HindeSight Investment #102 July 2023 - Newsletter - Read Here

To read next month’s HindeSight letter on the day it’s released please subscribe for the price of a cup of coffee per month, only £4.99 or save by subscribing yearly. More information at the bottom.

CONTENTS

OVERVIEW

INVESTMENT INSIGHTS

PORTFOLIO UPDATE

HINDESIGHT DIVIDEND UK - PORTFOLIO #1 JULY 2023

OVERVIEW

Apologies for a slightly delayed letter this month. I have just enjoyed a randomly planned holiday in Spain, which turned out to be most relaxing and pleasant mainly due to the fact it was a holiday resort for Spanish people. The only football shirts in sight were Spanish teams! It also meant the prices were local, rather than foreign tourist premium, especially for the great food, no €50 for five prawns in sight! Mentally noting as a place to return to, I am not telling any of my friends!

I did manage to read a few books picked up at the airport, as you do, one of them being, “Winter in Madrid”-Sansom. I am a simple guy-going to Spain-buy book that must be to do with Spain, even if I was nowhere near Madrid. The background of the 1936-39 Spanish Civil War is dramatic and very thought provoking. The class struggle between left and right, led to the outside foreign support for the Republicans by the Soviets while Hitler supported Franco’s Nationalists. The ultimate victory saw Franco stay in power for almost 40 years, before ‘democracy’ returned. Yet, now in the recent, still being contested Spanish elections, there is a strong chance the far right will re-emerge in power for the first time since Franco’s death in 1975.

The tragedy and futility of the internecine war was well depicted, but I couldn’t help thinking of its relevance to the depressingly familiar situation in the Russian-Ukrainian conflict that still continues almost 18 months on. Nothing changes much, unfortunately. While the anti-Russian neo-cons in the US have mugged off the masses spouting the 1930’s appeasement line to support the sovereignty of Ukraine and push NATO west, there are or certainly were elements of civil war in southern/ eastern Ukraine and Crimea, prior to the west’s involvement with the same tragedy and futility to be seen, and it certainly isn’t as black and white as the western media would have us believe.

Although less addicted to the newsreel on vacation, I couldn’t miss the fascinating new farce with NatWest, Coutts and Nigel Farage. Barely three years on after NatWest Group changed their name from RBS Group to ‘forget’ the last farce during the 2008 Great Financial Crisis ‘inspired’ by old Freddie Goodwin, a new debacle unfolds. More than a few people must have been amazed by the “Subject Access Report” that Nigel Farage was able to get from Coutts, not least the people who actually made those statements! Long gone are the days of walking into Coutts, Lombard Street to be met by staff wearing tailcoats…..ah, the good old days.

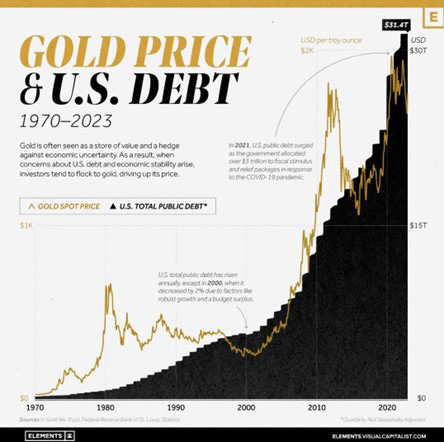

News that has certainly not been widely picked up by the mainstream media is the BRICS summit in Johannesburg, August 22-24th. In GDP terms, the BRICS nations have recently overtaken the G7 nations, as a reference point on their growing status and importance in the global economy. Of course, they are now, ‘on the other side’. With South Africa party to the International Criminal Court, Russia’s Vladimir Putin has decided to participate by Zoom rather than risk arrest subject to the issued warrant by the ICC and head to The Hague, but the Western ‘coalition’ nations should take notice of developments at the summit. Especially the discussion on a new gold-backed currency for the participating nations with more determination than ever to move away from the US Dollar world to a New World Order.

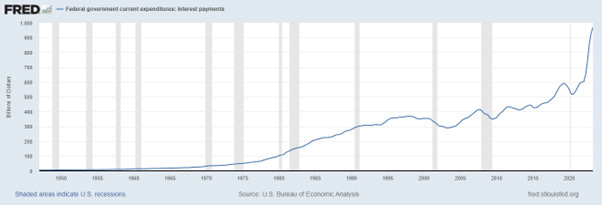

As the global reserve currency, the US Dollar and the United States have been privileged to spend and borrow without constraint since the collapse of Bretton Woods in 1971 but the numbers are really getting out of control now. In the next few months, you will see the US interest expense on Government debt pass $1trillion and still rising. FML, and I thought my credit card was an issue!

