[COPY] HindeSight Letters Investment Insights Archive - READ HERE

Our FREE archive posts allow our subscribers to access valuable insights and analysis and a deeper understanding of market trends and investment strategies that were relevant at the time the HindeSight newsletter was published.

Additionally, reading archived newsletter content can give you a sense of the long term performance of the investments or strategies discussed which can be helpful in making informed investment decisions.

Furthermore reading this content can provide historical context and help you see how market conditions have changed over time, allowing you to better anticipate future developments.

Overall reading our archived content can be a useful tool for gaining a broader perspective on the market.

LIMITED OFFER. GET A 90 DAY FREE TRIAL OF OUR PREMIUM SUBSCRIPTION & MAXIMISE YOUR INVESTMENT POTENTIAL

INVESTMENT INSIGHTS ARCHIVE

Originally posted in July 2015

VIEWS - All For One and One For All

By Ben Davies

Gambling is the wagering of money or a stake with material value on an event with an uncertain outcome, with the sole intent of winning more money or additional material goods. Brinkmanship is often considered tantamount to a gamble. Brinkmanship is the art of pursuing a dangerous policy to the limits of safety before stopping, especially in politics.

I think that we would all agree that Greece and the other EU members have been indulging in a veritable game of brinkmanship. Tsipras, Merkel and Schauble have danced close to the edge of economic and political instability by enabling a potential Grexit. Such an exit by extension skirts dangerously close to a cessation of the European Union, whose sole purpose of origin has been to encourage a long-lasting harmony between European nations, by uniting them in the collective pursuit of economic prosperity. Its ultimate aim was to avoid a repeat of two World Wars.

Both sides’ negotiations have entailed a huge gamble, not only in the political sense but in the literal sense too. After all, Greece as the debtor and the EU as the creditor have wagered their discourse on another bail-out whereby both sides definitely lose money in the event of there being no agreement. If both sides agree on terms, Greece receives more money and the creditors, despite paying out more, gamble that they will be repaid in full on all monies lent. Of course, the gamble is so much more than just Greece.

The Debt Gamble

Everywhere I look appears to be a gamble between creditors and debtors. Today, debtors and creditors alike are caught in the 'debt trap'. Despite ZIRPs and now even NIRPs, where debtors get paid to hold debt, the world seems intractably and insolvably boxed-in by ever growing debt burdens. The economic and indeed political debate has been over who should foot the bill – creditors or debtors?

Notwithstanding a debt jubilee, where all debts are forgiven (best for the debtor, still not great for the creditors), the way to deleverage with least hiatus is to grow the economy out of its predicament by receiving enough revenues by which to pay back the interest and principal owed. The debates on creating growth revolve around providing short-term fiscal stimulus or belt-tightening, austerity measures. Either way, the aim is to increase income relative to costs.

Encouraging reform of the public sector, reducing the State costs and encouraging entrepreneurial endeavours is the more sustainable pathway for achieving growth. Not everyone agrees with this and so herein lies the ideological battle we witness today around the world, no more so than in Europe. Europe is a federal state that prefers more state control of enterprise and greater welfarism, which are seen as ‘fairer’ modalities for growing a country.

History is replete, however, with how government indebtedness has led to continuous economic failure. The 2008 Crisis itself, far from being a failure of free markets, symbolised an innate failure of a form of State capitalism, that of the State monopoly of the issuance of money. The abuse of the supply of money in ever increasing amounts to arrest the failures of TBTF and various private institutions has enabled a far more protracted demise of our economies than if failure had been recognised. Such failure, so needed in capitalism to allow fresh roots to flourish, is considered almost unconscionable by policymakers today. The money issuance encourages price inflation as a means to mask the collapse in existing money and credit in circulation.

The only price inflation we have witnessed to date is that of real asset appreciation, including stocks, housing and bonds, whose ownership is not widespread, and so this has merely exacerbated the social fractures of inequality caused by a welfare indebted State.

Stage 1 to 3: Stock Metastasis

The debt burden has thus been controlled by holding rates below the market rate of preferred lending, for who would pay their neighbour to borrow money from them? (Answers on a postcard if you actually have a logical answer to this question and conundrum). This has helped borrowers to service their debts but it hasn't helped repayment, so a repayment crisis such as we witness with Greece still remains.

