynamic’ local council, although arguably they are like NASA scientists with lightening efficiency, compared to my dealings for a recent consultancy with the Guernsey government and civil service-truly, a world low, in my opinion.

There has been extensive coverage in the press of the absolute farce that has seen Birmingham Council heading for bankruptcy. I believe it is the biggest local authority in Europe with over £3bn in revenue and now in the sh*tter! £3bn ffs! If you speak to 99% of the people in the UK who actually pay their council tax and ask them what services they ‘hope’ to have, it’s just a weekly bin collection and the potholes in the road repaired! Unfortunately, both of which seem to be far beyond most councils’ abilities, no matter what revenue they soak in. Much of the rest of the spend is just the jollies for whatever clown/s are in charge at the time.

Of course, that £3bn has to cover some pretty huge salaries, £250,000/year for the CEO of the now bankrupt council. Why do we always have to hear absolute horse manure about councils and charities having to pay private sector rates in order to be competitive to get the best staff? Deborah Cadman, CEO of Birmingham Council hasn’t come within 100 miles of the private sector, her entire career, and why would she? If you want to earn £250,000 in the private sector, you usually have to be pretty astute and do 70+ hours a week at the coal-face, not a 9:30-4:30 at best, four days a week, with 30 days sick and 30 days holiday a year at the local council/civil service.

As it used to state, back in the day on many job offers, £££ AAE, -according to age and experience. Of course, that is out of the window now. Diversity/woke/believing in your own deluded ability-all comes at a price if meritocracy is no longer the defining factor. Education is attained, expertise can be learned and experience has a time factor, with meritocracy being able to place the best people in the right jobs to excel, or not. Clearly, that didn’t happen with the risk committee at now defunct Silicon Valley Bank nor Birmingham Council and the results have been equally devastating. Wrong people, wrong place, wrong abilities.

In the investment markets, knowing your abilities/ limitations is key to surviving and thriving in the long run and importantly, IMO, knowingly operating within understandable risk/reward metrics. Expertise and experience are key. Younger, ‘smart’ investors/traders sometimes rise to great heights with the ‘expertise’, brimming with overconfidence, but often without understanding the true risks they are taking, which invariably comes with experience. Older, veteran investors are often too cautious, knowing the sh*t hitting the fan potential, that can happen. The over exuberance at the highs, with much optimism and lack of caution compares inversely to the pessimism and caution/reluctance to invest at the lows.

The biggest worry for all investors in any asset class at this time should be the size and speed of the global real policy rate change over the last 18 months, rising by 600bps. The fall in prices of long duration fixed income investments has already seen victims, such as Silicon Valley Bank, but also, most pension managers have seen their 60/40 portfolios really suffer over the last 18 months, despite stock markets, such as the FTSE generally treading water.

To continue reading the rest of the HindeSight letter please subscribe for the price of a cup of coffee per month, only £4.99, paid subscribers please scroll down to continue reading.

WHY SUBSCRIBE TO THE HINDESIGHT LETTER?

INVESTMENT INSIGHTS

Not only do we break down the reasoning behind our monthly share choices, we explain the methodology behind investing so you will learn more about strategies and how they impact your portfolio. Investing is like anything else, the more you know, the better you'll be at it and the better your decision to invest will be.

EMAIL ALERTS

You will also receive timely email alerts detailing portfolio changes to the HindeSight Dividend Portfolio #1, that covers FTSE350 stock as suggested by our Hinde Dividend Matrix and seasoned money managers. These are for immediate changes in opening or closing a position.

HINDESIGHT PORTFOLIO SELECTION

In our monthly HindeSight portfolio selection article we cover in-depth and in plain English, our reasons why we added the previous share to our portfolio with additional insights and performance data that's usually reserved for the trading floor.

OVERVIEW

Our overview features analysis, research & opinion on the latest news and current affairs and is a window into understanding factors that shape markets.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99. Our history is there for all to see, measure and research.

Visit hindesightletters.com for more information