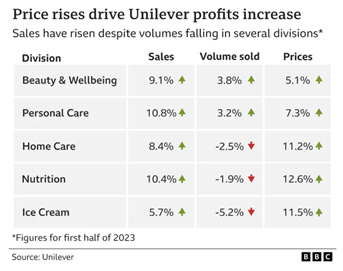

Of course, outstanding global debt is rising everywhere, with debt/GDP ratios rising above levels that have historically, albeit country specific, seen very high(hyper) inflation. Everyone is aware of high inflation in the world, and the hope that it is waning, whether it gets back to the 2% that the central banks are ‘targeting, (laughter in the crowd) is another matter, or the assumption that it doesn’t rise strongly again? But it should be remembered clearly that inflation is a growth number, whether it is 10% or 5% or 2%, prices are still rising continually, just at a slower rate. At the higher numbers, it can really skew some typical market observations that most are oblivious too. I thought these numbers from Unilever were of interest and no doubt widespread, with price rises so high, it looks like revenue is really rising, suggesting strong growth, but the actual number of goods sold may well be lower. And that feeds back into all the metrics, arguably, supporting nominal prices in equities….for now. Historically, this rarely ends well.

At the Gold & Silver Investment Summit in 2010, my long term friend and colleague, Ben Davies spoke for Hinde Capital about “Debt-There is no Jubilee”. (Will post full article in the email archives during August-sign up for free)

His opening comment was, “The world has too much debt. In the book of Leviticus (Old Testament), a Jubilee year is mentioned to occur every fifty years, in which slaves and prisoners would be freed, debts would be forgiven. Today there is no Jubilee”

Despite recent news that US President Joe Biden is giving a debt jubilee to tranches of student debt, the debt is just assumed by the US government, there is really no chance of a global debt jubilee. The “Deleveraging Process” as detailed in the slide below doesn’t really give us much to hope for. The likelihood of belt-tightening or the global economy growing out of this current debt ‘conundrum’, especially with China fading away, polarisation and de-globalisation. So that just leaves high inflation or massive default to look forward to! Or maybe a complete reset, a half century on from the US dropping the gold standard in 1971, to a New World Order with a new backed gold currency settlement system run by the other side. Let’s see what comes out of the summit, but seems to me the clock is ticking anyway………

INVESTMENT INSIGHTS

As our theoretical Permanent Portfolio demonstrates, the market returns so far this year are nothing to write home about. While savers are benefiting from cash and short dated bonds yielding something again, this is offset by the decline in longer dated bonds as interest rates rise. Gold has yet to shine in any meaningful way, while the modest equity gains are largely dividend collection.

The Permanent Portfolio

According to Nationwide recently, UK house prices fell at the sharpest rate in 14 years, 3.8% down from last year. As written previously, the large re-fixing rates for mortgages with 100,000 rolling over monthly will continue to pressure prices aggressively as transactions dry up. But, apart from the gradual net disposal income squeeze with mortgage and rent payments rising, there doesn’t seem to as much recession worry/chit-chat as you might expect at this juncture. Monetary conditions are obviously tightening and loan demand is dropping and if we believe the US is a leader on the inflation front, we should see some slowing over the next six months in UK, as the rate rises start to bite.

This leads to me to believe that there is some complacency/ hope in current or future prices, most certainly in property, but despite all the “UK equities are cheap to US comments”, they definitely don’t appear to have priced in much of a slowdown with today’s valuations with the huge risk-free rate change.

I mentioned last month about how best to take advantage of the policy error by the Bank of England with respect to real rates, namely being long/receiver GBP short dated bonds/rates as well as long the GBP currency on a cross, either against the USD or EUR as the combined trade has merit. I will give myself the entry point from last month’s letter publish date, July 4th. At GBP/USD 126.80 and June 2024 Sonia 94.84. So far, so good…not counting my money while seating at the table etc.

In the same vein on macro investing thoughts, I heard a very interesting update on the Japanese equity market given by Julian Wheeler of Shard Capital at the East India Club Investors dinner recently.

While the Nikkei visually looks like it has had an outsized move since the 2008-10 lows of 8500, after a two decade drop from 40,000 in 1989 when Japan fever ruled the world, before its’ ‘lost decades’ of constant deflation, the 4-fold rise to its current level at 33,500 is still less than the 7-fold rise for the US SP500 from GFC lows of 666 over the last 15 years.