The debt malaise seems to have crept insidiously around the world and remains stubbornly entrenched, impacting not just emerging and less developed countries but even those more 'stable' developed nations. Japan symbolises this entrenchment but their creditors haven't called time because the Japanese government owes its own people. Foreigners tend to be less malleable and more impatient. Now every developed country is heading toward Japan-styled debt traps. Europe, itself, suffers from a similar debt deflationary straitjacket as it suffers from an internal, rather than an external debt problem.

The EU, unlike in Japan though, has numerous sovereign nations that are exposed to this internal debt, and it is clear in trying to resolve their debt problem there has been no political solidarity when it comes to sharing such a burden; especially when the periphery country debtors are perceived to be feckless and profligate spenders in contrast to the erstwhile prudent saver nations. In essence, any intra-European transfers – let's say from Germany to Greece – is nothing but a zero-sum game. What is a gain to Greece, is a loss to the rest of Europe?

Dumas, the French author of ‘The Three Musketeers’ once wrote that immortal rallying cry 'all for one and one for all.' This seems ironically lacking these days but perhaps understandably so. Political union with a central fiscal authority is what is needed to staunch the bleed, i.e. the union in EU will be dropped for a single Europe(an) entity, the formation of a one member nation state. There is no chance this will happen voluntarily. Sovereign identity is sacrosanct, although Tsipras has seemingly ceded any Greek sovereignty to the centre. Or rather the coercive efforts of the centre have wrested a nation's sovereignty from under them. Time will tell if the people undertake a coup d'etat over Syrizas and their own government, much in the same way that Europe has achieved a coup d'etat in Greece. Maybe this is all part of the master plan, albeit opportunistic, that aims to achieve the one member, one nation state, but I can't see such oppressive tactics providing any real accord and unity. Although I do not believe we are moving to some neo-Marxist state, it is clear that the battle lines have been drawn between Statism and open democracy.

Open democracy seeks to preserve the nation's individual sovereignty both that of its own and its people. The vote of democracy in Greece has counted for nothing as the voters referendum outcome was swept aside. Vice-President Alexis Mitropoulus referred to Brussels' deal as a 'manifesto of social genocide', a totally inappropriate reference to actual genocides in history, but it was a measure of the emotions at stake. For not only Greece sacrificed individual sovereignty it has lost its own national sovereignty to the wider State of Europe by agreeing to undertake this absurd bail-out. It does feel as though there is something far more sinister about this German, sorry EU, re-occupation of Greece as it's a battle that marks the start of the war and not the end.

Global debt resolution has intensified the creep of the State over the private sector and the property rights of individuals. It has led politicians to haphazardly juggle reconciling domestic democracy with International obligations. Individuals are losing to the State but State's are now losing to each other as the thin veil of diplomacy between nations has opened up old fissures. The Greeks’ pledge of its assets and islands is not unique, for outside of the European Union too much debt has also led to conflict.

The use of currency devaluation as a means to erode the debt problem and as a means of stimulating exports to grow revenues, always creates international friction. Japan devalued its currency under Abenomics, which negatively impacted China's ability to export cheaply within APAC. To alleviate economic woes and misery at home both countries have diverted attentions by raking up age-old enmities, as symbolised by the ownership dispute over the Senkaku or Diaoyu islands, as they are known in Japan and China respectively. The governments in both countries have polarised sovereign identity and ownership internally and turned nationalistic unity outward as a means to prevent the inward cannibalisation of their own power base. Globalisation and technology had done so much to recede such frictions over the past few decades as individuals and not governments communicated at the inter-personal level. It is such a shame to see governments undoing this connection.

China’s Problem Gambling

Ethnocentrism often lies at the root of International conflict. It is the belief that one's own country is at the centre of the world. China historically referred to itself as the Middle Kingdom, Zhōngguó or literally Central Kingdom. The term originally reflected the cultural significance of the central region of a China, whose Emperor had unified the various independent states. As time passed, the term has been used as a means of unifying Chinese people and their significance in the world by referring to themselves as the centre kingdom (of the world). For my mind, there is no doubt that China is at the centre of economic importance right now and whilst the events of the EU have caught our eye, it equally won't have escaped people's notice that something has been afoot in China – the panic and mania that is overwhelming stock markets.

It is fascinating to observe that whilst many financial participants have been debating the China economic miracle, there were very few in recent years who recognised that such economic feats were yet again supercharged and predicated on the recycling of debt. In China's case this is by use of the semi-fixed yuan exchange rate, which is also so crucial to the continuity of the global monetary system today – Bretton Woods II. As most readers know, we have continually stated that the defining nature of this international and financial monetary system is that it finances the United States' enormous external deficit and its associated fiscal deficit at low interest rates, whilst supporting an investment boom in Asia – mainly China. This is how the dollar hegemony thrives. We have written extensively about how China has resided over the greatest misallocation of capital in the last 200 years. Last year in an interview, I stated:

"I feel more disposed to a collapse in 90% of asset classes – equities, bonds and commodities, but with the other 10% cash and gold going up in value. This is the outcome in a deflationary scenario. I envisage this more than I expect higher asset prices and goods inflation. I see too much stress in the system to expect a muddle through. The likely trigger (or hope) for the deflationary outcome is China, irrespective of European and other Anglo-Saxon woes which still remain. Of course, one country’s capital is another’s consumption, so the world is inherently interlinked."

In 2008, in response to the Great Financial Crisis, China gambled on the largest stimulus initiative it had ever embarked on when it ordered drastic cuts in bank rates and a near US$1 trillion package to ignite loan production to SOEs, which then set-off a once in millennial real estate boom. Its initial success in preventing any financial contagion from the developed countries perversely provided the blueprint by which the developed countries then sought to solve their own solvency and liquidity issues. A hint as to why such a bold action was taken can perhaps be traced to the cultural psyche of a nation.

Gambling is embedded in the traditions of the Chinese. It has been performed by its people for thousands of years with the first account of gambling found as far back as the Shang dynasty of 2000 to 1500 B.C. The Ming period from 1600 to 1900 A.D. witnessed epidemic levels of gambling, which many historians attribute to the demise of this once rich and powerful dynasty, with cricket fighting and paper mahjong being the principal culprits. The Chinese will also bet on anything from horses, ducks, cockerels, dogs (when they are not eating them), football and more recently a myriad of casino games, where the allure of free credit, drinks and promotions are so enticing.

China's addiction to gambling is an open secret. National lotteries aside, gambling in China is actually illegal. As any visitor to China or the self-styled China(town) in major metropolises around the world can testify, the street side bustle of mahjong and card players is a seemingly enchanting past-time. Who cannot forget the staccato 'rat-a-tat-tat of Mandarin dialects' rabidly commenting on the games in a fervour of communal debate. The public flouting of the gambling laws seems even innocent and just harmless fun.

Even the young 'play' for money with Auntie and Uncle Wang, Granny and Grandpa Tang. They are enthralled by the mystical qualities of luck, fate and chance. Numerology plays a central role in many Asian cultures and China's is no exception. The number 8 is extremely lucky, a fact not lost on the Western online poker site www.888.com whom no doubt targets clients of Oriental origin. The number 4 on the other hand, whose vowel when spoken sounds like the word for death, is a sign of bad luck at the tables of fortune.

In short, gambling is illegal but socially acceptable, which makes acknowledgement of addiction problematic and there are widespread issues. The Chinese people have elevated levels of gambling addiction compared to their Western counterparts. It’s endemic. An epidemic even. These elevated rates have been exacerbated by the rapid expansion of gambling venues within the Pan-Pacific region.

Pathological to problem to disorderly, gambling is the continuum of worsening gambling addiction. Pathological gambling refers to a condition where the sufferer shows persistent and recurrent maladaptive behaviour, resulting in dysfunctions in the areas of work, studies, social and family relationships. The disease gets progressively worse as individuals experience high rates of gambling-related fantasy, start lying and use it as an escape. They then experience substantial interpersonal, financial and legal difficulties, accompanied by substance abuse, mood / anxiety disorders and even suicidality.

Chinese gambling addicts experience almost 5 times as much prevalence of the extreme affliction – disorderly. In San Francisco, 70% of Asians cite gambling as their community’s number 1 social issue, with over 21% of them considered pathological gamblers. Compare this with the 1.6% of North Americans who are problem gamblers, which by the way is a recognised psychiatric disorder. In China alone, the amount spent on illegal gambling is estimated at over one trillion yuan (US$200 bn plus), which is approximately the financial output of Beijing.

The Great Wall Of Money

Fast-forward to the present day and we have begun to witness the real extent of China's gambling addiction on the grandest of scales. A multi-billion dollar underground industry has migrated into an 'open market' trillion dollar industry – that of the Chinese Stock markets.