But, rather than have risen to excessively rich valuations by historical metrics of the US market, the Japanese market is still arguably very cheap. We have long accepted that Japanese companies;

• Have inefficient balance sheets-up to 75% of companies trade less than book value

• Hoard cash

• Don’t pay dividends or engage in share buy backs

• Have convoluted cross shareholdings with multiple other Japanese companies preventing activist/ M&A/hostile or other interest

• Are underweighted in investors global allocation. (Asia, ex-Japan funds etc)

But, times are-a-changing, as Bob Dylan would say, primarily as a result of continued advancement of Japanese Governance code, started under Kuroda and now continuing with new BOJ Governor Kazuo Ueda.

The new Prime 150 Index that was outlined in March by the operator of the Tokyo Stock Exchange will be made up of 150 stocks for Japanese companies that are estimated to create value. It will be made up of the top 75 names in the TSE Prime market by market capitalisation, with priceto- book ratios greater than one and the top 75 names with the highest spreads between return on equity and cost of equity.

We are seeing and you should expect to see accelerating the same dynamics as we would expect in the US and European markets to increase shareholder value.

The easiest way to get your book value up with excessive cash is to have share buy backs, which the US markets are all too aware of but, in Japan from levels that make far more sense as a methodology for returning money to shareholders, rather than management options!

Cross shareholdings are also being reduced allowing good governance in respect of shareholder value and will accelerate.

On these factors alone, it warrants a far closer investigation but there is also another key component.

The Japanese currency has long been used as a source of cheap funding, short Yen-long anything and so on has been around for years. With the long period of deflation now over, and with global rising interest rates, the long employed Yield Curve Control policy has still been at 0.50% for 10 year bonds despite inflation rearing its head in Japan as well, being exacerbated as a major importer. Well, last week despite a somewhat confused signal, the YCC level appears to have been raised to 1% from 0.50%.

I remember reading the book by Andrew Craig, “How to own the world”, (another East India Club speaker last year) that advised people to invest overseas to protect their global purchasing power especially in times of home currency strength.

Easier said than done of late in the UK with a weak pound over the last few years leaving less options. But in the case of GBP/JPY, GBP is enjoying relative strength. Since 2008, the GBP/JPY cross rate has been trading between 1.20 - 1.90, currently at 1.8250.

So you can sell a ‘rich’ currency, (GBP) and buy a cheap currency, (JPY) and with that cheap currency you can buy cheap Japanese stocks on typical metrics with a clear major policy change to support that. Also it must be remembered that owing JPY has often been seen as cheap put protection in times of crisis, equity or other.

It is key to remember that it is a combined trade analysis, like the GBP/USD-Sonia trade. Ie unhedged currency. Too many Japanese market access funds for equities will be currency hedged which is not the same at all.

If GBP/JPY reverts to mid-range of 1.55 that is almost a 20% increase in a GBP investment returns even with no movement in Japanese stock market.

There is of course opportunity costs in rate interest, real negative carry costs on levered trades with the large difference in short term rates in GBP and JPY but the significance of this sea change in policy should not be overlooked. For education purposes, I will take my trade monitoring mark at letter publish date, hopefully not too far away from now, at 1.8250 and 32390.

There is a few of the interesting charts and stats that came across my radar this month below.

In its quarterly survey of 158 big banks, the European Central Bank (ECB) said that demand for loans from businesses over the last three months fell at the fastest pace on record (the time series began in 2003) and banks tightened their credit standard to consumers over the last three months.

Some more good press for the Bank of England. Bonuses for getting inflation higher which increased their linker-dominated pension pots … trebles all round!

HINDESIGHT PORTFOLIO UPDATE (JULY)

HINDESIGHT DIVIDEND UK PORTFOLIO # 1 (JULY 2023)

Visit hindesightletters.com for more information

To read next month’s HindeSight letter on the day it’s released please subscribe for the price of a cup of coffee per month, only £4.99 or save 2 months with a yearly subscription.

WHY SUBSCRIBE TO THE HINDESIGHT LETTER?

INVESTMENT INSIGHTS

Not only do we break down the reasoning behind our monthly share choices, we explain the methodology behind investing so you will learn more about strategies and how they impact your portfolio. Investing is like anything else, the more you know, the better you'll be at it and the better your decision to invest will be.

EMAIL ALERTS

You will also receive timely email alerts detailing portfolio changes to the HindeSight Dividend Portfolio #1, that covers FTSE350 stock as suggested by our Hinde Dividend Matrix and seasoned money managers. These are for immediate changes in opening or closing a position.

HINDESIGHT PORTFOLIO SELECTION

In our monthly HindeSight portfolio selection article we cover in-depth and in plain English, our reasons why we added the previous share to our portfolio with additional insights and performance data that's usually reserved for the trading floor.

OVERVIEW

Our overview features analysis, research & opinion on the latest news and current affairs and is a window into understanding factors that shape markets.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99. Our history is there for all to see, measure and research.