The Chinese Stock markets have replaced mahjong as Auntie Wang and Granny Tang's favourite pastime. Flipping stocks is the real thing and it's not only socially acceptable, it has actually been actively encouraged and promoted by the State. Gambling just became legal. But why?

For all the talk of reform of the markets in preparation for liberalisation of the capital account, China is desperately trying to prevent an uncontrolled collapse of its over-leveraged economy, which rests on extremely indebted Local Governments and SOEs. Far worse, this debt consists of a complex and interconnected web of investment financing vehicles, themselves over collateralised by ailing or absent commodities and housing stock.

New Individual investor account openings: Shanghai & Shenzen only

The recent encouragement of stock investing has been part of what has been, until now, a successful attempt to recapitalise the very same SOEs that the government provided untold stimulus to, in 2008.

So whilst the top-down pronouncements and government directives contradict the rapidly worsening real economy, it was yet again the latest gamble of the State to promote a bail-out of its over indebted system in no doubt one of the largest debt-to-equity swaps in history.

One needs to look no further than this chart to understand why the Chinese authorities are trying to reignite the economy with a stock market bull run. Perhaps this time, instead of the West following the Chinese playbook, the Chinese have taken a leaf out of Ben Bernanke's book, that of herding the markets higher in a vain attempt to create an illusion of real wealth.

As Sean Corrigan, our CIO wrote in our subscription publication, ‘Money Macro & Markets’ – which you can find at the hindesightletter.com site – "Let us remind you that this present mania for stocks is nothing less than a tacitly encouraged means for deleveraging companies at the expense of the greater risks being run by the legions of first-time buyers and amateur margin traders who snap up their counters."

Sean hat-tipped the potential for a mania in the Chinese markets, whilst residing in his old investment seat – perhaps more from the stance of – can the authorities really engineer this debt-for-equity swap?

To give you an idea of the magnitude of the stakes in play here, I am going to quote liberally from Sean's ‘Money Macro & Markets’, May letter 2015:

“Turnover in April was CNY30 trillion – or around $4.8 trillion dollars – with 90 billion shares a day changing hands, up 44% from March and 8.7 times the level of a year ago. To put such mind-boggling numbers in perspective, NYSE volume for the month was a lowly $1.4 trillion at a rate of around 1.6 billion shares a day. Turnover in the US is therefore of the order of 100% of GDP per day – which should be enough frantic short-termism for anyone’s taste. In China last month, it hit 560% of GDP. Dollar volume on Shanghai alone was greater than that in all of the Americas – North and South – combined and one in every two shares traded anywhere around the globe was traded in China, according to WFE data! ...

“As the Chinese madness intensifies, the last seven weeks have seen 17.7 million new stock accounts and 7.4 million new fund accounts opened (some of these latter heavily leveraged), draining household accounts of Y1 trillion in deposits last month and piling that cash up instead on the books of the non-bank financial institutions with whom they deal. Try as it might, it is obvious that the PboC just cannot force its ongoing infusions of monetary assistance into the wellsprings of real economic activity, rather than adding them to the ever expanding walls of this latest and arguably greatest speculative bubble.

“Faced with an economy stalling under the weight of its own contradictions; with unknowable quantities of capital either utterly wasted or helplessly locked into sub-marginal uses; with the debt load crushing and the monetary system riven with fraud and inefficiency, like latter day equivalents of the Duc d’Orléans, regent of France, and his Scottish adventurer advisor, John Law of Lauriston, the CCP’s top men have also opted to bamboozle the masses under their sway. By holding out the prospect of the fabulous gains to be had in developing a little-known wilderness far from the nation’s heartland, they have sought to exploit the enthusiasm thus kindled in order to transform some of that mass of unpayable debt into supposedly sure-fire equity holdings. With the AIIB in place of the Banque Générale and the central Asian vastness of the ‘Silk Road Economic Belt’ taking the place of the pestilential Louisiana bayous, we can see all too many parallels.”

Xi and Li really are riding the tiger with this one.

Yes, least I forget, the Chinese have always bet on tigers as well, not just crickets! Unfortunately, this bet has become less of a "therapeutic debt-for-equity swap on a truly titanic scale, (rather) a frantic debt-for-debt swap as Auntie borrowed all she could get her hands on to maximise her chance of gain." Not only did Auntie borrow but so many of the newly listed SOE companies pledged stock in return for more bank financing. This is reminiscent of the heady days of the U.S. Roaring Twenties and the Baburu Keiki of Japan in the late 80s.

Stage 1,2,3 & 4 Complete Mestastasis, Now Death?

Sean documented the continuing insanity:

“The attempt to convey in words alone a sense of what is afoot there quickly becomes an empty exercise in superlatives so, for the moment, let us simply try to let the numbers speak for themselves. And what numbers they are! In terms of turnover, things were simply extraordinary. April and May combined saw $10 trillion’s worth of shares traded (versus $4.5tln in New York), meaning that for every $7 which changed hands in the whole rest of the world combined, $8 were bought and sold in China. At that pace, China’s turnover was 5 1/2 times its GDP while the multiple of national income realised Stateside was a mere 1 1/2. Just imagine what that means for broking house fees – or for stamp duty receipts, for that matter.

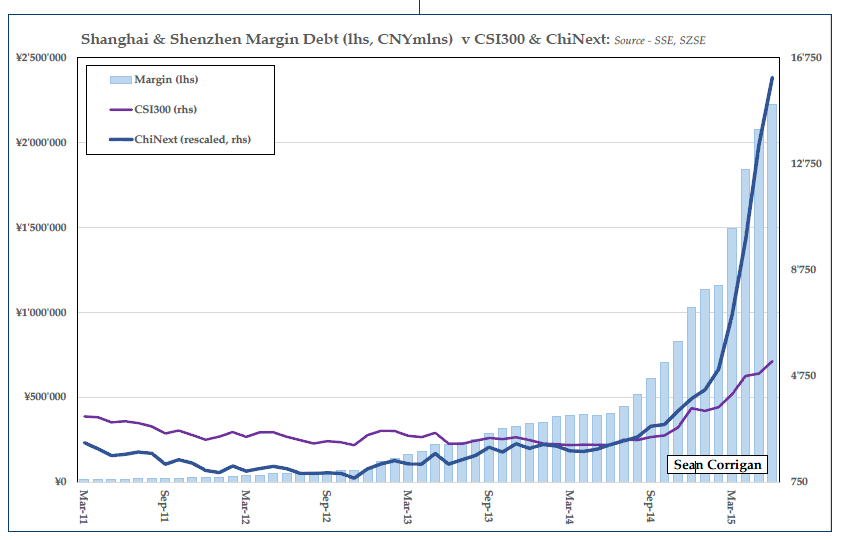

“Then we come to leverage. Official margin debt has doubled just since February and quadrupled since last August, adding over CNY1.1 trillion in that time, equivalent to $180bln or around $50bln a month. The total as of June 18th’s peak was CNY2,273bln or $366bln, a sum equating to around 3.5% of market capitalisation, more still of free float. For comparison, margin debt on the NYSE took a full 3 1/2 years of the bull market to double to today’s $507bln where it still represents only 2% of market cap – even if that less lofty proportion is still a 98th percentile reading. Despite the ongoing rally in Japan, margin there is an un-exceptionable 0.8% of market cap of the Topix, only some 0.2 sigmas over the post-Bubble mean.

“What this means is that in the three months to end-May, Chinese margin debt accounted for 35% of all new loans taken out, equating to 35% of all the re-investment under-taken and to 13% of nationwide retail sales rung up. Since last August, the increase has exceeded the total contemporaneous addition to the stock of M1 money.

“As a final attempt to have your jaws drop at the scale of the excess, consider that the addition to margin so far this year of CNY1.25 trillion amounts to the entire income of no less than 50 million Chinese at the average national wage of CNY50,000 a year. That’s like saying almost the entire population of England, or of California plus Oregon and Washington State, took on a 100% debt: income obligation and ploughed it – alongside that same income itself – straight into equities as they soared ever upward.

WHY CHOOSE US?

HindeSight Letters is a unique blend of financial market professionals – investment managers, analysts and a financial editorial team of notable pedigree giving you insights that never usually make it off the trading floor.

We help our paid subscribers have 100% control to build their own portfolios with knowledge that lasts a lifetime and all for the price of a good coffee a month - just £4.99 or save 2 months by subscribing to our yearly plan, only £49.99.

Our history is there for all to see, measure and research.

LIMITED OFFER. GET A 90 DAY FREE TRIAL OF OUR PREMIUM SUBSCRIPTION & MAXIMISE YOUR INVESTMENT POTENTIAL

Visit hindesightletters.com for more information